Exhibit 99.11

RESTRICTED SHARE UNIT PLAN OF

RED WHITE & BLOOM BRANDS INC. (effective as of July 27, 2020)

PART 1

GENERAL PROVISIONS

Establishment and Purpose

1.1 The Company hereby establishes a Restricted Share Unit plan, in this document referred to as the “Plan”.

1.2 The purpose of the Plan is to secure for the Company and its shareholders the benefits of incentive inherent in share ownership by Eligible Persons who, in the judgment of the Board, will be responsible for its future growth and success. The Board also contemplates that through the Plan, the Company will be better able to compete for and retain the services of the individuals needed for the continued growth and success of the Company.

1.3 Restricted Share Units granted pursuant to this Plan will be used to compensate Eligible Persons who have forgone salary to assist the Company in cash management in exchange for the grant of Restricted Share Units and incentive stock options under the Company’s stock option plan.

Definitions

1.4 In this Plan:

(a)“Applicable Withholding Tax” means any and all taxes and other source deductions or other amounts which the Company is required by Applicable Law to withhold from any amounts paid or credited to a Participant under the Plan, which the Company determines to withhold in order to fund remittance obligations;

(b) “Award” means an award of Restricted Share Units under this Plan represented by a Restricted Share Unit

Notice;

(c)“Award Payout” means the applicable Share issuance in respect of a vested Restricted Share Unit pursuant and subject to the terms and conditions of this Plan and the applicable Award;

(d) “Board” means the board of directors of the Company;

(e) “Business Day” means means a day upon which the Canadian Securities Exchange is open for trading;; (f) “Code” means the U.S. Internal Revenue Code of 1986, as amended;

(g)“Committee” means the Compensation Committee of the Board or other committee of the Board, consisting of not less than three directors, to whom the authority of the Board is delegated in accordance with Section 1.8 hereof;

(h)“Consultant” means an individual or Consultant Company other than an Employee or a Director of the Company, that (i) provides ongoing consulting, technical, management or other services to the Company or to an Affiliate of the Company; (ii) provides the services under a written contract between the Company or the Affiliate and the individual or the Consultant Company; (iii) spends or will spend a significant amount of time and attention on the affairs and business of the Company or an Affiliate of the Company; and (iv) has a relationship with the Company or an Affiliate of the Company that enables the individual to be knowledgeable about the business and affairs of the Company;

(i) “Company” means Red White & Bloom Brands Inc., and includes any successor Company thereto; (j) “Director” means a member of the Board;

(k) “Eligible Person” means any person who is an Employee, Officer, Director or a Management Company

Employee or a Consultant;

(l) “Employee” means an employee of the Company or of a Related Entity;

(m) “Expiry Date” means the earlier of (i) five (5) years from the date of vesting of a Restricted Share Unit, and

(ii) ten (10) years from the Grant Date;

(n) “Grant Date” means the date of grant of any Restricted Share Unit;

(o) “Insider” means has the meaning ascribed to that term pursuant to the British Columbia Securities Act;

2

(p)“Management Company Employee” means an individual employed by a corporation providing management services to the Company which are required for the ongoing successful operation of the business enterprise of the Company, but excluding a person engaged in Investor Relations Activities;

(q)“Officer” means an individual who is an officer of the Company or of a Related Entity as an appointee of the Board or the board of directors of the Related Entity, as the case may be;

(r) “Outstanding Issue” means the number of Shares outstanding on a non-diluted basis;

(s)“Participant” means an Eligible Person who may be granted Restricted Share Units from time to time under this Plan;

(t) “Plan” means this Restricted Share Unit Plan, as amended from time to time;

(u)“Restricted Share Unit” means a right granted under this Plan to receive the Award Payout on the terms contained in this Plan as more particularly described in Section 4.1 hereof;

(v)“Related Entity” means a person that is controlled by the Company. For the purposes of this Plan, a person (first person) is considered to control another person (second person) if the first person, directly or indirectly, has the power to direct the management and policies of the second person by virtue of

