Exhibit 99.20

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This short form prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by the persons permitted to sell such securities.

The securities offered under this short form prospectus have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or the securities laws of any state of the United States (as such term is defined in Regulation S under the U.S. Securities Act) (the “United States”), and may not be offered or sold within the United States, or to, or for the account or benefit of a U.S. Person (as defined in Rule 902(k) of Regulation S under the U.S. Securities Act) or a person in the United States, except as permitted by the Underwriting Agreement (as defined herein) and in transactions exempt from registration under the U.S. Securities Act and applicable U.S. state securities laws. This short form prospectus does not constitute an offer to sell or a solicitation of an offer to buy any of the securities offered hereby within the United States or to, or for the account or benefit of, U.S. persons.

Information has been incorporated by reference in this short form prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of the Company at our head office located at 789 West Pender Street, Suite 810, Vancouver, BC, V6C

1H2, Telephone 604-687-2038, and are also available electronically at www.sedar.com.

New Issue September 18, 2020

SHORT FORM PROSPECTUS

RED WHITE & BLOOM BRANDS INC.

$21,750,000

29,000,000 UNITS

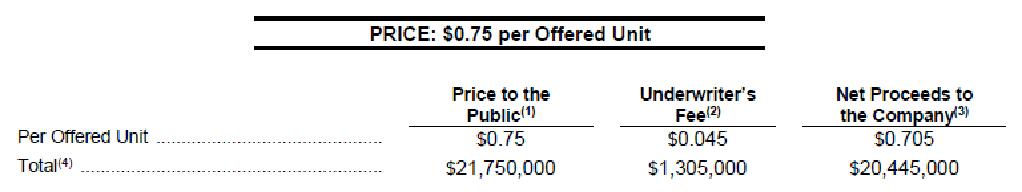

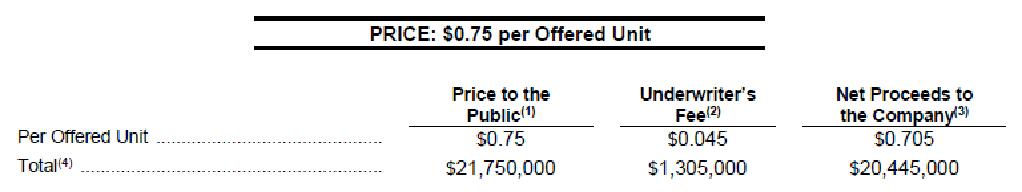

This short form prospectus (the “Prospectus”) qualifies the distribution and offering (the “Offering”) of 29,000,000 units (the “Offered Units”) of Red White & Bloom Brands Inc. (“RWB” or the “Company”) at a price of $0.75 per Offered Unit (the “Offering Price”) for total gross proceeds of $21,750,000, pursuant to the terms of an underwriting agreement (the “Underwriting Agreement”) dated August 25, 2020 between the Company, PI Financial Corp. and Eight Capital as co-lead underwriters (the “Co-Lead Underwriters”), together with Canaccord Genuity Corp. and Echelon Wealth Partners Inc. (collectively, the “Underwriters”), as amended. See “Plan of Distribution”.

Each Offered Unit consists of one common share (“Common Share”) in the capital of the Company (each a “Unit Share”) and one transferable Common Share purchase warrant of the Company (each such warrant, a “Warrant”). Each Warrant will entitle the holder thereof to acquire, subject to adjustment in certain circumstances, one Common Share (each, a “Warrant Share”) at an exercise price equal to $1.00 per Warrant Share (the “Exercise Price”) for a period of twenty-four (24) months following the Closing Date (as defined herein). If, at any time prior to the expiry date of the Warrants, the volume-weighted average price of the Common Shares on the Canadian Securities Exchange (the “CSE”) (or such other stock exchange where the majority of the trading volume occurs) exceeds

$1.50 for 10 consecutive trading days, the Company may provide written notice to the holders of the Warrants by way of a news release advising that the Warrants will expire at 5:00 p.m. (Vancouver time) on the 30th day following the date of such notice unless exercised by the holders prior to such date (the “Accelerated Exercise Period”). The Warrants will be governed by a warrant indenture (the “Warrant Indenture”) to be entered into on the Closing Date between the Company and National Securities Administrators Ltd., as warrant agent. See “Description of Securities Being Distributed”.

The Underwriters have agreed to act as, and the Company has appointed the Underwriters as, the sole and exclusive underwriters of the Company to offer the Offered Units for sale in accordance with the conditions contained in the Underwriting Agreement.

ii

The Common Shares are listed and posted for trading on the CSE under the trading symbol “RWB” and trade in the United States on the OTCQX under the trading symbol “RWBYF”. On September 17, 2020, the last trading day prior to the date of this Prospectus, the closing prices of the Common Shares listed on the CSE and the OTCQX were $0.61 and US$0.48, respectively.

The Company has applied to list the Unit Shares, the Warrants and the Warrant Shares (including those underlying the Over-Allotment Units (each as defined herein)), the Compensation Shares, the Compensation Warrants and the Compensation Warrant Shares (each as defined herein) on the CSE. Listing will be subject to the Company fulfilling all listing requirements of the CSE. There is currently no market through which the Warrants may be sold and purchasers may not be able to resell the Warrants purchased under this Prospectus. See “Risk Factors” and “Plan of Distribution”.

Notes:

(1) The Offering Price was determined by arm’s length negotiation between the Company and the Co-Lead Underwriters on behalf of the Underwriters, with reference to the prevailing market price of the Common Shares.

(2) The Company has agreed to pay to the Underwriters a cash fee equal to 6.0% of gross proceeds raised in respect of the Offering (including any gross proceeds raised on exercise of the Over-Allotment Option (as defined herein)) (collectively, the “Underwriters’ Fee”). As additional consideration for the services rendered in connection with the Offering, the Company has agreed to issue to the Underwriters such number of non-transferable compensation options (the “Compensation Options”) to acquire that number of units of the Company on the same terms as the Offered Units (the “Compensation Units”) as is equal to 6.0% of the number of Offered Units sold under the Offering (including upon the exercise of the Over-Allotment Option). Each Compensation Option shall be exercisable into one Compensation Unit consisting of one Common Share (a “Compensation Share”) and one Warrant (a “Compensation Warrant”) at the Offering Price for a period of 24 months following the Closing Date, subject to adjustment in certain customary events. Each Compensation Warrant will entitle the holder thereof to acquire one Common Share (each, a “Compensation Warrant Share”) at the Exercise Price for a period of twenty-four (24) months following the Closing Date, subject to acceleration on the same terms as the Warrants. This Prospectus qualifies the distribution of the Compensation Options to the Underwriters. See “Plan of Distribution”.

(3) After deducting the Underwriters’ Fee, but before deducting the expenses of the Offering, estimated to be $450,000 (excluding taxes and disbursements), which, together with the Underwriters’ Fee, will be paid out of the gross proceeds of the Offering.

(4) The Underwriters have been granted an over-allotment option exercisable in whole or in part, at the sole discretion of the Underwriters by giving notice to the Company at any time, and from time to time, on or before 5:00 p.m. (EDT) on the 30th day following the Closing Date, to purchase up to an additional 15% of the number of Offered Units sold under the Offering, being up to 4,350,000 Offered Units (the “Over-Allotment Units”) and/or up to

4,350,000 Unit Shares (“Over-Allotment Unit Shares”) and/or up to 4,350,000 Warrants (“Over-Allotment Warrants”), to cover the Underwriters’

over-allocation position, if any, and for market stabilization purposes (the “Over-Allotment Option”). The Over-Allotment Option may be exercised by the Underwriters to acquire: (a) Over-Allotment Units at the Offering Price; (b) Over-Allotment Unit Shares at a price of $0.67 per Over-Allotment Unit Share; (c) Over-Allotment Warrants at a price of $0.08 per Over-Allotment Warrant; or (d) any combination of Over-Allotment Units, Over-Allotment Unit Shares and Over-Allotment Warrants, so long as the aggregate number of Over-Allotment Unit Shares and Over-Allotment Warrants which may be issued under the Over-Allotment Option does not exceed 4,350,000 Over-Allotment Unit Shares and 4,350,000 Over-Allotment Warrants. If the Over- Allotment Option is exercised in full, the total “Price to the Public”, “Underwriters’ Fee” and “Net Proceeds to the Company” will be $25,012,500,

$1,500,750 and $23,511,750, respectively. This Prospectus qualifies the grant of the Over-Allotment Option and the distribution of the Over-Allotment Units issuable upon exercise of the Over-Allotment Option. A purchaser who acquires Over-Allotment Units, Over-Allotment Unit Shares or Over- Allotment Warrants forming part of the Underwriters’ over-allocation position acquires those Over-Allotment Units, Over-Allotment Unit Shares or Over- Allotment Warrants under this Prospectus, regardless of whether the over-allocation position is ultimately filled through the exercise of the Over- Allotment Option or secondary market purchases. See “Plan of Distribution”.

The following table sets out information relating to the Over-Allotment Option and the Compensation Options:

Underwriters’ Position

| Maximum Number of

Securities Available

|

Exercise Period

|

Exercise Price

|

| Up to 4,350,000 Over- Allotment Units, Over-

|

For a period of 30 days from

| $0.75 per Over-Allotment

Unit, $0.67 per Over-

|

Over-Allotment Option

| Allotment Unit Shares

| and including the Closing

| Allotment Unit Share and

|

| and/or Over-Allotment

| Date

| $0.08 per Over-Allotment

|

| Warrants

|

| Warrant

|

Compensation Options

| 2,001,000 Compensation

Options (including upon

|

24 months from the Closing

|

$0.75 per Compensation

|

| exercise of the Over-

| Date

| Option

|

| Allotment Option)

|

|

|

ii

Unless the context otherwise requires, when used herein, all references to “Offering” include the exercise of the Over-Allotment Option and all references to “Offered Units”, “Unit Shares”, “Warrants” and “Warrant Shares” include the securities underlying the exercise of the Over-Allotment Units.

