Exhibit 99.31

AMENDMENT NO. 2 TO AGREEMENT AND PLAN OF MERGER

THIS AMENDMENT NO. 2 TO AGREEMENT AND PLAN OF MERGER (this “Amendment”) is made effective as of January 9, 2020, by and among Michicann Medical Inc., Mid-American Growers, Inc., RWB Acquisition Sub, Inc. and Arthur VanWingerden and Ken VanWingerden, as Sellers.

BACKGROUND

WHEREAS, the parties entered into that certain Agreement and Plan of Merger, dated as of October 9, 2019, as amended by that Amendment No. 1 to Agreement and Plan of Merger dated as of November 1, 2019 (as amended, the “Merger Agreement”); and

WHEREAS, the parties desire to amend certain terms and conditions of the Merger Agreement as set forth herein in accordance with the terms of Section 11.4 of the Merger Agreement and to provide for the joinder of certain additional parties to the Merger Agreement.

NOW THEREFORE, in consideration of the mutual covenants contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

AGREEMENT

1. Waiver of RTO Closing Condition.

a. In exchange for the amendments to certain terms and conditions of the Merger Agreement as set forth herein, each of Buyer and Sellers hereby waives the closing condition set forth in Section 7.3(b) that requires completion of the RTO prior to Closing.

2. Hemp Operations Payable

a. Section 7.3(c) of the Merger Agreement is hereby deleted and replaced as Section 7.1(p) of the Merger Agreement as follows:

(p) Sellers shall provide evidence satisfactory to Buyer that the Hemp Operations Payable has been paid or satisfied by the Company in full prior to Closing.

b. Section 9.6 of the Merger Agreement is hereby amended and restated in its entirety as follows:

Hemp Operations Payable. Prior to Closing, the Sellers will cause the Company to pay in full or otherwise satisfy the Hemp Operations Payable and terminate that certain confirmation of payable agreement dated October 9, 2019, so that as of Closing, the Company shall not owe any payables or any other amounts or obligations to NZ Newco, LLC, a Kentucky limited liability company (“NZ”). Evidence of such payment or other satisfaction of the Hemp Operations

1

Payable shall include, without limitation, acknowledgment by NZ in a separate letter agreement that such payable is deemed satisfied and the Company no longer owes any such amounts or obligations to NZ or its affiliates and the letter agreement is deemed terminated with no further force or effect. Without limiting the foregoing, but for the avoidance of doubt, the Hemp Operations Payable is an Excluded Liability that shall not remain a Company obligation following the Closing.

c. Section 10.1(f) of the Merger Agreement is hereby amended and restated in its entirety as follows:

(f) any Excluded Liabilities (including the Hemp Operations Payable);

3. Amendments Relating to Merger Consideration.

a. Section 2.2 of the Merger Agreement is hereby amended and restated in its entirety as follows:

(a) Within two (2) Business Days of execution of this Agreement, Buyer shall pay to Sellers a cash payment equal to $5,000,000 and (ii) on or around November 1, 2019, Buyer shall pay to Sellers a cash payment equal to $1,000,000 (together, the payments under clauses (i) and (ii), the “Deposit”), which Deposit shall be applied toward the Aggregate Purchase Price at Closing, or should the Closing not occur and this Agreement is terminated, such Deposit shall be fully refundable to Buyer by Sellers in accordance with Section 8.3.

(b) At the Closing, Sellers shall deliver and surrender to Buyer (or to Buyer’s agent) the Certificates formerly representing the issued and outstanding Company Capital Stock.

(c) At the Closing, Buyer shall deliver to the applicable party listed below the following:

(i) to Sellers, a cash payment equal to the Estimated Merger Consideration, minus the Deposit, by wire transfer of immediately available funds in accordance with the distribution schedule and to the account or accounts designated by Sellers on Schedule 2.2, subject to that Letter of Direction to be delivered by Sellers at Closing with respect to Bruce Daniel; and

(ii) At Buyer’s election, Buyer shall cause the refinancing of the Specified Indebtedness in connection with the Closing (or, if permissible, the parties shall cause the Company shall to retain the Specified Indebtedness at the Closing, in either case, Specified Indebtedness shall be deemed paid by Buyer as a result of such refinancing or assumption; and

(iii) Buyer shall pay, or cause to be paid, on behalf of Sellers, the

2

Estimated Seller Transaction Expenses by wire transfer of immediately available funds as directed by Sellers.

(iv) [Intentionally Omitted].

(d) [Intentionally Omitted].