(i) ownership of or direction over voting securities in the second person, (ii) a written agreement or indenture,

(iii) being the general partner or controlling the general partner of the second person, or

(iv) being a trustee of the second person;

(w) “Required Approvals” has the meaning contained in Section 64.1 hereof;

(x) “Securities Act” means the Securities Act (Ontario), as amended from time to time;

(y) “Share” means a common share in the capital of the Company as from time to time constituted;

(z)“Total Disability” means, with respect to a Participant, that, solely because of disease or injury, within the meaning of the long-term disability plan of the Company, the Participant, is deemed by a qualified physician selected by the Company to be unable to work at any occupation which the Participant, is reasonably qualified to perform;

(aa)“Trigger Date” means the date a Participant requests the issuance of Shares, pursuant to a Trigger Notice, issuable upon vesting of an Award and prior to the Expiry Date;

(bb)“Trigger Notice” means the notice respecting the issuance of Shares pursuant to vested Restricted Share Unit(s), substantially in the form attached to Restricted Share Unit Notice, duly executed by the Participant; and

Interpretation

1.5 For all purposes of this Plan, except as otherwise expressly provided or unless the context otherwise requires:

(a)any reference to a statute shall include and shall, unless otherwise set out herein, be deemed to be a reference to such statute and to the regulations made pursuant thereto, with all amendments made thereto and in force from time to time, and to any statute or regulations that may be passed which has the effect of supplementing or superseding such statute or such regulations;

(b)the singular includes the plural and vice-versa, and a reference to any of the feminine, masculine or neuter includes the other two;

(c)any reference to “consent” or “discretion” of any person shall be construed as meaning that such person may withhold such consent arbitrarily or grant it, if at all, on such terms as the person sees fit, and may exercise all discretion fully and in unfettered manner; and

(d)any reference to “including” or “inclusive” shall be construed as not restricting the generality of any foregoing or other provision.

Effective Date

1.6 This Plan will be effective on July 27, 2020. The Board may, in its discretion, at any time, and from time to time, issue Restricted Share Units to Eligible Persons as it determines appropriate under this Plan. However, any

3

such issued Restricted Share Units may not be paid out until receipt of the necessary approvals from shareholders of the Company and any applicable regulatory bodies (the “Required Approvals”).

Administration

1.7 The Board is authorized to interpret this Plan from time to time and to adopt, amend and rescind rules and regulations for carrying out the Plan. The interpretation and construction of any provision of this Plan by the Board shall be final and conclusive. Administration of this Plan shall be the responsibility of the appropriate officers of the Company and all costs in respect thereof shall be paid by the Company.

Delegation to Committee

1.8 All of the powers exercisable hereunder by the Board may, to the extent permitted by law and as determined by a resolution of the Board, be delegated to a Committee including, without limiting the generality of the foregoing, those referred to under §1.7 and all actions taken and decisions made by the Committee or by such officers in this regard will be final, conclusive and binding on all parties concerned, including, but not limited to, the Company, the Eligible Person, and their legal representatives.

Incorporation of Terms of Plan

1.9 Subject to specific variations approved by the Board all terms and conditions set out herein will be incorporated into and form part of each Restricted Share Unit granted under this Plan.

Maximum Number of Shares

1.10 The aggregate number of Shares that may be reserved for issuance, at any time, under this Plan and under any other share compensation arrangement adopted by the Company, including the Company’s incentive stock option plan(s), shall not exceed up to a maximum of 20% of the issued and outstanding Shares at the time of grant pursuant to awards granted under the 2020 Plans;

1.11 Any Shares subject to a Restricted Share Unit which has been granted under the Plan and which is cancelled or terminated in accordance with the terms of the Plan without being paid out in Shares as provided for in this Plan shall again be available under the Plan.