The Underwriters, as principals, conditionally offer the Offered Units, subject to prior sale, if, as and when issued by the Company and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under “Plan of Distribution” and subject to the approval of certain legal matters on behalf of the Company by Gowling WLG (Canada) LLP and on behalf of the Underwriters by Borden Ladner Gervais LLP. An investment in the Offered Units involves a high degree of risk and should only be made by persons who can afford the total loss of their investment. Before purchasing the Offered Units, prospective purchasers should carefully review and evaluate the risk factors described under “Risk Factors” in this Prospectus and in the Annual Information Form (as defined herein), which can be found on the Company’s profile on SEDAR at www.sedar.com. Prospective purchasers are advised to consult their own tax advisors regarding the application of Canadian federal income tax laws to their particular circumstances, as well as any other provincial, foreign and other tax consequences of acquiring, holding or disposing of the Offered Units, Unit Shares, Warrants and/or Warrant Shares. See “Cautionary Note Regarding Forward- Looking Statements” and “Risk Factors”.

Prospective purchasers should rely only on the information contained or incorporated by reference in this Prospectus. The Company and the Underwriters have not authorized anyone to provide prospective purchasers with information different from that contained or incorporated by reference in this Prospectus. The Underwriters are offering to sell and seeking offers to buy the Offered Units only in jurisdictions where, and to persons to whom, offers and sales are lawfully permitted. Prospective purchasers should not assume that the information contained in this Prospectus is accurate as of any date other than the date on the cover page of this Prospectus.

Subscriptions for the Offered Units will be received subject to rejection or allotment, in whole or in part, and the Underwriters reserve the right to close the subscription books at any time without notice. Closing of the Offering (the “Closing”) is expected to take place on or about September 24, 2020 or such other date as the Underwriters and the Company may mutually agree (the “Closing Date”), acting reasonably, provided that the Offered Units are to be taken up by the Underwriters on or before the date that is not later than 42 days after the date of the receipt for the (final) short form prospectus relating to the Offering. See “Plan of Distribution”.

In connection with the Offering, and subject to applicable laws, the Underwriters may over-allot or effect transactions that are intended to stabilize or maintain the market price of the Unit Shares at levels other than that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. The Underwriters may offer the Offered Units at a lower price than stated above. See “Plan of Distribution”.

It is anticipated that the Offered Units will be delivered under the book-based system through CDS Clearing and Depository Services Inc. (“CDS”) or its nominee and deposited in electronic form. A purchaser of Offered Units will receive only a customer confirmation from the Underwriters or another registered dealer from or through which the Offered Units are purchased and who is a CDS depository service participant (a “Participant”). CDS will record the Participants who hold Unit Shares and Warrants comprising the Offered Units on behalf of owners who have purchased Offered Units in accordance with the book-based system. No certificates evidencing the Unit Shares or Warrants comprising the Offered Units will be issued to subscribers, except in certain limited circumstances, and registration will be made in the name of the nominee of CDS. Notwithstanding the foregoing, all Offered Units, Unit Shares and Warrants and any Warrant Shares, offered and sold in the United States or to or for the account or benefit of U.S. Persons who are institutional “accredited investors” as such term is defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D promulgated under the U.S. Securities Act (the “U.S. Accredited Investors”), and who are not “qualified institutional buyers,” as such term is defined in Rule 144A under the U.S. Securities Act (“Qualified Institutional Buyers”, and together with the U.S. Accredited Investors, the “U.S. Purchasers”) will be issued in certificated, individually registered form. See “Plan of Distribution”.

A controlling shareholder of PI Financial Corp. is concurrently an influential shareholder of Bridging Finance Inc. (“Bridging”), which is a lender to certain subsidiaries of the Company (being Mid-American Growers, Inc. (“MAG”) and RWB Illinois, Inc. (“RWB Illinois”)) pursuant to the Amended Facility (as defined below) under which such subsidiaries are currently indebted and which the Company has guaranteed. Consequently, the Company may be considered to be a “connected issuer” (within the meaning of National

3

Instrument 33-105 – Underwriting Conflicts) of PI Financial Corp. under applicable Canadian securities legislation. See “Relationship Between the Company and Certain Underwriters”.

In this Prospectus, references to “RWB”, the “Company”, “we”, “us” and “our” refer to Red White & Bloom Brands Inc. and/or, as applicable, one or more of its subsidiaries. The Company’s head office and registered office is located at 789 West Pender Street, Suite 810, Vancouver, BC, V6C 1H2.

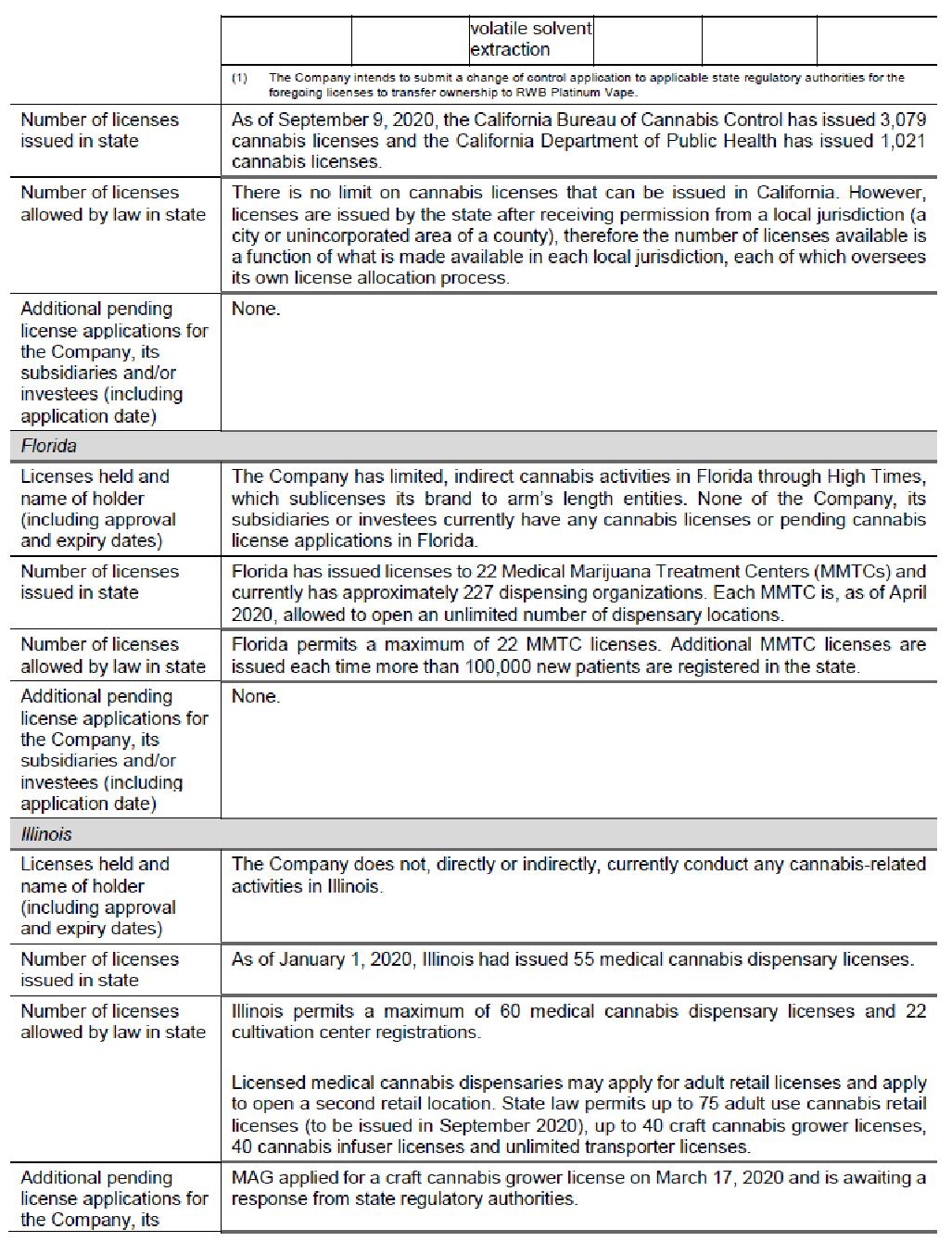

This Prospectus qualifies the distribution of securities of an entity that currently derives and intends to derive, directly, a substantial portion of its revenues from the cannabis industry in certain U.S. states, which industry is illegal under U.S. Federal law and enforcement of relevant laws is a significant risk. The Company is directly involved through certain subsidiaries and investees and expects to be directly involved through additional subsidiaries and proposed acquisition targets in the medical and adult-use cannabis industry in the States of Michigan, Illinois, California and Massachusetts which states have regulated such industries. Currently, the Company is directly engaged in, or pursuing operations regarding, the cultivation, possession, use, sale and distribution of medical and adult-use cannabis in such states. The Company, through certain subsidiaries and investees, has limited indirect operations in Florida and Oklahoma through sublicensing arrangements with arm’s length entities. The Company does not currently hold any cannabis licenses or have any pending cannabis license applications in either Florida or Oklahoma.