(e) Upon Closing, by virtue of this Section 2.2(e), Buyers shall be deemed to have issued to Sellers a non-transferrable, fully paid right (at the time specified below) to receive the shares of RWB Stock (pro rata in accordance with each Seller’s percentage set forth on Schedule 2.2) (the “RWB Stock Issuance Right”), which Stock Issuance Right entitles Sellers to the actual issuance of RWB Stock as follows:

(i) If the RTO will be completed prior to June 1, 2020, immediately prior to completion of the RTO, Buyer shall cause the issuance to Sellers of Michicann Stock in escrow (pro rata in accordance with each Seller’s percentage set forth on Schedule 2.2), without payment of any additional consideration by Sellers, and in connection with the completion of the RTO promptly thereafter, Sellers shall exchange such Michicann Stock for the shares issued in the RTO at the same exchange ratio available to other common stock holders of Michicann Stock, in accordance with the RTO exchange procedures and subject to and conditioned upon Sellers executing a mutually agreeable lock-up escrow agreement with Buyer, which will require a lock-up period expiring no later no later than six (6) months following the Closing Date for all of the RWB Stock (and, in any event, full lock-up in escrow of 20% of the RWB Stock for the later of 12 months after Closing or the date of the closure of the LUST Matter in accordance with this Agreement), and subject to the foregoing, will provide for the release of the RWB Stock to Sellers in accordance with a distribution schedule, with such legends as required by applicable securities laws. Buyer shall deposit directly with the escrow agent all shares of Michicann Stock and upon exchange of such shares in the RTO, all RWB Stock shall be deposited with the escrow agent accordingly.

(ii) If the RTO is not completed prior to June 1, 2020, then on June 1, 2020, (x) Buyer shall deliver to Sellers an aggregate cash payment equal to $5,000,000 by wire transfer of immediately available funds to the account or accounts designated by Sellers on Schedule 2.2 and (y) Buyer shall cause the issuance to Sellers of the shares of Michicann Stock (pro rata in accordance with each Seller’s percentage set forth on Schedule 2.2, as reduced by shares of Michicann Stock deposited in escrow as provided herein), subject to and conditioned upon Sellers and Buyer executing a mutually agreeable lock-up escrow agreement, which will require full lock-up in escrow of 20% of the RWB Stock for the later of 12 months

3

after Closing or the date of the closure of the LUST Matter in accordance with this Agreement, and executing a shareholder’s agreement containing a drag-along provision in favor of the controlling shareholders substantially similar to the following:

In the event that shareholders of Michicann holding at least 51% of the issued and outstanding common shares of Michicann (the “Controlling Shareholders”) propose to sell or transfer all of their Common Shares to a third party on a share exchange, amalgamation, plan of arrangement or similar transaction in connection with an initial public offering, reverse takeover, qualifying transaction or other going public transaction involving Michicann or a sale of all of the shares of Michicann (the “Liquidity Event”), the Controlling Shareholders may, subject to compliance with all applicable securities laws, by written notice delivered to the Subscriber (the “Drag Along Notice”) require the Subscriber to transfer the Purchased Shares, and any additional shares of Common Shares which the Subscriber may own, for a consideration that is the same as the consideration per share of Common Shares at which the Controlling Shareholders propose to sell or transfer shares to the third party, all but not less than all the Common Shares owned by such Subscriber (the “Dragged Shares”). The delivery by the Controlling Shareholders of a Drag Along Notice shall bind the undersigned to sell or transfer the Dragged Shares. The date on which the sale or transfer is to close and the other closing arrangements (which shall be the same, mutatis mutandis, as those for the sale or transfer between the Controlling Shareholders and the third party) shall be as specified in the Drag Along Notice. Except as specifically provided for above, the Drag Along Notice shall contain only such terms and conditions, if any, as are identical to those pursuant to which the Controlling Shareholders propose to sell or transfer to the third party. This drag along shall terminate upon the earlier of (i) there being one beneficial owner of all of the shares of Michicann; and

(ii) the date of closing of the Liquidity Event.

Buyer shall deposit directly with the escrow agent all shares of Michicann Stock subject to such escrow arrangement.

(iii) Except as otherwise specifically provided in clauses (i) and (ii) above, prior to the issuance to Sellers of the RWB Stock, Sellers shall not be entitled to vote or receive dividends or be deemed the holder of shares of capital stock of Michicann or its successor in the RTO for any purpose, nor shall anything contained in the RWB Stock Issuance Right be construed to confer upon any Seller any of the rights of a shareholder of Michicann or its successor in the RTO or any right to vote, give or

