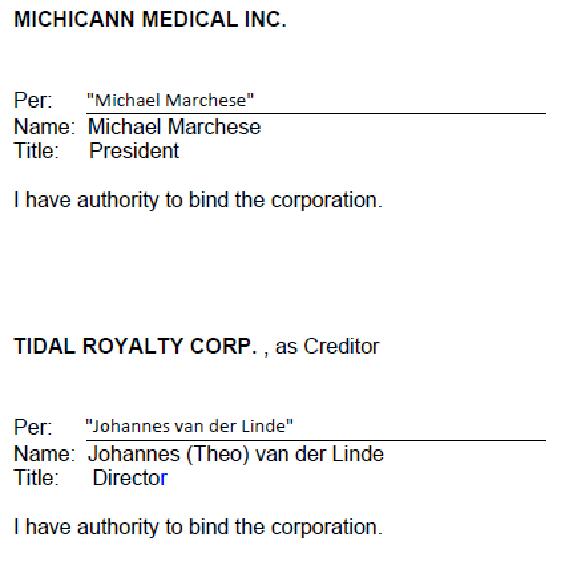

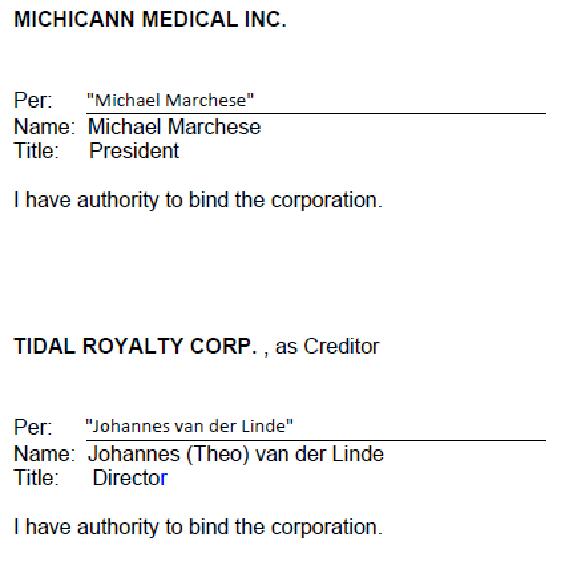

IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date first above written.

9

LEGAL*48677083.3

Exhibit 99.30

SECOND AMENDING AGREEMENT

This Second Amending Agreement (this “Amendment”) is entered into this 11th day of September,

2019.

BETWEEN:

TIDAL ROYALTY CORP.

(the “Creditor”)

- and - MICHICANN MEDICAL INC. (the “Corporation”)

WHEREAS, the Corporation and the Creditor entered into a senior secured convertible debenture dated as of February 25, 2019 and due on September 30, 2019 (as amended, amended and restated, renewed, extended, supplemented, replaced or otherwise modified to the date hereof, including the First Amending Agreement entered into on August 28, 2019, the “Convertible Debenture”);

AND WHEREAS, the parties hereto wish to further amend the Convertible Debenture on the terms and subject to the conditions set forth herein;

NOW, THEREFORE, in consideration of the mutual covenants, terms and conditions set forth herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1. Interpretation & Incorporation of Terms.

(a) Capitalized terms used not otherwise defined in this Amendment shall have the respective meanings assigned to them in the Convertible Debenture.

(b) The provisions of Article One and Article Seven of the Convertible Debenture are incorporated into, and shall apply to, this Amendment, mutatis mutandis, as if set out in full herein.

2. Amendments to the Convertible Debenture.

(a) The principal amount of the Convertible Debenture is hereby increased from CDN

$15,000,000 to CDN $15,000,000 plus USD $2,000,000.

(b) In order to give effect to the foregoing, all references to $15,000,000 in the

Convertible Debenture are hereby deleted and replaced with CDN $15,000,000 plus USD

$2,000,000.