The United States federal government regulates drugs, in part, through the Controlled Substances Act (21 U.S.C. § 811) (the “Controlled Substances Act”), which places controlled substances, including cannabis, in a schedule. Cannabis is classified as a Schedule I drug. Under United States federal law, a Schedule I drug or substance has a high potential for abuse, no accepted medical use in the United States, and a lack of accepted safety for the use of the drug under medical supervision. The United States Food and Drug Administration has not approved marijuana as a safe and effective drug for any indication.

In the United States, marijuana is regulated at both the federal and state level, however these regulations are in direct conflict. State laws regulating cannabis are in direct conflict with the federal Controlled Substances Act, which makes cannabis use and possession federally illegal. Although certain states authorize medical or adult-use cannabis production and distribution by licensed or registered entities, under U.S. federal law, the possession, use, cultivation, and transfer of cannabis and any related drug paraphernalia is illegal, and any such acts are criminal acts under federal law. The Supremacy Clause of the United States Constitution establishes that the United States Constitution and federal laws made pursuant to it are paramount and, in case of conflict between federal and state law, the federal law shall apply. Third party service providers could suspend or withdraw services as a result of the Company operating in an industry that is illegal under United States federal law.

On January 4, 2018, then United States Attorney General Sessions issued a memorandum (the “Sessions Memo”) to all United States Attorneys which rescinded previous guidance from the U.S. Department of Justice specific to cannabis enforcement in the United States, including the Cole Memo (as defined herein). With the Cole Memo rescinded, and United States federal prosecutors having no further guidance relating to prosecution of cannabis-related violations of U.S. federal law, discretion on whether or not to prosecute such alleged violations has reverted to each respective U.S. Attorney to make such a determination. In the absence of such uniform federal guidance, as had been established by the Cole Memo, numerous United States Attorneys with state-legal marijuana programs within their jurisdictions have announced enforcement priorities for their respective offices. For instance, Andrew Lelling, United States Attorney for the District of Massachusetts, stated that while his office would not immunize any businesses from federal prosecution, he anticipated focusing the office’s marijuana enforcement efforts on: (1) overproduction; (2) targeted sales to minors; and (3) organized crime and interstate transportation of drug proceeds. Other United States Attorneys provided less assurance, promising to enforce federal law, including the Controlled Substances Act in appropriate circumstances. United States Attorney General Sessions resigned on November 7, 2018. He was replaced by William Barr on February 14, 2019. It is unclear what specific impact this development will have on U.S. federal government enforcement policy as the Department of Justice under Mr. Barr has not taken a formal position on federal enforcement of laws relating to cannabis. However, during his confirmation, and in response to written inquiries by U.S. Senators, Mr. Barr stated that “[he does] not

4

intend to go after parties who have complied with state law in reliance on the Cole Memorandum.” Mr. Barr has also stated that, while his preference would be to have a uniform federal rule addressing cannabis; absent such a uniform position, his preference would be to permit the existing federal approach of allowing individual states or territories to determine cannabis policy and to trust the judgment of U.S. prosecutors on how to enforce U.S. federal law. If the Department of Justice policy under Attorney General Barr was to prosecute cannabis-related business, including but not limited to any investors, financiers, employees, officers and managers, and United States Attorneys followed such Department of Justice policies through pursuing prosecutions, then the Company could face (i) seizure of its cash and other assets used to support or derived from its cannabis operations; (ii) the arrest of its employees, directors, officers and managers; and (iii) the barring of its employees, directors, officers, managers and investors who are not United States citizens from entry into the United States. There is no guarantee that state laws legalizing and regulating the sale and use of cannabis will not be repealed or overturned, or that local governmental authorities will not limit the applicability of state laws within their respective jurisdictions. Unless and until the United States Congress amends U.S. federal law with respect to cannabis (and as to the timing or scope of any such potential amendments there can be no assurance), there is a risk that federal authorities may enforce current U.S. federal law. If the United States federal government begins to enforce United States federal laws relating to cannabis in states where the sale and use of cannabis is currently legal under state law, or if existing applicable state laws are repealed or curtailed, the Company’s business, results of operations, financial condition and prospects would be materially adversely affected.

Although the Cole Memo has been rescinded, one legislative safeguard for the medical marijuana industry remains in place: Congress has passed a so-called “rider” provision in the FY 2015, 2016, 2017 and 2018 Consolidated Appropriations Acts to prevent the federal government from using congressionally appropriated funds to enforce federal marijuana laws against regulated medical marijuana actors operating in compliance with state and local law. The rider is known as the “Rohrabacher-Farr” Amendment after its original lead sponsors (it is also sometimes referred to as the “Rohrabacher-Blumenauer” or “Joyce-Leahy” Amendment, but it is referred to in this Prospectus as “Rohrabacher-Farr”). Most recently, the Rohrabacher-Farr Amendment was included in the Consolidated Appropriations Act of 2019, which was signed by President Donald Trump on February

14, 2019 and funds the departments of the federal government through the fiscal year ending September

30, 2019. In signing the Act, President Trump issued a signing statement noting that the Act “provides that the Department of Justice may not use any funds to prevent implementation of medical marijuana laws by various States and territories,” and further stating “I will treat this provision consistent with the President’s constitutional responsibility to faithfully execute the laws of the United States.” While the signing statement can fairly be read to mean that the executive branch intends to enforce the Controlled Substances Act and other federal laws prohibiting the sale and possession of medical marijuana, the President did issue a similar signing statement in 2017 and no major federal enforcement actions followed. On December 20, 2019, President Trump signed the 2020 Fiscal Year Appropriations Bill which included the Rohrabacher-Farr Amendment, which prohibits the funding of federal prosecutions with respect to medical cannabis activities that are legal under state law, extending its application until September 30, 2020. There can be no assurances that the Rohrabacher/Blumenauer Amendment will be included in future appropriations bills. See “Regulatory Overview – U.S. Federal Regulatory Landscape”.

There is no guarantee that state laws legalizing and regulating the sale and use of cannabis will not be repealed or overturned, or that local governmental authorities will not limit the applicability of state laws within their respective jurisdictions. Unless and until the United States Congress amends the Controlled Substances Act with respect to marijuana (and as to the timing or scope of any such potential amendments there can be no assurance), there is a risk that federal authorities may enforce current U.S. federal law. If the United States federal government begins to enforce United States federal laws relating to cannabis in states where the sale and use of cannabis is currently legal, or if existing applicable state laws are repealed or curtailed, the Company’s business, results of operations, financial condition and prospects would be materially adversely affected.

Marijuana remains a Schedule I controlled substance at the federal level, and neither the Cole Memo nor its rescission nor the continued passage of the Rohrabacher-Farr Amendment has altered that fact. The federal government of the United States has always reserved the right to enforce federal law in regard

5

to the sale and disbursement of medical or adult-use marijuana, even if state law sanctions such sale and disbursement. If the United States federal government begins to enforce United States federal laws relating to cannabis in states where the sale and use of cannabis is currently legal, or if existing applicable state laws are repealed or curtailed, the Company’s business, results of operations, financial condition and prospects would be materially adversely affected.

Additionally, under United States federal law, it may potentially be a violation of federal anti-money laundering statutes for financial institutions to take any proceeds from the sale of any Schedule I controlled substance. Due to the Controlled Substances Act categorization of marijuana as a Schedule I drug, federal law makes it illegal for financial institutions that depend on the Federal Reserve’s money transfer system to take any proceeds from marijuana sales as deposits. Banks and other financial institutions could be prosecuted and possibly convicted of money laundering for providing services to cannabis businesses under the United States Currency and Foreign Transactions Reporting Act of 1970 (the “Bank Secrecy Act”) as amended by Title III of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001. Therefore, under the Bank Secrecy Act, banks or other financial institutions that provide a cannabis business with a checking account, debit or credit card, small business loan, or any other service could be charged with money laundering or conspiracy. Despite the absence of express banking protections under U.S. federal law, the FinCEN Guidance (as described herein), which was adopted by the U.S. Department of the Treasury in 2014 and remains in place presently, advised prosecutors not to focus their enforcement efforts on banks and other financial institutions that serve marijuana-related businesses so long as that business is legal in their state and none of the federal enforcement priorities referenced in the Cole Memo are being violated.

The Company’s objective is to capitalize on the opportunities presented as a result of the changing regulatory environment governing the cannabis industry in the United States. Accordingly, there are a number of significant risks associated with the business of the Company. Unless and until the U.S. Congress amends the Controlled Substances Act with respect to adult-use cannabis (and as to the timing or scope of any such potential amendments there can be no assurance), there is a risk that federal authorities may enforce current federal law, and the business of the Company may be deemed to be producing, cultivating, extracting, or dispensing cannabis or aiding or abetting or otherwise engaging in a conspiracy to commit such acts in violation of federal law in the United States.

In light of the political and regulatory uncertainty surrounding the treatment of United States cannabis related activities, on February 8, 2018, the Canadian Securities Administrators published CSA Staff Notice 51-352 – (Revised) Issuers with U.S. Marijuana-Related Activities (the “Staff Notice 51-352”) setting out the Canadian Securities Administrator’s disclosure expectations for specific risks facing issuers with cannabis related activities in the United States. Staff Notice 51-352 includes additional disclosure expectations that apply to all issuers with United States cannabis-related activities, including those with direct and indirect involvement in the cultivation and distribution of cannabis, as well as issuers that provide goods and services to third parties involved in the United States cannabis industry. The Company is directly involved through certain subsidiaries and investees in the cultivation and distribution of cannabis in the United States for purposes of Staff Notice 51-352.