4

withhold consent to any corporate action (whether any reorganization, issue of stock, reclassification of stock, consolidation, merger, conveyance or otherwise), receive notice of meetings, receive dividends or subscription rights, or otherwise. Notwithstanding the foregoing, Michicann shall provide the Sellers with copies of the same notices and other information given to the shareholders of Michicann generally, contemporaneously with the giving thereof to the shareholders. Sellers acknowledge the RWB Stock Issuance Right is not transferrable by Sellers. Without limiting the foregoing, Sellers further acknowledge and agree that the RWB Stock Issuance Right and the RWB Stock is not and at the time of issuance will not be registered under the Securities Act of 1933, as amended, or any state securities laws, and may not be transferred or sold except pursuant to the registration provisions of the Securities Act of 1933, as amended, or pursuant to an applicable exemption therefrom and subject to state securities laws and regulations, as applicable. The RWB Stock will be issued with such legends as required by applicable securities laws.

b. Section 2.6(i) (Lock-Up Escrow Agreements) in the Merger Agreement is hereby amended and restated in its entirety as follows: [Intentionally Omitted]

c. Section 5.4 of the Merger Agreement is hereby amended and restated as follows: “Upon issuance in accordance with this Agreement, the RWB Stock will be duly and validly issued, outstanding as fully paid and non-assessable.”

d. Section 11.9 of the Merger agreement is hereby amended to add the following new definitions (to be placed in alphabetical order accordingly):

(i) “Lock-Up Escrow Agreements” means those certain escrow agreements executed by the Sellers in form mutually agreeable to Buyer and Sellers as contemplated by Section 2.2(e).

(ii) “Michicann Stock” means 17,133,600 shares of common stock in Michicann (which is an aggregate number of shares of such common stock equal to the quotient of $64,900,000, multiplied by a 1.32 exchange rate, and then divided by the Fixed Stock Price).

e. Certain definitions in Section 11.9 of the Merger agreement are hereby amended and restated as follows:

“Cash Consideration” means $7,100,000.

“RWB Stock” means the Michicann Stock, unless and until it is exchanged by Sellers for stock in the RTO as contemplated by and in accordance with this Agreement, at which point, RWB Stock means the class of stock of Michicann’s successor to be listed on the Canadian

5

Securities Exchange or other similar exchange following completion of the RTO.

f. The terms (and related definitions) of “Post-Closing Cash Consideration” and “Stock Consideration in the Merger agreement are deleted in their entirety.

4. Amendments Relating to Milestone Payment and Earn-Out Payment.

a. Section 2.4 of the Merger Agreement is hereby amended and restated in its entirety as follows:

(a) Milestone Payment.

(i) So long as Sellers have used commercially reasonable efforts to assist Buyer and the Company in achieving the Milestone Event, subject to offset under Section 10.8, (i) Buyer shall issue to Sellers an aggregate 2,640,000 additional shares of Michicann Stock (which is an aggregate number of shares of such common stock equal to the quotient of $10,000,000, multiplied by a 1.32 exchange rate, and then divided by the Fixed Stock Price), subject to applicable escrow agreements (the “Milestone Payment”), and (ii) only if the Milestone Event is achieved during calendar year 2020, Buyer shall pay to Sellers in the aggregate an additional $5,000,000 cash payment (the “Additional Milestone Payment”), upon the achievement by or on behalf of Buyer and the Company of the following (the “Milestone Event”):

If by the date which is twelve (12) months following the Closing, the State of Illinois Department of Agriculture and/or such other applicable regulatory authorities (acceptable to Buyer) shall have issued to the Company a commercial cultivation center license for the Illinois Facility, which license permits a minimum of 200,000 square feet of cultivation of cannabis products, including the packaging and processing of cannabis.

(ii) Buyer shall promptly notify Sellers after the Milestone Event has been achieved. Within five (5) Business Days of notification by Buyer to Sellers of the realization of the Milestone Event (but in no event less than ten (10) days following realization of the Milestone Event), Buyer shall (i) if the RTO is not yet completed at such time, issue the Milestone Payment in Michicann Stock to the account or accounts designated by Sellers on Schedule 2.2, subject to and conditioned upon Sellers executing an escrow agreement, which will require that 20% of such Milestone Payment is held in escrow for the later of 12 months after Closing or the date of the closure of the LUST Matter in accordance with this Agreement, or (ii) if the RTO has previously been completed, issue RWB Stock to Sellers in exchange for the Milestone Payment (which for

6

clarity, was 2,640,000 shares of Michicann Stock) at the same exchange ratio that was available to other common stock holders of Michicann Stock upon the original RTO closing, subject to any applicable RTO exchange procedures, and subject to and conditioned upon Sellers executing a mutually agreeable lock-up escrow agreement with Buyer, which will require a lock-up period expiring no later than six (6) months following the Closing Date for all of the RWB Stock so issued (and, in any event, full lock-up in escrow of 20% of the RWB Stock for the later of 12 months after Closing or the date of the closure of the LUST Matter in accordance with this Agreement), and subject to the foregoing, will provide for the release of the RWB Stock to Sellers in accordance with a distribution schedule, with such legends as required by applicable securities laws. Buyer shall deposit directly with the escrow agent all shares of Michicann Stock or RWB Stock, as applicable, with the escrow agent accordingly in connection with realization of the Milestone Event. Additionally, if the Milestone Event is achieved in accordance with this Agreement during calendar year 2020, Buyer shall also pay to Sellers the Additional Milestone Payment by wire transfer in immediately available funds during the time period set forth above.