(c) Section 7.16 of the Convertible Debenture is hereby deleted in its entirety and replaced with the following provision:

The Corporation shall make each payment under the Convertible Debenture

(whether on account of principal, interest, fees, costs or any other amount) in

LEGAL*48677083.3

the currency in which the Obligations are denominated (the “Agreed Currency”). If the Creditor receives any payment in any currency other than the Agreed Currency, that payment will constitute satisfaction of the Corporation’s obligations only to the extent of the amount of the Agreed Currency that the Creditor, in accordance with its normal banking procedures, could purchase with that amount of the first Business Day after the day of receipt. All payments shall be made in freely transferable, immediately available funds and without set-off, withholding or deduction of any kind whatsoever except to the extent required by applicable law.

3. Limited Effect. Except as expressly provided herein, all of the terms and provisions of the Convertible Debenture and the other Loan Documents are and shall remain in full force and effect and are hereby ratified and confirmed by the Corporation. The amendments contained herein shall not be construed as a waiver or amendment of any other provision of the Convertible Debenture or the other Transaction Documents or for any purpose except as expressly set forth herein or a consent to any further or future action on the part of the Corporation that would require the waiver or consent of the Creditor.

4. Conditions Precedent. This Amendment shall become effective upon the date (the “Effective Date”) on which the Creditor shall have received this Amendment, duly executed and delivered by the parties hereto.

5. Representations and Warranties. The Corporation, for and on behalf of itself, and on behalf of each of its subsidiaries, hereby represents and warrants to the Creditor (before and after giving effect to this Amendment) that:

(a) The execution, delivery and performance by the Corporation of this Debenture, and the extension of credit (or continued extension of credit) under the Convertible Debenture as amended and as further amended by this Amendment (the “Amended Convertible Debenture”):

(i) are within the Corporation's corporate power;

(ii) have been duly authorized by all necessary or proper corporate action;

(iii)do not contravene any provision of the Corporation's constating documents or bylaws or any resolutions passed by the directors (or any committee thereof) or shareholders of the Corporation;

(iv) do not result in any breach or violation of any statute or any judgment, decree, order, rule, policy or regulation of any court, governmental authority, arbitrator, stock exchange or securities regulatory authority applicable to the Corporation or any of its subsidiaries or any of their respective properties or assets;

(v) do not conflict with or result in the breach or termination of, constitute a default under or accelerate or permit the acceleration of any performance required by, any indenture, mortgage, deed of trust, lease, agreement or other instrument to which the Corporation is a party or by which the Corporation, or any of its property or assets is bound; and

9

LEGAL*48677083.3

(vi) do not require the consent, approval, authorization, order or agreement of, or registrations or qualification with any Governmental Authority or any other Person;

(b) This Amendment has been duly executed and delivered by the Corporation and constitutes a legal, valid and binding obligation of the Corporation enforceable against it in accordance with its terms, subject only to:

(i) applicable bankruptcy, insolvency, liquidation, reorganization, reconstruction,

moratorium laws or similar laws affecting creditors’ rights generally; and

(ii)the fact that the availability of equitable remedies, such as specific performance and injunctive relief, are in the discretion of a court and may not be available where damages are considered an equitable remedy;

(c) No Default or Event of Default has occurred and is continuing, or will result from this Amendment or any extension of credit, including any continued extension of credit, under the Amended Convertible Debenture;

(d) No consent or authorization of, filing with, notice to or other act by, or in respect of, any Governmental Authority or any other Person is required in connection with this Amendment, the extensions of credit under the Amended Convertible Debenture or the execution, delivery, performance, validity or enforceability of this Amendment, or the performance, validity or enforceability of the Amended Convertible Debenture, except consents, authorizations, filings and notices which have been obtained or made and are in full force and effect; and

(e) Each of the representations and warranties of the Corporation contained in this Amendment and in all certificates delivered pursuant to or contemplated by this Amendment will survive the execution of this Amendment.

6. Confirmation of Security. The Corporation hereby confirms that the Security Agreement is and continues to be in full force and effect as continuing security for the payment and performance by it of all its present and future indebtedness, liabilities and obligations to the Creditor now or hereafter arising, to the extent provided therein, and the Security Agreement is enforceable against the Corporation by the Creditor in accordance with its terms.

7. Transaction Document. The parties each acknowledge and agree that this Amendment is a

“Transaction Document”, as such term is defined in the Convertible Debenture.

[SIGNATURE PAGE FOLLOWS]

9

LEGAL*48677083.3

IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date first above written.

9

LEGAL*48677083.3