PART 2

AWARDS UNDER THIS PLAN

Eligibility

2.1 Awards will be granted only to Eligible Persons. If any Eligible Person is (pursuant to the terms of his or her employment, engagement or otherwise) subject to a requirement that he or she not benefit personally from an Award, the Committee may (in its discretion, taking into account relevant corporate, securities and tax laws) grant any Award to which such Person would otherwise be entitled to the Person’s employer or to any other entity designated by them that directly or indirectly imposes such requirement on the Person. The Committee shall have the power to determine other eligibility requirements with respect to Awards or types of Awards.

Limitation on Issuance of Shares to Insiders

2.2 Notwithstanding anything in this Plan, the Company shall not issue Shares under this Plan to any Eligible

Person who is an Insider of the Company where such issuance would result in:

(a)the total number of Shares issuable at any time under this Plan to Insiders, or when combined with all other Shares issuable to Insiders under any other equity compensation arrangements then in place, exceeding 10% of the total number of issued and outstanding equity securities of the Company on a non-diluted basis; and

4

(b)the total number of Shares that may be issued to Insiders during any one year period under this Plan, or when combined with all other Shares issued to Insiders under any other equity compensation arrangements then in place, exceeding 10% of the total number of issued and outstanding equity securities of the Company on a non diluted basis.

PART 3

RESTRICTED SHARE UNITS

Participants

3.1 Restricted Share Units that may be granted hereunder to a particular Eligible Person in a calendar year will (subject to any applicable terms and conditions and the Board’s discretion) represent a right to a bonus or similar payment to be received for services rendered by such Eligible Person to the Company or a Related Entity, as the case may be, in the Company’s or the Related Entity’s fiscal year ending in, or coincident with, such calendar year.

Grant

3.2 The Board may, in its discretion, at any time, and from time to time, grant Restricted Share Units to Eligible Persons as it determines is appropriate, subject to the limitations set out in this Plan, and shall be as set forth in a Restricted Share Unit Notice delivered to such Participant. In making such grants the Board may, in its sole discretion but subject to Section 3.3 hereof, in addition to Performance Conditions set out below, impose such conditions on the vesting of the Awards as it sees fit, including imposing a vesting period on grants of Restricted Share Units.

Vesting

3.3 Except as provided in this Plan, Restricted Share Units issued under this Plan will vest and become subject to a Trigger Notice, only upon the date determined by the Board, or if applicable the Committee, which shall be as set forth in a Restricted Share Unit Notice delivered to such Participant.

Forfeiture and Cancellation Upon Expiry Date

3.4 Restricted Share Units which do not vest and have not been issued on or before the Expiry Date of such Restricted Share Unit will be automatically deemed cancelled, without further act or formality and without compensation.

Account

3.5 Restricted Share Units issued pursuant to this Plan (including fractional Restricted Share Units, computed to three digits) will be credited to a notional account maintained for each Participant by the Company for the purposes of facilitating the determination of amounts that may become payable hereunder. A written confirmation of the balance in each Participant’s account will be sent by the Company to the Participant upon request of the Participant.

Adjustments and Reorganizations

3.6 In the event of any dividend paid in shares, share subdivision, combination or exchange of shares, merger, consolidation, spin-off or other distribution of Company assets to shareholders, or any other change in the capital of the Company affecting Shares, the Board, in its sole and absolute discretion, will make, with respect to the number of Restricted Share Units outstanding under this Plan, any proportionate adjustments as it considers appropriate to reflect that change.