(iii) Upon Buyer’s payment of the Milestone Payment and any applicable Additional Milestone Payment, if any, all amounts due by Buyer under this Agreement with respect to the Milestone Event will be deemed paid in full.

(v) The right of Sellers to receive the Milestone Payment and Additional Milestone Payment (i) is solely a contractual right and is not a security for purposes of any federal or state securities Laws, (ii) will not be represented by any form of certificate or instrument, (iii) does not give Sellers any equityholder rights, including, without limitation, any dividend rights, voting rights, liquidation rights, preemptive rights or other rights common to holders of Buyer’s equity securities, (iv) is not redeemable and (v) may not be sold, assigned, pledged, gifted, conveyed, transferred or otherwise disposed of (a “Transfer”), except by operation of Law (and any Transfer in violation of this Section 2.4(d) shall be null and void).

(vi) Sellers and Buyer agree to treat and report any Milestone Payment and Additional Milestone Payment as additional consideration for the Company Capital Stock, unless otherwise required pursuant to a “final determination” within the meaning of Section 1313(a) of the Code.

(b) Earn-out.

(i)As additional Final Merger Consideration, so long as Sellers have used commercially reasonable efforts to continue to assist Buyer and the Company to produce and sell Company Hemp Products

7

during the Earn-Out Period, subject to Buyer’s holdback and offset rights under Section 10.8, Buyer shall pay to Arthur VanWingerden, Ken VanWingerden and Bruce Daniel, collectively (the “Earn-Out Sellers”), with respect to each Calculation Period within the Earn-Out Period an aggregate amount, if any (each an “Earn-Out Payment”), equal to the product of (x) the Revenue for such Calculation Period multiplied by (y) twenty-three percent (23%).

(ii) During the Earn-Out Period, Buyer will prepare quarterly statements setting forth the calculations necessary to determine the amount of the actual Earn-Out Payments to be paid to such Sellers based on the Company’s fiscal quarters. Buyer shall deliver such statements within 30 days of the end of each corresponding Calculation Period. Each Earn-Out Payment, if any, is due within 45 days after the end of each Calculation Period based on the quarterly statement delivered by Buyer for that fiscal quarter provided the Earn-Out Sellers have provided applicable wire instructions to Buyer.

(iii) The Earn-Out Sellers shall have the right to audit the Company’s relevant books and records to ensure compliance with the terms of this Agreement with respect to the Earn-Out Payments. The audit shall be conducted only by a representative of a nationally recognized independent certified public accounting firm who signs a non-disclosure agreement reasonably acceptable to Buyer. Buyer shall be entitled to 30 days written notice to schedule the audit on a mutually convenient date. The audit shall be conducted during normal business hours in such a manner as not to interfere with normal business activities and shall occur only one time with respect to the Earn-Out Payments. The auditor’s report shall only confirm compliance or noncompliance with the terms of this Agreement with respect to the Earn-Out Payments and shall, in no event, include information considered by Buyer to be confidential. The Earn-Out Sellers shall be responsible for the costs of such audit.

(iv) The Earn-Out Payments are speculative in that Buyer (and the Company, after the Closing) make no representations, warranties, covenants, promises or guarantees as to the level of efforts they will expend in the production, marketing, distribution or sales of the Company Hemp Products. Similarly, Buyer (and the Company, after the Closing) make no representations, warranties, covenants, promises or guarantees as to the amount of resulting Revenue or the amount of any Earn-Out Payments that may be earned by Earn-Out Sellers during the Earn-Out Period. Sellers acknowledge that Buyer may elect not to release the Company Hemp Products for a period of time after Closing. Sellers also acknowledge that Buyer (and the Company, after the Closing) may market and sell the Company Hemp Products at their sole discretion and Buyer (and the Company, after the Closing) may discontinue all production,

8

marketing, distribution and sales of the Company Hemp Products during the Earn-Out Period for any or no reason.