For these reasons, the Company’s involvement in the U.S. cannabis market may subject the Company to heightened scrutiny by regulators, stock exchanges, clearing agencies and other U.S. and Canadian authorities. There can be no assurances that this heightened scrutiny will not in turn lead to the imposition of certain restrictions on the Company’s ability to operate in the United States or any other jurisdiction. There are a number of risks associated with the business of the Company. See the sections entitled “Regulatory Overview” and “Risk Factors” in this Prospectus, and the sections entitled “General Development of the Business – Trends, Commitments, Events or Uncertainties” and “Risk Factors” in the Listing Statement (as defined herein).

6

TABLE OF CONTENTS

GENERAL MATTERS.............................................................................................................................................. 1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS......................................................... 1

MARKET AND INDUSTRY DATA ........................................................................................................................... 3

MARKETING MATERIALS ...................................................................................................................................... 3

ELIGIBILITY FOR INVESTMENT ............................................................................................................................ 3

DOCUMENTS INCORPORATED BY REFERENCE .............................................................................................. 4

THE COMPANY....................................................................................................................................................... 6

RECENT DEVELOPMENTS ................................................................................................................................... 9

REGULATORY OVERVIEW.................................................................................................................................. 10

CONSOLIDATED CAPITALIZATION .................................................................................................................... 40

USE OF PROCEEDS ............................................................................................................................................ 42

MARKET FOR SECURITIES................................................................................................................................. 44

DESCRIPTION OF SECURITIES BEING DISTRIBUTED .................................................................................... 46

PLAN OF DISTRIBUTION ..................................................................................................................................... 49

RELATIONSHIP BETWEEN THE COMPANY AND CERTAIN UNDERWRITERS .............................................. 52

RISK FACTORS .................................................................................................................................................... 52

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS................................................................. 63

STATUTORY RIGHTS OF WITHDRAWAL AND RESCISSION........................................................................... 67

INTEREST OF EXPERTS ..................................................................................................................................... 67

AUDITORS, TRANSFER AGENT AND REGISTRAR........................................................................................... 67

CERTIFICATE OF THE COMPANY……………………………………………………………………………………. C-1

CERTIFICATE OF THE UNDERWRITERS……………………………………………………………………………. C-2

GENERAL MATTERS

Purchasers should rely only on the information contained in or incorporated by reference into this Prospectus and are not entitled to rely on parts of the information contained in this Prospectus to the exclusion of others. The Company and the Underwriters have not authorized anyone to provide purchasers with additional or different information. Information contained on the Company’s website shall not be deemed to be a part of this Prospectus or incorporated by reference herein and may not be relied upon by prospective purchasers for the purpose of determining whether to invest in the securities qualified for distribution under this Prospectus. The Offered Units are not being offered or sold in any jurisdiction where the offer or sale is not permitted. Prospective purchasers should assume that the information appearing or incorporated by reference in this Prospectus is accurate only as at the respective dates thereof, regardless of the time of delivery of the Prospectus or of any sale of the Offered Units. The Company’s business, financial condition, results of operations and prospects may have changed since that date. The Company does not undertake to update the information contained or incorporated by reference herein except as required by applicable Canadian securities laws.

This Prospectus shall not be used for any purpose other than in connection with the Offering.

Except as otherwise indicated, references to “Canadian dollars” or “$” are to the currency of Canada.

This Prospectus, including the documents incorporated by reference herein, contains company names, product names, trade names, trademarks and service marks of the Company and other organizations, all of which are the property of their respective owners.

The documents incorporated or deemed to be incorporated by reference herein contain meaningful and material information relating to the Company and prospective purchasers should review all information contained in this Prospectus and the documents incorporated or deemed to be incorporated by reference herein.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus, including the documents incorporated by reference herein, contains forward-looking statements or information (collectively “forward-looking statements”) which are based upon the Company’s current internal expectations, estimates, projections, assumptions and beliefs. In some cases, these forward-looking statements can be identified by words or phrases such as “may”, “believes”, “expects”, “will”, “intends”, “projects”, “anticipates”, “estimates”, “continues”, “plans”, “aim”, “seek” or the negative of these terms, or other similar expressions intended to identify forward-looking statements. The Company has based these forward-looking statements on current expectations and projections about future events and financial trends that they believe may affect the Company’s financial condition, results of operations, business strategy and financial needs, as the case may be.

Forward-looking statements relating to the Company include, among other things, statements relating to:

* the completion of the Offering and the receipt of all regulatory and CSE approvals in connection therewith;

* the listing on the CSE of the Unit Shares, the Warrants and Warrant Shares (including the Compensation Shares, the Compensation Warrants and the Compensation Warrant Shares)

* the Company’s use of proceeds and business objectives and milestones and the anticipated timing of execution, see “Use of Proceeds”;

* the performance of the Company’s business and operations;

* the successful completion of the Company’s previously announced transactions, including, but not limited to, the Company’s proposed acquisition of Platinum Vape, LLC (“Platinum Vape”), the Company’s proposed acquisition of PharmaCo Inc. (“PharmaCo”), the Company’s exclusive partnership for the distribution and commercialization of Avicanna Inc. (“Avicanna”) products, the Company’s growing and sales agreement with 39 Industries, LLC (operating as Critical 39) (“Critical 39”);

* the intention to expand the business, operations and potential activities of the Company;

current legislation in the United States and various states thereof pertaining to the production, distribution, sale and use of medical and recreational cannabis;

* future prices and demand for cannabis in the United States and the supply of cannabis and the production of products derived therefrom;

* development of projects in which the Company invests being on time and on budget;

* the accuracy and veracity of information and projections sourced from third parties respecting, among other things, future industry conditions and demand for cannabis;

* the competitive conditions of the cannabis industry;

* the competitive and business strategies of the Company;

* the Company’s anticipated operating cash requirements and future financing needs;

* the anticipated future gross revenues and profit margins of the Company’s operations;

* the Company’s expectations regarding its revenue, expenses and operations;

* impacts of potential litigation;

* the Company’s intention to build brands and develop cannabis products targeted to specific segments of the market;

* the ongoing and proposed expansion of the Company’s facilities, products or services, including associated costs and any applicable licencing;

* the current political, legal and regulatory landscape surrounding medical and recreational cannabis and expected developments in any jurisdiction in which the Company operates or may operate;

* the receipt of any regulatory and stock exchange approvals required at any given time;

* the applicable laws, regulations and any amendments thereof;

* medical benefits, viability, safety, efficacy and dosing of cannabis;

* the expected growth in the number of patients;

* the expected number of grams of medical cannabis used by each patient;

* expectations with respect to the advancement and adoption of new product lines and ingredients;

* the acceptance by customers and the marketplace of new products and solutions;

* the ability to attract new customers and develop and maintain existing customers;

* expectations with respect to future production costs and capacity;

* expectations and anticipated impact of the COVID-19 pandemic;

* expectations with respect to the receipt, renewal, amendment and/or extension of the Company’s permits and licences;

* the ability to protect, maintain and enforce the Company’s intellectual property rights;

* the ability to successfully leverage current and future strategic partnerships and alliances;

* the ability to attract and retain personnel;

* anticipated labour and materials costs;

* the Company’s competitive condition and expectations regarding competition, including pricing and demand expectations and the regulatory environment in which the Company operates; and

* anticipated trends and challenges in the Company’s business and the markets and jurisdictions in which the Company operates or may operate.

Forward-looking statements are based on certain key assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions and expected future developments and other factors the Company believes are appropriate and are subject to risks and uncertainties and include assumptions made by the Company about its business, the economy and the cannabis industry in general, particularly in light of the impact of the COVID-19 virus (“COVID-19”). Although management believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect. Given these risks, uncertainties and assumptions, shareholders and prospective purchasers of the Company’s securities should not place undue reliance on these forward-looking statements. The above list of forward-looking statements is not exhaustive and whether actual results, performance or achievements will conform to the Company’s expectations and predictions is subject to a number of known and unknown risks, uncertainties, assumptions and other factors.

Further, any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by applicable law, the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

Certain of the forward-looking statements contained herein concerning cannabis, the general expectations of the Company related thereto, and the Company’s business and operations are based on estimates prepared by the Company using data from publicly available governmental sources, as well as from market research and industry

-2-

analysis and on assumptions based on data and knowledge of this industry which the Company believes to be reasonable. However, although generally indicative of relative market positions, market shares and performance characteristics, such data is inherently imprecise. While the Company is not aware of any misstatement regarding any industry or government data presented herein, the current cannabis industry involves risks and uncertainties that are subject to change based on various factors. It is not possible for management to predict all such factors and to assess in advance the impact of each such factor on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward- looking statement. Readers are cautioned that actual future results may differ materially from management’s current expectations and the forward-looking statements contained in this Prospectus and the documents incorporated by reference herein are expressly qualified in their entirety by this cautionary statement. For a description of material factors that could cause the Company’s actual results to differ materially from the forward-looking statements in this Prospectus, please see “Risk Factors” in this Prospectus and in the Company’s Annual Information Form for the period ended July 31, 2019, filed under the Company’s profile on SEDAR and available at www.sedar.com.

MARKET AND INDUSTRY DATA

Market and industry data contained and incorporated by reference in this Prospectus concerning economic and industry trends is based upon good faith estimates of our management or derived from information provided by industry sources. The Company believes that such market and industry data is accurate and that the sources from which it has been obtained are reliable. However, we cannot guarantee the accuracy of such information and we have not independently verified the assumptions upon which projections of future trends are based.