Notice and Acknowledgement

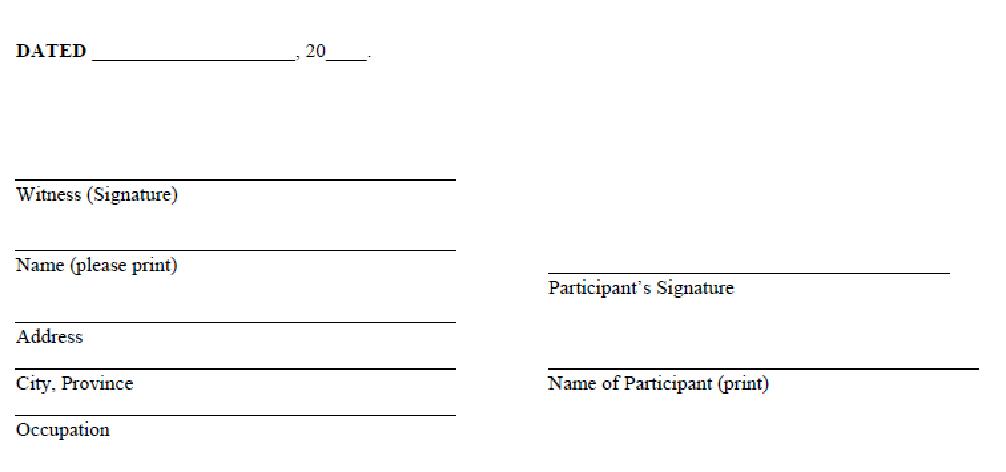

3.7 No certificates will be issued with respect to the Restricted Share Units issued under this Plan. Each Participant will, prior to being granted any Restricted Share Units, deliver to the Company a signed acknowledgement substantially in the form of Schedule “A” to this Plan.

5

PART 4

PAYMENTS UNDER THE RESTRICTED SHARE UNITS Payment of Restricted Share Units

4.1 Subject to the terms of this Plan and, without limitation, Section 3.3 hereof, the Company will pay out vested Restricted Share Units issued under this Plan and credited to the account of a Participant by issuing (net of any Applicable Withholding Tax) to such Participant, on or before the 10th Business Day following the Trigger Date but no later than the Expiry Date of such vested Restricted Share Unit, an Award Payout of, subject to receipt of the Required Approvals, one Share for such whole vested Restricted Share Unit. Fractional Shares shall not be issued and where a Participant would be entitled to receive a fractional Share in respect of any fractional vested Restricted Share Unit, the Company shall pay to such Participant, in lieu of such fractional Share, cash equal to the Vesting Date Value as at the Trigger Date of such fractional Share. Each Share issued by the Company pursuant to this Plan shall be issued as fully paid and non-assessable.

Award Payout

4.2 Upon the vesting of Restricted Share Units, no Shares will be issued by the Company to the Participant, until the receipt by the Company, on or before 5:00 p.m. (PT) on the Expiry Date of a Trigger Notice.

Effect of Termination of Employment or Engagement, Death or Disability

4.3 If a Participant shall die while employed or retained by the Company, or while an Officer or Director, the Expiry Date of any vested or unvested Restricted Share Units held by the Participant at the date of death, which have not yet been subject to a Trigger Notice and subsequent Award Payout, shall be amended to the earlier of (i) one (1) year after the date of death, and (ii) the Expiry Date of such Award, except that in the event the expiration of the Award is earlier than one (1) year after the date of death, with Required Approvals, the Expiry Date shall be up to one (1) year after the date of death as determined by the Board. Notwithstanding the foregoing, the Board, in its discretion, may resolve that up to all of the Restricted Share Units held by a Participant at the date of death which have not yet vested shall vest immediately upon death.

4.4 If the employment or engagement of a Participant shall terminate with the Company due to Total Disability while the Participant is employed or retained by the Company, the Expiry Date of any vested or unvested Restricted Share Units held by the Participant at the date of his or her termination due to Total Disability, which have not yet been subject to a Trigger Notice and subsequent Award Payout, shall be amended to the earlier of (i) one (1) year after the date of his or her termination due to Total Disability, and (ii) the Expiry Date of such Award, except that in the event the expiration of the Award is earlier than one (1) year after the date of his or her termination due to Total Disability, with Required Approvals, the Expiry Date shall be up to one (1) year after the date of his or her termination due to Total Disability as determined by the Board. Notwithstanding the foregoing, the Board, in its discretion, may resolve that up to all of the Restricted Share Units held by a Participant at the date of his or her termination due to Total Disability which have not yet vested shall vest immediately upon death.