(c) Company Operations. Subsequent to the Closing, Buyer and the Company shall have sole discretion with regard to all matters relating to the operation of the Company and the Business; provided, that Buyer shall not, directly or indirectly, take any actions in bad faith that would have the purpose of avoiding the Milestone Payment or Earn-Out Payments hereunder.

b. Section 2.6(h) (Consulting Agreement) of the Merger Agreement is hereby amended and restated in its entirety as follows: [Intentionally Omitted]

c. Section 11.9 of the Merger agreement is hereby amended to add the following new definitions (to be placed in alphabetical order accordingly):

(i) “Company Hemp Products” means any product produced by the Greenhouse at the Illinois Facility that is hemp as defined in the 2018 Farm Bill or the Illinois 2019 Industrial Hemp Act.

(ii) “Earn-Out Period” means the period from April 1, 2020 through March 31, 2021.

(iii) “Revenue” means, with respect to any Calculation Period, the net amount of revenue attributable to the Company Hemp Products that are produced, sold and for which payment has been received by the Company, as recognized by Buyer and the Company in accordance with then-existing accounting and corporate policies, less product returns, customer and distributor discounts and excluding amounts invoiced for any other product, shipping, taxes, duties or other similar amounts.

(iii) “Calculation Period” means (a) the period beginning April 1, 2020 and ending on last day of June 2020, and (b) each of the Company’s fiscal quarters ending on September 30, 2020, December 31, 2020 and March 31, 2021, respectively.

2. Amendments Relating to Setoff and Holdback Rights.

a. Section 9.7 of the Merger Agreement is hereby amended and restated in its entirety as follows:

Escrow Agreement. Buyer and Sellers will enter into a mutually agreeable escrow agreement as a condition to the actual issuance of the RWB Stock underlying the RWB Stock Issuance Right as contemplated by Section 2.2(e). Such escrow agreement will include, among other things (as applicable), escrow indemnity provisions with respect to Buyer’s setoff rights against the RWB Stock under Section 10.8 substantially similar to the following:

9

(a) Subject to the terms and conditions of the Merger Agreement, in addition to such other lock-up terms, as applicable, the escrow agent will hold in an escrow account (the “Escrow Account”) a number shares of RWB Stock issued to Sellers equal to an aggregate of 20% of all RWB Stock issued to Sellers pursuant to Section 2.2(e) and the RWB Stock issuable in connection with the Milestone Event) (the “Escrowed Property”).

(b) At any time and from time to time on or prior to (i) the twelve (12) month anniversary of the Closing or (ii) the date of closure of the LUST Matter in accordance with the Merger Agreement, whichever is later (the “Escrow Release Date”), if any Buyer Indemnified Party makes a claim for indemnity pursuant to and in accordance with Section 10.1 (a “Claim”), the Buyer Indemnified Party (or Buyer on its behalf) shall deliver to the escrow agent (the “Escrow Agent”) and any Seller a written notice (an “Escrow Notice”) setting forth in reasonable detail the amount, nature, and basis of the Claim by the Buyer Indemnified Party.

(c) If a Seller, in good faith, delivers to the Escrow Agent and Buyer a written objection (a “Dispute Notice”) to any Claim or portion thereof or the amount of such Claim within ten (10) business days following both the Escrow Agent’s and such Seller’s receipt of such Escrow Notice, then the Escrow Agent shall not distribute to Buyer any portion of the Escrow Property in the Escrow Account that is the subject of the Dispute Notice until the Escrow Agent receives either (i) joint written instructions signed by the Sellers and Buyer authorizing the release to Buyer of the portion of the Escrow Property in the Escrow Account that is agreed upon as the amount recoverable in respect of the Dispute Notice or (ii) a final and non-appealable order of any court of competent jurisdiction directing the release to Buyer of the portion of the Escrow Property in the Escrow Account that is determined to be the amount recoverable in respect of the Dispute Notice; provided, that notwithstanding the foregoing, if a Seller objects in part to the amount of the Claim, the Escrow Agent shall, after the lapse of the aforementioned time period, deliver to Buyer an amount from the Escrow Account equal to the portion of the Claim not objected to by such Seller (determined as a number of shares of RWB Stock equal to the quotient of the dollar amount of such undisputed portion of the Claim (multiplied by a 1.32 exchange rate) divided by the Fixed Stock Price. Upon receipt of such joint written instructions or such final and non-appealable order, as the case may be, the Escrow Agent shall release to Buyer such amount of the Escrow Property in the Escrow Account in accordance with such written instructions or final and non-appealable order.

(d) If Seller delivers to the Escrow Agent and Buyer a written notice (a “Cash Election Notice”) within ten (10) business days following both the Escrow Agent’s and such Seller’s receipt of an Escrow Notice, whereby Sellers elect to pay immediately available funds to such Buyer Indemnified Party (in lieu of Escrow Property) to satisfy such Claim, then Escrow Agent shall not release such Escrow Property in connection with such Escrow Notice, so long as Sellers make

10

such cash payment in the amount of such Claim to Buyer Indemnified Party and provide evidence of such payment to Escrow Agent within five (5) business days after delivering the Cash Election Notice.