MARKETING MATERIALS

Any “template version” of “marketing materials” (as such terms are defined in National Instrument 41-101 – General Prospectus Requirements) will be incorporated by reference into the final short form prospectus. However, any such template version of marketing materials will not form part of the final short form prospectus to the extent that the contents of the template version of marketing materials are modified or superseded by a statement contained in the final short form prospectus. Any template version of marketing materials filed after the date of this Prospectus and before the termination of the distribution under the Offering (including any amendments to, or an amended version of, the Marketing Materials (as defined herein)) is deemed to be incorporated in this Prospectus.

ELIGIBILITY FOR INVESTMENT

In the opinion of Gowling WLG (Canada) LLP, counsel to the Company, and Borden Ladner Gervais LLP, counsel to the Underwriters, based on the current provisions of the Income Tax Act (Canada) and the regulations thereunder (collectively, the “Tax Act”) as of the date hereof, the Unit Shares, the Warrants and the Warrant Shares, if issued on the date hereof, would be “qualified investments” under the Tax Act for trusts governed by registered retirement savings plans, registered retirement income funds, registered education savings plans, registered disability savings plans and tax-free savings accounts, each as defined in the Tax Act (collectively “Registered Plans”) and trusts governed by deferred profit sharing plans (“DPSPs”), provided that:

(i) in the case of Unit Shares and Warrant Shares, the Common Shares are listed on a “designated stock exchange” as defined in the Tax Act (which currently includes the CSE) or the Company qualifies as a “public corporation” (as defined in the Tax Act); and

(ii) in the case of Warrants, the Warrants, once listed on a “designated stock exchange” as defined in the Tax Act (which currently includes the CSE), or the Warrant Shares are qualified investments as described in (i) above and neither the Company, nor any person with whom the Company does not deal at arm’s length, is an annuitant, a beneficiary, an employer or subscriber under or a holder of such Registered Plan or DPSP.

Notwithstanding the foregoing, holders, annuitants or subscribers of Registered Plans (each a “Controlling Individual”) will be subject to a penalty tax in respect of the Unit Shares, Warrants and Warrant Shares held in a trust governed by a Registered Plan if such Unit Shares, Warrants or Warrant Shares, as the case may be, are a

-3-

“prohibited investment” under the Tax Act for the particular Registered Plan. Unit Shares, Warrants or Warrant Shares will generally not be a “prohibited investment” for a Registered Plan unless the Controlling Individual of the Registered Plan (i) does not deal at arm’s length with the Company for purposes of the Tax Act; or (ii) has a “significant interest”, as defined in the Tax Act, in the Company. In addition, the Unit Shares and Warrant Shares will not be a “prohibited investment” if such securities are “excluded property” (as defined in the Tax Act for purposes of the prohibited investment rules) for trusts governed by a Registered Plan.

Persons who intend to hold Unit Shares, Warrants or Warrant Shares in a Registered Plan or DPSP, should consult their own tax advisors in regard to the application of these rules in their particular circumstances.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of the Company at 789 West Pender Street, Suite 810, Vancouver, BC, V6C 1H2, Telephone 604-687-2038, and are also available electronically on SEDAR at www.sedar.com.

The following documents of the Company filed with the securities commissions or similar authorities in Canada are incorporated by reference in this Prospectus:

1. the Company’s annual information form dated August 7, 2020 (the “Annual Information Form”) in respect of the fiscal year ended July 31, 2019 (excluding any reference in the Annual Information Form to the Company as a passive foreign investment company (“PFIC”). See “Risk Factors – Risks Related to the Business – Passive Foreign Investment Company Status”;

2. the Company’s CSE Form 2A listing statement dated June 1, 2020 respecting the business combination transaction (the “Business Combination Transaction”) involving the Company (formerly Tidal Royalty Corp. (“Tidal”)) and MichiCann Medical Inc. (“MichiCann”) (excluding Tidal’s interim financial statements and management’s discussion and analysis thereon) (the “Listing Statement”);

3. the Company’s audited consolidated financial statements and the notes thereto as at and for the years ended July 31, 2019 and 2018, together with the auditor’s report thereon (the “Annual Financial Statements”);

4. the Company’s management’s discussion and analysis for the years ended July 31, 2019 and 2018 (the

“Annual MD&A”);

5. the Company’s statement of executive compensation for the financial years ended July 31, 2019 and 2018;

6. the Company’s audited consolidated financial statements in respect of MichiCann and the notes thereto as at and for the years ended December 31, 2019 and 2018, together with the auditor’s report thereon;

7. the Company’s management’s discussion and analysis of financial conditions and operations in respect of

MichiCann for the years ended December 31, 2019 and 2018;

8. the Company’s unaudited condensed interim consolidated financial statements and the notes thereto as at and for the three and six months ended January 31, 2020 and 2019;

9. the Company’s management’s discussion and analysis for the six month period ended January 31, 2020 and 2019;

10. the Company’s reviewed amended and restated unaudited condensed interim consolidated financial statements and the notes thereto as at and for the three and six months ended June 30, 2020 and 2019 (the “Interim Financial Statements”);

11. the Company’s amended and restated management’s discussion and analysis for the three and six months ended June 30, 2020;

12. the Company’s management information circular dated August 5, 2020 respecting an annual and special meeting of shareholders of the Company;

-4-

13. the material change report dated August 24, 2020 respecting: (i) the entering into by the Company on July 24, 2020 of a growing and sales agreement with Critical 39 (the “Critical 39 Agreement”); (ii) the entering into by the Company on August 11, 2020 of a distribution agreement with Avicanna for the exclusive distribution of Avicanna’s advanced and clinically backed cannabidiol (“CBD”) based cosmetic and topical products Pura H&W™ in the United States and certain other markets (the “Avicanna Distribution Agreement”); (iii) the Company’s providing of notice to PharmaCo shareholders (the “PharmaCo Shareholders”) on July 24, 2020 of its intent to exercise its right to acquire 100% of the issued and outstanding shares of PharmaCo pursuant to the put/call option agreement dated January 4, 2019 between MichiCann, PharmaCo and PharmaCo Shareholders (the “PharmaCo Put/Call Agreement”); (iv) the entering into by the Company on July 21, 2020 of a binding letter of intent to acquire 100% of the issued and outstanding shares of Platinum Vape; and (v) the appointment of CNBC Market Analyst Steven Grasso as Business Advisor.

14. the material change report dated July 7, 2020 respecting a debt settlement subscription agreement with an arm-length investor entered into on June 30, 2020 to settle advances made by the investor to PharmaCo;

15. the material change reports dated June 8, 2020 and June 11, 2020 respecting the Company’s acquisition on June 10, 2020 of 1251881 B.C. Ltd. (“Newco”), being the entity holding the licensing rights for the branding of High Times® (“High Times”) dispensaries and High Times cannabis-based CBD and THC products in the states of Michigan, Illinois and Florida and branding of High Times hemp-derived CBD products nationally in the United States carrying the Culture® brand pursuant to a retail license agreement and a product license agreement with HT (as defined below), which transactions were completed by way of a three-cornered amalgamation under the Business Corporations Act (British Columbia), whereby 1252034 B.C. Ltd., a wholly-owned British Columbia subsidiary of RWB, amalgamated with 1251881 B.C. Ltd. to form RWB Licensing Inc. (“RWB Licensing”) in exchange for the issuance to 1252240 B.C. Ltd. (the “Seller”), a wholly-owned subsidiary of HT Retail Licensing, LLC (“HT”) of: (i) 13,500,000 Common Shares issued at a deemed price of $1.50 per Common Share; and (ii) a special warrant of the Company that is exercisable into 4,500,000 additional Common Shares if the volume weighted average price of the Common Shares on the CSE, for the first 180 days following June 10, 2020 is below $1.50, all pursuant to an acquisition agreement between the Company, HT, the Seller and Newco dated June 4, 2020 (the “RWB Licensing Acquisition”);

16. the material change report dated June 8, 2020 respecting the resumption of trading of the Company’s shares on the CSE;

17. the material change report dated April 29, 2020 respecting the completion of the Company’s Business Combination Transaction with MichiCann on April 24, 2020 whereby (i) the Company changed its name from “Tidal Royalty Corp.” to “Red White & Bloom Brands Inc.” and completed a 16:1 share consolidation including common shares, series I convertible preferred shares (the “Series I Preferred Shares”), options and warrants; (ii) the Company fixed the number of directors at five and appointed Brad Rogers, Johannes (Theo) van der Linde, Brendan Purdy, Michael Marchese and William Dawson; (iii) appointed Brad Rogers as Chief Executive Officer and Johannes (Theo) van der Linde as Chief Financial Officer; (iv) the Company issued Common Shares, series II convertible preferred shares (the “Series II Preferred Shares”), warrants and options to former holders of MichiCann common shares, warrants and options; (v) certain shareholders entered into voluntary escrow agreements; and (vi) the Company agreed to guarantee certain obligations of PharmaCo, MAG and RWB Illinois pursuant to an amended and restated credit agreement with Bridging dated January 10, 2020;

18. the material change report dated March 13, 2020 respecting the entering into of an amended and restated business combination agreement with MichiCann in respect of the Business Combination Transaction;

19. the notice of change in corporate structure dated May 14, 2020 whereby, effective as of April 24, 2020, the Company changed its year end to December 31, 2020; and

20. the template version of the term sheet for the Offering dated August 21, 2020 (the “Marketing Materials”);

21. the material change report dated August 28, 2020 respecting the announcement of the Offering;

22. the material change report dated September 8, 2020 respecting the definitive agreement with Platinum Vape (the “Platinum Vape Definitive Agreement”); and

-5-

23. the material change report dated September 15, 2020 respecting (i) the issuance of a $10 million convertible debenture to 1260356 Ontario Limited on September 11, 2020 (the “Convertible Debenture”) of which a portion of the proceeds was used to make the initial payment under the Platinum Vape Definitive Agreement; and (ii) the completion of the Platinum Vape acquisition on September 14, 2020 whereby RWB Platinum Vape Inc., a wholly-owned California subsidiary of RWB (“RWB Platinum Vape”), acquired all of the issued and outstanding equity interests of Platinum Vape.