4.5 Subject to Section 4.16 hereof, if a Participant ceases to be an Eligible Person (other than as provided in Section 4.3 or 4.4), the Expiry Date of any vested or unvested Restricted Share Units held by the Participant at the date such Participant ceased to be an Eligible Person, which have not yet been subject to a Trigger Notice and subsequent Award Payout, shall be amended to the earlier of (i) one (1) year after the date such Participant ceased to be an Eligible Person, and (ii) the Expiry Date of such Award. Notwithstanding the foregoing, the Board, in its discretion, may resolve that up to all of the Restricted Share Units held by a Participant on the date the Participant ceased to be an Eligible Person which have not yet vested shall vest immediately upon such date.

4.6 If the employment of an Employee or Consultant is terminated for cause (as determined by the Board) no Restricted Share Units held by such Participant may be subject to a Trigger Notice following the date upon which termination occurred.

Tax Matters and Applicable Withholding Tax

4.7 The Company does not assume any responsibility for or in respect of the tax consequences of the grant to Participants of Restricted Share Units, or payments received by Participants pursuant to this Plan. The Company or relevant Related Entity, as applicable, is authorized to deduct any Applicable Withholding Tax, in such manner (including, without limitation, by selling Shares otherwise issuable to Participants, on such terms as the Company determines) as it determines so as to ensure that it will be able to comply with the applicable provisions of any

6

federal, provincial, state or local law relating to the withholding of tax or other required deductions, or the remittance of tax or other obligations. The Company or relevant Related Entity, as applicable, may require Participants, as a condition of receiving amounts to be paid to them under this Plan, to deliver undertakings to, or indemnities in favour of, the Company or Related Entity, as applicable, respecting the payment by such Participant’s applicable income or other taxes.

4.8 To the extent required by law, the Company shall make adjustments to, and interpret, the Restricted Share

Units as required by the U.S. Uniformed Services Employment and Reemployment Rights Act.

PART 5

MISCELLANEOUS

Compliance with Applicable Laws

5.1 The issuance by the Company of any Restricted Share Units and its obligation to make any payments hereunder is subject to compliance with all applicable laws. As a condition of participating in this Plan, each Participant agrees to comply with all such applicable laws and agrees to furnish to the Company all information and undertakings as may be required to permit compliance with such applicable laws. The Company will have no obligation under this Plan, or otherwise, to grant any Restricted Share Unit or make any payment under this Plan in violation of any applicable laws.

The Company intends that the Awards and payments provided for in this Plan either be exempt from Section 409A of the Code, or be provided in a manner that complies with Section 409A of the Code, and any ambiguity herein shall be interpreted so as to be consistent with the intent of this Section 5.1. In no event whatsoever shall the Company be liable for any additional tax, interest or penalty that may be imposed on the any person by Section 409A of the Code or damages for failing to comply with Section 409A. Notwithstanding anything contained herein to the contrary, all payments under this Plan to paid or provided at the time of a termination of employment or service will be paid at a termination of employment or service that constitutes a “separation from service” from the Company within the meaning of Section 409A of the Code and the regulations and guidance promulgated thereunder (determined after applying the presumptions set forth in Treas. Reg. Section 1.409A-1(h)(1)). Further, if at the time of a Participant’s termination of employment with the Company, the Participant is a “specified employee” as defined in Section 409A of the Code as determined by the Company in accordance with Section 409A of the Code, and the deferral of the commencement of any payments or benefits otherwise payable hereunder as a result of such termination of employment is necessary in order to prevent any accelerated or additional tax under Section 409A of the Code, then the Company will defer the payment hereunder until the date that is at least six (6) months following the Participant’s termination of employment with the Company (or the earliest date permitted under Section 409A of the Code).