(e) If neither a Dispute Notice nor Cash Election Notice is received by Buyer and the Escrow Agent from Sellers within ten (10) business days after Buyer’s delivery of an Escrow Notice to the Escrow Agent and any Seller, then the entire amount set forth in the Claim shall be deemed valid, conclusive and binding upon Buyer and Sellers, and shall be satisfied by the Escrow Agent from the Escrow Property (or in part, if the Escrow Property is not sufficient to satisfy the Claim in full) on the next business day by return and release of such Escrow Property to Buyer of such number of shares of RWB Stock equal to the quotient of the dollar amount of such Claim identified in the Escrow Notice (multiplied by a 1.32 exchange rate) divided by the Fixed Stock Price.

b. Section 10.8 of the Merger Agreement is hereby amended and restated in its entirety as follows:

(a) Earn-Out Holdback. Buyer shall be entitled to holdback 20% of each Earn-Out Payment, if any, payable to the Earn-Out Sellers for a Calculation Period during the Earn-Out Period (the “Earn-Out Holdback”), as partial security for Losses payable to a Buyer Indemnified Party pursuant to Article X. Subject to the limitations set forth in Article X (including the Basket, the Cap and Environmental Cap), Buyer shall be entitled to satisfy any resulting Losses payable to a Buyer Indemnified Party pursuant to Article X from the Earn-Out Holdback in accordance with clause (b) below. Following (i) the twelve (12) month anniversary of the Closing or (ii) the date of closure of the LUST Matter, whichever is later (the “Holdback Period”) (but no later than 10 business days thereafter), Buyer shall pay to the Earn-Out Sellers any remaining Earn-Out Holdback (that was not previously used as offset by Buyer to satisfy Losses in accordance with clause (b) below), less the estimated amount of any unresolved Claim made by a Buyer Indemnified Party in accordance with Article X prior to expiration of the Holdback Period, which amount may continue to be held by Buyer and applied for offset in accordance with clause (b) below through resolution of such Claim.

(b) Manner of Payment. Subject to the limitations set forth in this Article X (including the Basket, the Cap and Environmental Cap), any Losses payable to a Buyer Indemnified Party pursuant to this Article X shall be satisfied: (i) (A) from the RWB Stock (including shares of RWB Stock to be issued pursuant to the RWB Stock Issuance Right) whether at such time only existing as a contractual RWB Stock Issuance Right under this Agreement or RWB Stock actually held in escrow after issuance directly to the escrow agent pursuant to an applicable lockup escrow agreement or otherwise, (x) prior to the actual issuance of such RWB Stock in accordance with Section 2.2(e) or Section 2.4, as applicable, Buyer shall cancel such number of shares of RWB Stock that would be issued pursuant to the

11

RWB Stock Issuance Right determined by dividing the amount of such Loss (multiplied by 1.32 exchange rate) by the Fixed Stock Price (provided such setoff of RWB Stock shall not exceed in the aggregate twenty percent (20%) of the RWB Stock issuable to Sellers under 2.2(e) plus the RWB Stock issuable to Sellers in connection with the Milestone Payment) or (y) after the actual issuance of such RWB Stock directly to the escrow agent in accordance with Section 2.2(e) or Section 2.4, by Buyer requesting return of such RWB Stock to Buyer from the applicable escrow account for cancellation by Buyer (the number of shares of RWB Stock to be returned shall equal the quotient of the dollar amount of such Loss (multiplied by a 1.32 exchange rate) divided by the Fixed Stock Price) (provided such setoff of RWB Stock shall not exceed in the aggregate twenty percent (20%) of the RWB Stock issued to Sellers under Section 2.2(e) plus the RWB Stock issuable to Sellers in connection with the Milestone Payment) and (B) from the Earn-Out Holdback; and (ii) to the extent the amount of Losses exceeds the RWB Stock and Earn-Out Holdback available to the Buyer Indemnified Party for setoff, then directly from the Sellers. Notwithstanding the foregoing, at Sellers’ option (subject to Sellers providing prompt notice of the same to the Buyer Indemnified Party), Sellers may pay immediately available funds to such Buyer Indemnified Party for such Losses in lieu of such Buyer Indemnified Party exercising its setoff rights against the RWB Stock or Earn-Out Holdback under this Section 10.8.