Any documents of the type referred to above or similar material and any documents required to be incorporated by reference herein pursuant to National Instrument 44-101 – Short Form Prospectus Distributions, including any annual information form, all material change reports (excluding confidential reports, if any), all annual and interim financial statements and management’s discussion and analysis relating thereto, or information circular or amendments thereto that the Company files with any securities commission or similar regulatory authority in Canada after the date of this Prospectus and prior to the termination of this Offering will be deemed to be incorporated by reference in this Prospectus and will automatically update and supersede information contained or incorporated by reference in this Prospectus.

Any statement contained in this Prospectus or a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Prospectus, to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies, replaces or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not constitute a part of this Prospectus, except as so modified or superseded.

THE COMPANY Summary of the Business

RWB focuses on investing in and financing businesses that pertain in any way to cannabis and which are carried out in compliance with applicable United States state laws (the “U.S. legal cannabis industry”). The Company actively seeks financing arrangements involving royalties, debt and other forms of investments and acquisitions in private and public companies in the U.S. legal cannabis industry. It is anticipated that the Company will predominately focus its investments, with the strength of its world‐class team, on major markets in the United States, including Michigan, Illinois, California, and Massachusetts with respect to cannabis and the entire United States for legal hemp CBD based products. The Company, through certain subsidiaries and investees, currently has limited indirect involvement in the U.S. legal cannabis industry in Florida and Oklahoma in the form of sublicensing arrangements with arm’s length entities.

The Company’s business objective is to provide capital solutions to companies in the U.S. legal cannabis industry with large-scale potential and a highly-skilled and experienced management team across multiple industry verticals, including cultivation, processing and distribution. The Company is actively pursuing opportunities to provide expansion capital to licensed, qualified operators across multiple industry verticals including cultivation, processing and distribution.

The nature and timing of the Company’s investments will depend, in part, on available capital at any particular time and the investment opportunities identified and available to the Company. As the board of directors of the Company (the “Board of Directors”) grows, the Company expects that it will establish a formal investment committee to evaluate future opportunities. Until such time as a formal committee is created, the Board of Directors will continue to carry out all functions in accordance with the Company’s investment policy. The Company expects its investment activities will be primarily focused on enterprises located in the United States, although investments may extend globally (including the purchase of securities listed on foreign stock exchanges). The Company expects to invest solely in the cannabis sector. The Company believes that any risk of limited diversification may be mitigated by

-6-

closely monitoring its investments. The actual composition of the Company’s investment portfolio will vary over time depending on its assessment of a number of factors, including the performance of United States cannabis markets and credit risk.

The Company’s current material subsidiaries and investees are MichiCann, PharmaCo, RWB Illinois, MAG, RWB Platinum Vape, Vista Prime Management, LLC, GC Ventures 2, LLC, Vista Prime 3, Inc., PV CBD LLC, Vista Prime 2, Inc., RWB Licensing, RLTY USA Corp., RLTY Development MA 1 LLC, RLTY Development Springfield LLC, RLTY Development Orange LLC, RLTY Beverage LLC and VLF Holdings LLC d/b/a Diem (“Diem”), the financing transactions in respect of each are described herein and in the Listing Statement.

For a detailed description of the business of the Company, prospective purchasers should refer to the Company’s Annual Information Form incorporated by reference into this Prospectus and available on the Company’s SEDAR profile at www.sedar.com.

Inter-Corporate Relationships

The following chart illustrates the Company’s material subsidiaries, the percentage of voting securities of each that are held by RWB either directly or indirectly, and their respective jurisdiction of incorporation, continuance, formation or organization:

Subsidiary Name

| Ownership by

RWB

| Jurisdiction of Incorporation,

Continuance, Formation or

Organization

|

RLTY USA Corp.

| 100%

| Delaware

|

RLTY Beverage 1 LLC

| 100%

| Delaware

|

RLTY Development MA 1 LLC

| 100%

| Delaware

|

RLTY Development Springfield LLC

| 100%

| Massachusetts

|

RLTY Development Orange LLC

| 100%

| Massachusetts

|

Michicann Medical Inc.

| 100%

| Ontario

|

Mid-American Growers, Inc.

| 100%

| Delaware

|

RWB Illinois, Inc.

| 100%

| Delaware

|

RWB Licensing Inc.

| 100%

| British Columbia

|

RWB Platinum Vape Inc.

| 100%

| California

|

Vista Prime Management, LLC

| 100%

| California

|

GC Ventures 2, LLC

| 100%

| Michigan

|

Vista Prime 3, Inc.

| 100%

| California

|

PV CBD LLC

| 100%

| California

|

Vista Prime 2, Inc.

| 100%

| California

|

-7-

Investees

The following table describes the Company’s material investees. Harborside Inc. and Lighthouse Strategies LLC were specifically excluded from the table as non-material investees.

PharmaCo

|

Incorporation date

| March 11, 2016

|

RWB ownership

| RWB holds a put/call option to acquire PharmaCo in exchange for 37,000,000 Common Shares and 37,000,000 Series II Preferred Shares pursuant to the PharmaCo Put/Call Agreement. As at June 30, 2020, the call option was determined to have a fair value of $19,828,224.

As at June 30, 2020, RWB has advanced an aggregate of $90,262,929 to PharmaCo through a promissory note and a senior secured convertible debenture, as further described in the Listing Statement.

|

interest and investment

amount

|

|

Management and

| James Skrinner, President and Director

Fernando Di Carlo, Vice-President and Director

PharmaCo operates at arm’s length to RWB, and as such RWB’s knowledge of the management and directors of PharmaCo is limited to information that is publicly available.

RWB does not have any compensation or employment arrangements with any members of management or the board of directors of PharmaCo.

|

directors, including

compensation and employment arrangements

|

|

|

|

|

Related party

transactions between

RWB and the investee

| None.

|

Exit strategy

| RWB has applied for regulatory approval to acquire PharmaCo and is currently awaiting a decision from Michigan regulatory authorities. If approved, RWB will assume the operation of PharmaCo’s business. In the event regulatory approval is not granted, RWB will evaluate options that include, among other things, terminating the relationship.

|

Management fee

| No current management fee arrangements. A previous management fee arrangement existed between PharmaCo and MichiCann whereby PharmaCo would pay US$100,000 per month for certain administrative, non-operational support services. PharmaCo retained outside service providers for these administrative services subsequent to Q1 2020.