Non-Transferability

5.2 Restricted Share Units and all other rights, benefits or interests in this Plan are non-transferable and may not be pledged or assigned or encumbered in any way and are not subject to attachment or garnishment, except that if a Participant dies the legal representatives of the Participant will be entitled to receive the amount of any payment otherwise payable to the Participant hereunder in accordance with the provisions hereof.

No Right to Service

5.3 Neither participation in this Plan nor any action under this Plan will be construed to give any Eligible Person or Participant a right to be retained in the service or to continue in the employment of the Company or any Related Entity, or affect in any way the right of the Company or any Related Entity to terminate his or her employment at any time.

Applicable Trading Policies

5.4 The Board and each Participant will ensure that all actions taken and decisions made by the Board or the Participant, as the case may be, pursuant to this Plan comply with any applicable securities laws and policies of the Company relating to insider trading or “blackout” periods.

Successors and Assigns

5.5 This Plan will enure to the benefit of and be binding upon the respective legal representatives of the Eligible Person or Participants.

7

Plan Amendment

5.6 The Board may amend this Plan as it deems necessary or appropriate, subject to the requirements of applicable laws, but no amendment will, without the consent of any Eligible Person or unless required by law (or for compliance with applicable corporate, securities or tax law requirements or related industry practice), adversely affect the rights of an Eligible Person or Participant with respect to Restricted Share Units to which the Eligible Person or Participant is then entitled under this Plan.

Plan Termination

5.7 The Board may terminate this Plan at any time, but no termination will, without the consent of the Participant or unless required by law, adversely affect the rights of a Participant respect to Restricted Share Units to which the Participant is then entitled under this Plan. In no event will a termination of this Plan accelerate the vesting of Restricted Share Units or the time at which a Participant would otherwise be entitled to receive any payment in respect of Restricted Share Units hereunder.

Governing Law

5.8 This Plan and all matters to which reference is made in this Plan will be governed by and construed in accordance with the laws of Ontario and the federal laws of Canada applicable therein.

Reorganization of the Company

5.9 The existence of this Plan or Restricted Share Units will not affect in any way the right or power of the Company or its shareholders to make or authorize any adjustment, recapitalization, reorganization or other change in the Company’s capital structure or its business, or to create or issue any bonds, debentures, Shares or other securities of the Company or to amend or modify the rights and conditions attaching thereto or to effect the dissolution or liquidation of the Company, or any amalgamation, combination, merger or consolidation involving the Company or any sale or transfer of all or any part of its assets or business, or any other corporate act or proceeding, whether of a similar nature or otherwise.

No Shareholder Rights

5.10 Restricted Share Units are not considered to be Shares or securities of the Company, and a Participant who is granted Restricted Share Units will not, as such, be entitled to receive notice of or to attend any shareholders’ meeting of the Company, nor entitled to exercise voting rights or any other rights attaching to the ownership of Shares or other securities of the Company, and will not be considered the owner of Shares by virtue of such issuance of Restricted Share Units.

No Other Benefit

5.11 No amount will be paid to, or in respect of, an Eligible Person under this Plan to compensate for a downward fluctuation in the fair market value or price of a Share, nor will any other form of benefit be conferred upon, or in respect of, an Eligible Person for such purpose.

Unfunded Plan

5.12 For greater certainty, the crediting of any Award to the notional accounts set out in this Plan for any Participant does not confer any entitlement, benefits, or any rights of a similar nature or otherwise, aside from the rights expressly set out in this Plan, and this Plan will be an unfunded plan, including for tax purposes and for purposes of the Employee Retirement Income Security Act (United States). Any Participant to which Restricted Share Units are credited to his or her account or holding Restricted Share Units or related accruals under this Plan will have the status of a general unsecured creditor of the Company with respect to any relevant rights that may arise thereunder.