3. Amendments Relating to Pre-Closing Restructuring Transactions and Affiliates.

a. The parties acknowledge and agree that the Merger Agreement is hereby generally amended so that (i) references to the Pre-Closing Restructuring Transactions involving RetainCo shall now be references to Color Point, LLC, (ii) the Restructuring Transaction Documents shall be executed between the Company and Color Point, LLC, with Color Point, LLC taking assignment of such assets and assuming all Liabilities of the non-hemp related business and indemnifying the Company, Buyer and Buyer Indemnified Parties for all such Liabilities, and (iii) that such Restructuring Transaction Documents shall survive the transactions contemplated by the Merger Agreement and will inure to the benefit of the Company, Buyer and Buyer Indemnified Parties (as direct parties or third party beneficiaries) following the Closing.

b. Article VI of the Merger Agreement is hereby amended to add the following Section 6.12:

Section 6.12 Affiliate Transactions. Sellers and the Company represent, warrant and confirm that (i) any intercompany arrangements between the Company, on the one hand, and Color Point LLC or any of its affiliates, on the other hand, are terminated and of no further force or effect, except for that certain Transition Services Agreement dated as of October 23, 2019 between the Company and Color Point LLC and that Bill of Sale and Assignment dated July 1, 2019 between the Company and Color Point LLC and the Pre-Closing Restructuring Documents, which agreements

12

will remain in effect and survive Closing, and (ii) notwithstanding the foregoing, any intercompany obligations, liabilities or amounts owed to or payable now or in the future by the Company to Color Point LLC or any of its affiliates have been discharged, satisfied, terminated and are of no further force and effect (excluding only Company obligations under the Transition Services Agreement that arise or relate solely to post-Closing operations of the Company). For clarity, such intercompany obligations, liabilities and amounts are Excluded Liabilities under this Agreement, subject to indemnification by Sellers under Article X.

c. The parties acknowledge and agree that in the event the State of Delaware delays or denies the effectiveness of the Merger due to the nature of Merger Sub, Real Estate Buyer or the Company’s business, the parties will use commercially reasonable efforts to re-domicile Merger Sub, Real Estate Buyer and the Company in the State of Illinois.

4. Amendments Relating to Additional Sellers.

a. Section 6.10 of the Merger Agreement is hereby amended and restated in its entirety as follows:

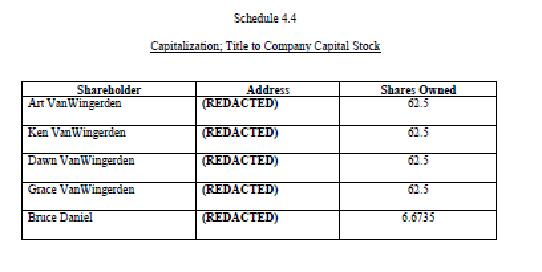

Additional Sellers. It is anticipated that Sellers may transfer a portion of their Company Capital Stock to each of their respective spouses, and the Company may issue shares to Bruce Daniel (“Mr. Daniel”) prior to Closing; provided that the portion of Company Capital Stock issued to Mr. Daniel shall be less than 10% in the aggregate. Sellers shall provide evidence of such transfer satisfactory to Buyer, and each of Grace VanWingerden, Dawn VanWingerden (collectively, the “Additional Sellers”), and Mr. Daniel shall execute a counterpart signature page to this Agreement, whereby he or she will agree to be bound by the terms, conditions and obligations herein and make the representations of Sellers herein as though an original party hereto, and Sellers shall update Schedule 4.4 to reflect such issuance of Company Capital Stock. Sellers contemplate that in connection with the transfer of Company Capital Stock to Mr. Daniel, prior to Closing, the Sellers will make a loan to Mr. Daniel (the “Daniel Loan”), which loan arrangement shall be documented in a form reasonably acceptable to Buyer and on the condition that such Daniel Loan must be paid in full at Closing.

b. Section 7.1 of the Merger Agreement is hereby amended by adding the following clauses (q) and (r):

(q) Payoff of Daniel Loan. The Daniel Loan shall be paid in full at Closing in accordance with a Letter of Direction in a form substantially the same as the attached. Such payoff of the Daniel Loan shall satisfy the Daniel Loan in full or shall otherwise be satisfactory to Buyer.

(r) Stock Valuation. Sellers and the Company shall have delivered to Buyer a valuation report with respect to the Company Capital Stock prepared by Blue and Co. in a form satisfactory to Buyer, provided, however, that Buyer’s acceptance of such valuation shall not (i) indicate Buyer’s acceptance of the conclusions stated therein, (ii) bind Buyer to file any Tax Returns in a manner consistent with such valuation or to defend such valuation in any Tax audit or similar proceeding (provided that Sellers, at their

13

cost, may defend such valuation in a Tax Audit or similar proceeding), (iii) preclude Buyer from obtaining a separate valuation of the Company Capital Stock, or (iv) preclude Buyer from causing the Company to file Tax Returns (including amended Tax Returns for pre-Closing Tax periods) reflecting the conclusions in the separate valuation obtained by Buyer; provided that Buyer may only file or cause to be filed such amended returns in connection with a Tax Audit or similar proceeding, after Sellers have been provided a good faith opportunity to defend in good faith Blue and Co.'s valuation. Sellers agree to cooperate with Buyer and its Affiliates in the filing of any amended Tax Returns as required by this Section 7.1(r).