|

arrangements

|

Diem

|

Incorporation date

| February 14, 2014

|

RWB ownership

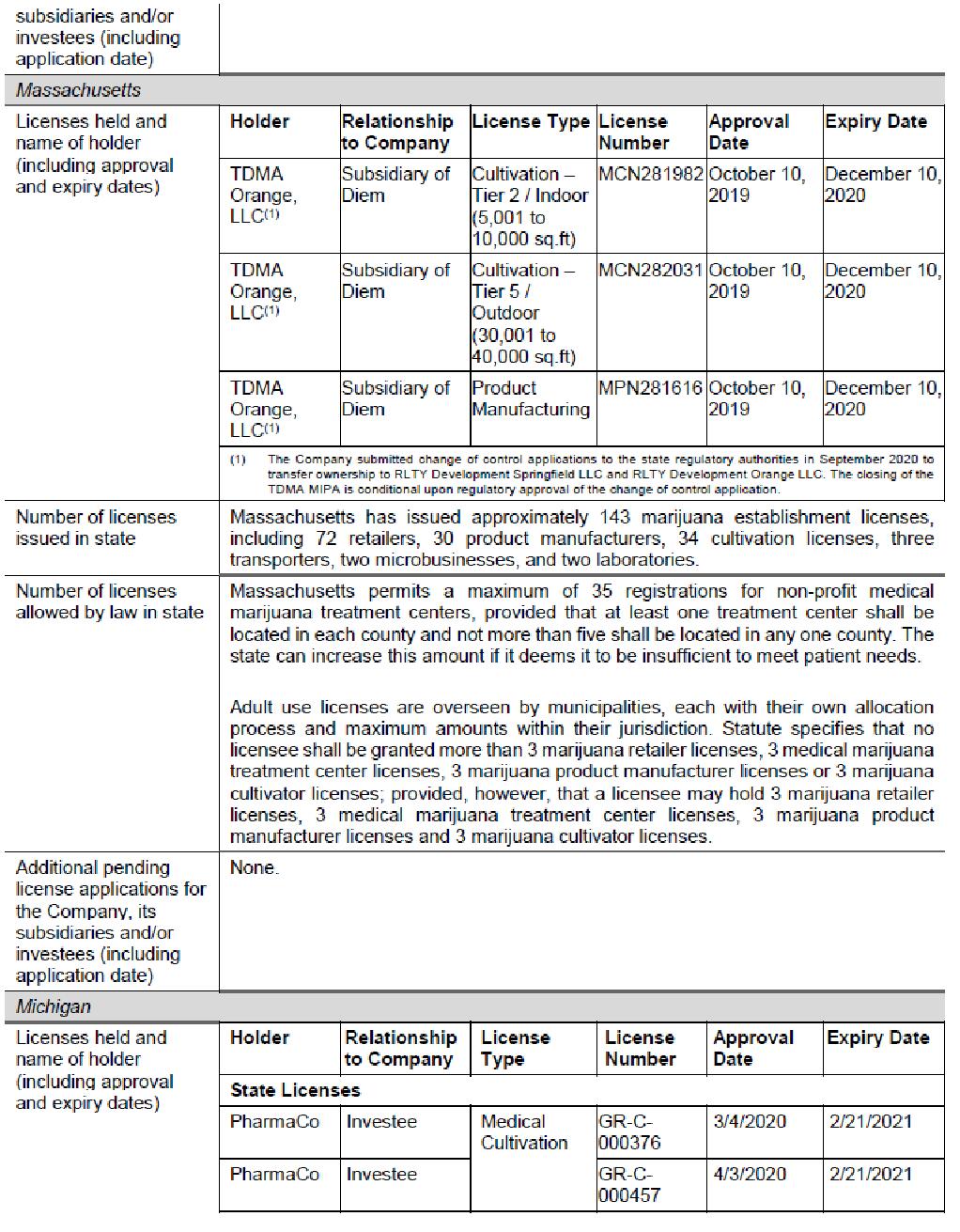

| RWB executed a definitive agreement with Diem on August 31, 2018, as amended on October 15, 2018 and December 26, 2018 (the “Diem Agreement”), to finance the expansion of TDMA LLC, a Massachusetts subsidiary of Diem (“TDMA”) into Massachusetts. Pursuant to the Diem Agreement, the Company will provide Diem with up to US$12.5 million over three years to develop and operate a large-scale cultivation and processing facility and up to four dispensaries in Massachusetts (the “Diem Financing”).

The terms of the Diem Financing were re-negotiated and RWB began the process of exiting the investment pursuant to the terms of the Diem Agreement. This culminated in RWB entering into a definitive Membership Interest Purchase Agreement on September 26, 2019 (the “TDMA MIPA”) with TDMA to acquire all of the issued and

|

interest and investment

amount

|

|

-8-

| outstanding equity in TDMA Orange, LLC, a Diem subsidiary. Pursuant to the terms of the TDMA MIPA, RWB will acquire a 100% ownership interest in two cultivation licenses and a processing license in Orange, Massachusetts conditional upon approval of a change of control application. As consideration for the TDMA MIPA, RWB will forgive certain promissory notes including accrued interest, cross collateralization and general security arrangement. A change of control application for the TDMA Orange licenses was submitted in September 2020 and it is anticipated that it will take 5 to 8 months to be processed by the Cannabis Control Commission of the Commonwealth of the State of Massachusetts.

|

Management and

Directors, including

compensation and

employment

arrangements

| Chris Mitchem, Chief Executive Officer

Diem operates at arm’s length to RWB, and as such RWB’s knowledge of themanagement and directors of Diem is limited to information that is publicly available.

RWB does not have any compensation or employment arrangements with any members of management or the board of directors of Diem.

|

Related party

transactions between

RWB and the investee

| None.

|

Exit strategy

| Upon receipt of the licenses currently awaiting regulatory approval from state authorities, RWB will determine whether to pursue a business in Massachusetts or to liquidate the licensed entities.

|

Management fee

| None.

|

arrangements

|

RECENT DEVELOPMENTS

The following are material recent developments of the Company since the filing of the Annual Information Form. PharmaCo continues to produce an aggregate of 2,500,000 grams of medical cannabis per year on an annual

basis from two facilities in Michigan. PharmaCo’s planned 85,000 square foot facility capable of producing

10,000,000 grams of medical cannabis per year is still under development and not yet operational. PharmaCo has been purchasing wholesale flower under offtake agreements to fulfill its excess supply needs as construction of its new facility continues. PharmaCo intends to have at least 25 operating provisioning centers prior to the end of the

2020 calendar year, subject to financing and applicable regulatory approvals.

On August 11, 2020, RWB entered into the Avicanna Distribution Agreement for the exclusive distribution of Avicanna’s advanced and clinically backed Pura H&W™ CBD-based cosmetic and topical products by RWB in the United States and certain other markets.

Under the Avicanna Distribution Agreement, which has an initial five-year term, RWB will exclusively distribute the Pura H&W™ brand and certain other white label brands at RWB’s direction. RWB will pay Avicanna an upfront cash licensing fee in the amount of $250,000, along with minimum purchase requirements for the rights to be the exclusive distributor of Avicanna’s Pura H&W™ branded cosmetics products in the United States. Under the Avicanna Distribution Agreement, RWB also has the right to purchase Avicanna’s cosmetics products for distribution into the United States and certain other territories under brands of RWB’s choosing. The initial product offerings under the agreement will include body and face lotions, cosmetic creams, gels and serums, as well as soaps and bath bombs.

On August 19, 2020, RWB entered into the Critical 39 Agreement with Critical 39, a Spokane, Washington based company focused on delivering premium products throughout the United States.

-9-

Under terms of the Critical 39 Agreement, Critical 39 has already delivered 100,000 seeds to RWB’s 3.6 million square foot facility in Granville, Illinois where they are being cultivated in accordance with good agricultural practices and will be processed into finished whole hemp flower. The initial crop is expected to utilize a small portion of the facility’s capacity. The Critical 39 Agreement has provisions for the parties to extend the relationship into the year 2022.

On September 1, 2020, RWB entered into the Platinum Vape Definitive Agreement, the terms of which are described in the material change report dated September 8, 2020. The Platinum Vape acquisition was completed on September 14, 2020, as more fully described in the material change report dated September 15, 2020. See “Documents Incorporated by Reference”. Platinum Vape are purveyors of a full product line of premium cannabis products sold at more than 700 retailers throughout Michigan, California and Oklahoma. It is intended that Platinum Vape will operate as RWB Platinum Vape, a separate division of the Company focused on the current markets it serves as well as provide hemp-derived CBD-based products nationally in the United States. RWB Platinum Vape will operate in California as a THC licensed entity from a 5100 square foot facility in San Diego and is in the process of moving to a new 9000 square foot facility in Chula Vista, California. Outside of California, RWB Platinum Vape products are manufactured and sold through arm’s length entities in other markets. RWB Platinum Vape will retain the previous management team to oversee the day to day operations of RWB Platinum Vape and its expansion, when warranted, to other U.S. legal cannabis markets.

On September 11, 2020, RWB entered into the Convertible Debenture, the terms of which are described in the material change report dated September 15, 2020. See “Documents Incorporated by Reference”.

REGULATORY OVERVIEW

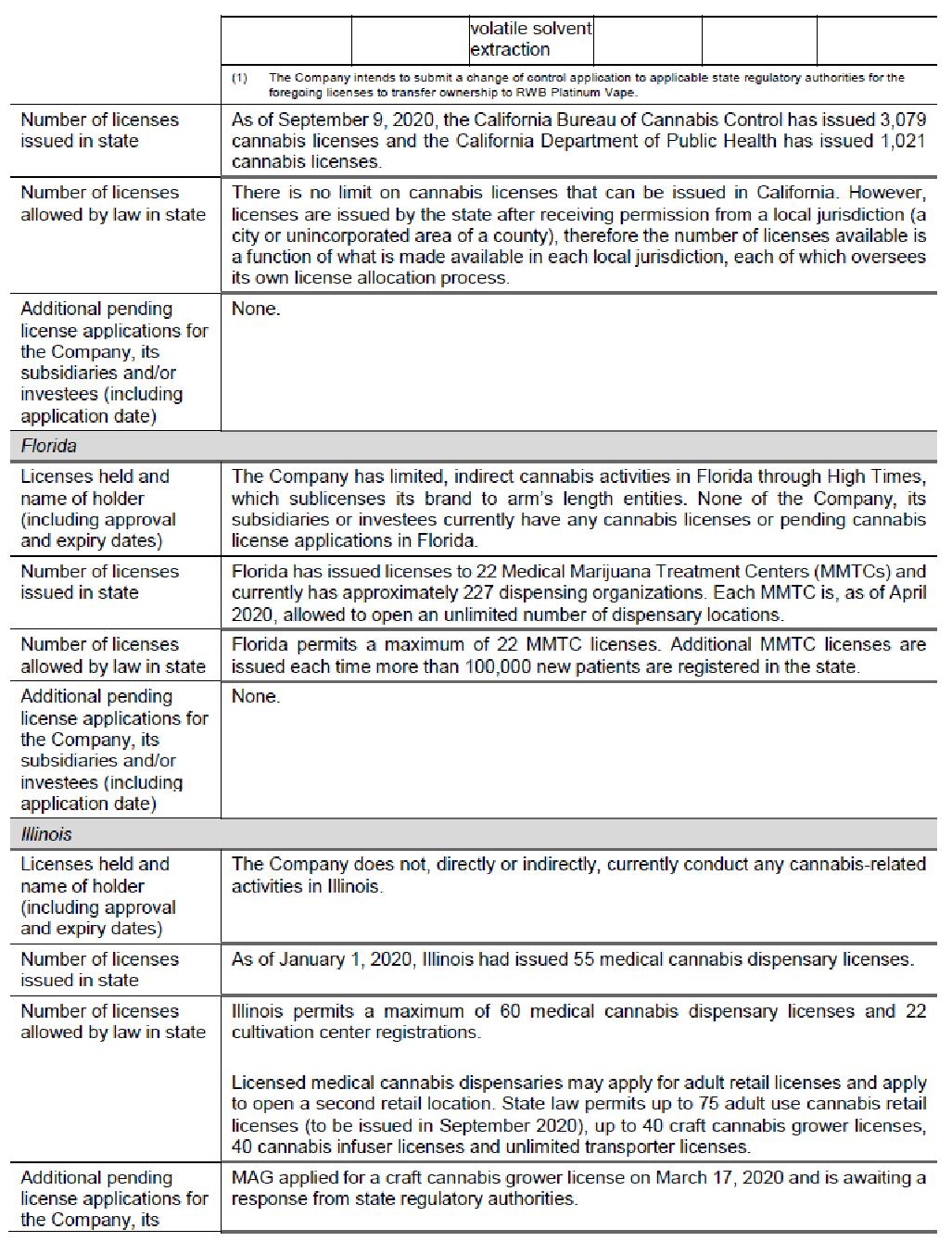

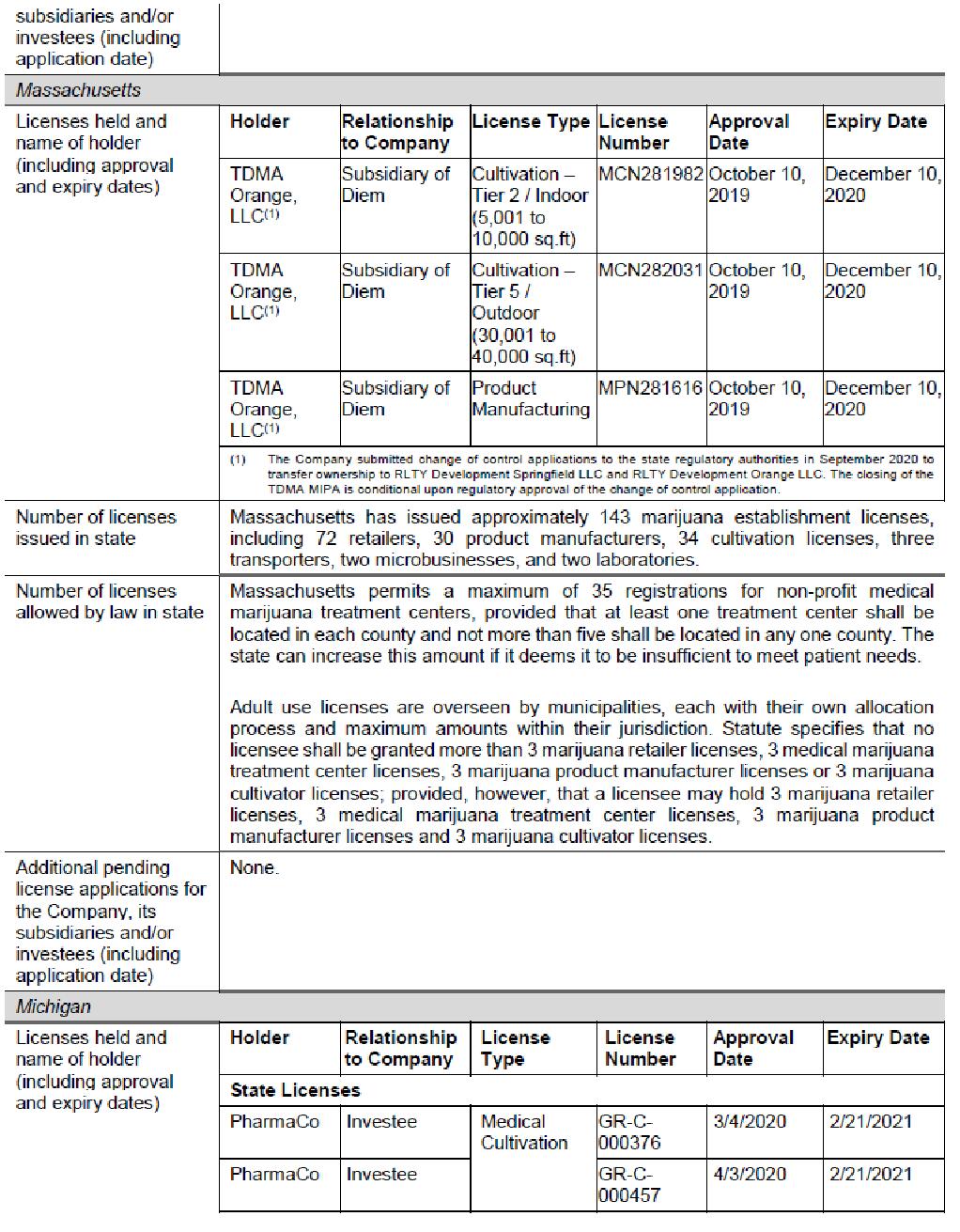

In accordance with Staff Notice 51-352, below is a discussion of the federal and state-level U.S. regulatory regimes in those jurisdictions where the Company is directly involved through certain subsidiaries and investees and expects to be directly involved through additional subsidiaries and investees in the U.S. legal cannabis industry. Pursuant to Staff Notice 51-352, issuers with U.S. cannabis-related activities are expected to clearly and prominently disclose certain prescribed information in prospectus filings and other required disclosure documents, such as this Prospectus. The Company is, through certain subsidiaries and investees, and intends to be, directly or indirectly, through additional subsidiaries and proposed acquisition targets, directly engaged in the cultivation, processing, sale and distribution of cannabis in the cannabis marketplaces in Michigan, Illinois, California and Massachusetts. The Company, through certain subsidiaries and investees, has limited indirect operations in Florida and Oklahoma through sublicensing arrangements with arm’s length entities. As such, the Company is subject to Staff Notice 51-352. Although the Company’s and, to the Company’s knowledge, its investees’ business activities are compliant with applicable U.S. state and local law, strict compliance with state and local laws with respect to cannabis may neither absolve the Company of liability under U.S. federal law, nor may it provide a defense to any federal proceeding which may be brought against the Company or its investees. In accordance with Staff Notice 51-352, the Company will evaluate, monitor and reassess this disclosure, and any related risks, on an ongoing basis and the same will be supplemented and amended to investors in public filings, including in the event of government policy changes or the introduction of new or amended guidance, laws or regulations regarding cannabis regulation. Any non-compliance, citations or notices of violation which may have an impact on the Company’s licenses, business activities or operations will be promptly disclosed by the Company.

In accordance with the Staff Notice 51-352, below is a table of concordance that is intended to assist readers in identifying those parts of this Prospectus that address the disclosure expectations outlined in Staff Notice 51-352.

Industry

| Specific Disclosure Necessary to Fairly

Present all Material Facts, Risks and

Uncertainties

| Cross-Reference (Prospectus or

Documents Incorporated by

Reference)

|

Involvement

|

All Issuers with

| Describe the nature of the issuer’s involvement in the U.S. marijuana industry and include the disclosures indicated for at least one of the direct,

| “The Company – Summary of the

|

U.S. Marijuana-

| Business” and “Recent

|

Related Activities

| Developments” in this Prospectus

|

-10-

| indirect and ancillary industry involvement types noted in this table.

| “General Development of the

Business – Three Year History” and

“Description of the Business” in the

Annual Information Form

“General Development of the

Business” and “Narrative

Description of the Business” in the

Listing Statement

|

Prominently state that marijuana is illegal under U.S. federal law and that enforcement of relevant laws is a significant risk

| Pages iv to vi (disclosure in bold typeface), “Regulatory Overview”

and “Risk Factors” in this

Prospectus

|

“Risk Factors – Risks Related to the Cannabis Industry” in the Annual Information Form

|

“Narrative Description of the

Business – Market Information,

Trends, Commitments, Events and Uncertainties”, “Risk Factors – Risks Related to the Cannabis Industry” in the Listing Statement

|

Discuss any statements and other available

guidance made by federal authorities or

prosecutors regarding the risk of enforcement

action in any jurisdiction where the issuer conducts

U.S. marijuana-related activities.

| Pages iv to vi (disclosure in bold

typeface), “Regulatory Overview”

and “Risk Factors” in this

Prospectus

“Risk Factors – Risks Related to the

Cannabis Industry” in the Annual

Information Form

“Narrative Description of the

Business – Market Information,

Trends, Commitments, Events and

Uncertainties” in the Listing

Statement

|

Outline related risks including, among others, the risk that third party service providers could suspend or withdraw services and the risk that regulatory bodies could impose certain restrictions on the issuer’s ability to operate in the U.S.

| “Risk Factors” in this Prospectus

|

“Risk Factors – Risks Related to the Cannabis Industry” in the Annual Information Form

|

“Narrative Description of the

Business – Market Information,

Trends, Commitments, Events and Uncertainties” and “Risk Factors – Risks Related to the Cannabis Industry” in the Listing Statement

|

Given the illegality of marijuana under U.S. federal law, discuss the issuer’s ability to access both

| “Risk Factors” in this Prospectus

|

-11-

| public and private capital and indicate what financing options are / are not available in order to

support continuing operations.

| “Risk Factors – Risks Related to the

Cannabis Industry” in the Annual

Information Form

|

“Risk Factors – Risks Related to the Cannabis Industry” in the Listing Statement

|

Quantify the issuer’s balance sheet and operating statement exposure to U.S. marijuana-related activities

| Please see the Interim Financial

Statements. As at June 30, 2020, the Company’s balance sheet and operating statement had 100% exposure to U.S. marijuana-related activities.

|

Disclose if legal advice has not been obtained, either in the form of a legal opinion or otherwise, regarding (a) compliance with applicable state

regulatory frameworks and (b) potential exposure

and implications arising from U.S. federal law.

| The Company and its subsidiaries have received and continue to receive legal input regarding (a)

compliance with applicable state

regulatory frameworks and (b)

potential exposure and implications

arising from U.S. federal law in certain respects.

|

U.S. Marijuana

Issuers with direct

involvement in cultivation or distribution