(s) Schedule with Respect To Taxes. Sellers shall have delivered a schedule of any Taxes payable by the Company and Mr. Daniel with respect to the Company’s stock issuance and any bonus payment made to Mr. Daniel under that certain Grant and Cash Bonus Agreement between the Company and Mr. Daniel in accordance with Section 9.9 of this Agreement in a form satisfactory to Buyer; provided, however, that Buyer’s acceptance of such schedule shall not indicate Buyer’s acceptance of the amounts stated therein or limit Buyer’s rights under Section 7.1(r). At Closing, Sellers (including Mr. Daniel) shall deliver to Buyer a certificate (in form satisfactory to Buyer) certifying to Buyer and the Company that all Taxes indicated pursuant to such schedule have been paid in full prior to Closing.

c. The following Section 9.9 is hereby added to the Merger Agreement:

Section 9.9 Taxes on Payments to Mr. Daniel. The Sellers and Mr. Daniel are responsible for any and all Taxes (including, but not limited to any income Taxes, income Tax withholding and employment Taxes) relating to the Company’s stock issuance and any bonus payment made to Mr. Daniel under that certain Grant and Cash Bonus Agreement between the Company and Mr. Daniel. The Sellers and/or Mr. Daniel shall fund such Tax payments prior to or concurrent with the Closing (or, to the extent such funds provided by the Sellers and/or Mr. Daniel are insufficient, upon demand of Buyer), and shall also indemnify the Company and Buyer for all such Taxes (including, without limitation, any Taxes imposed as a result of any amended Tax Returns filed by the Company in compliance with Section 7.1(r)). The Sellers, Mr. Daniel, the Company, and the Buyer shall agree on the amount of such Taxes prior to the Closing, and the Sellers shall provide a schedule of such Tax calculations in a form satisfactory to Buyer in accordance

14

with Section 7.1(s) of this Agreement.

d. The following clause (iv) is added to Section 10.1(c) of the Merger Agreement:

and (iv) imposed on the Company with respect to any payments or stock issuances to Mr. Daniel described in this Agreement.

5. Amendments Relating to the LUST Matter.

The following Section 9.8 is hereby added to the Merger Agreement:

Sellers have informed Buyer that they do not anticipate needing to conduct further testing or remediation work at the Property after Closing in order to close the LUST Matter pursuant to Section 6.11. In the event that Sellers do require such access to the Property after Closing, Sellers will execute a customary access and indemnity agreement with Buyer and the Company in form reasonably acceptable to Buyer with respect to granting access for such further testing or remediation work to be conducted on the Property for closure of the LUST Matter.

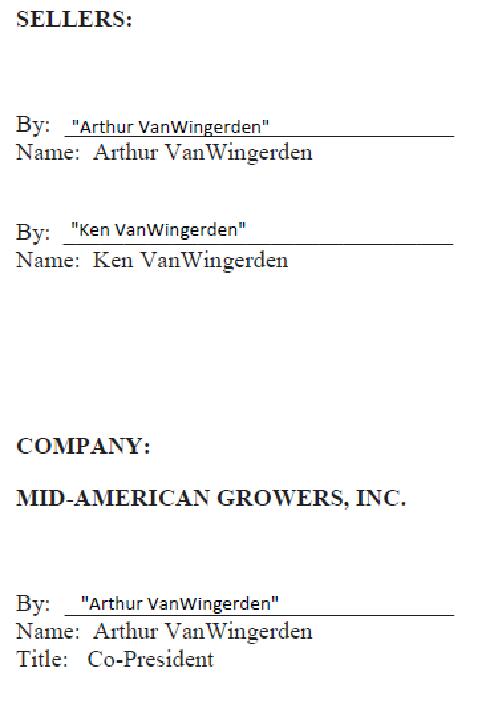

6. Schedule Updates. As of prior to Closing, immediately upon the Additional Sellers joining the Merger Agreement as contemplated by Section 6.10 of the Merger Agreement, Schedule 2.2, Schedule 3.2 and Schedule 4.4 of the Merger Agreement shall be deemed to be amended as provided in the attached amended disclosure schedules and Buyer hereby consents to such amendments pursuant to Section 6.5.

7. Affirmation. This Amendment is to be read and construed with the Merger Agreement as constituting one and the same agreement. Except as specifically modified by this Amendment, all remaining provisions, terms and conditions of the Merger Agreement shall remain in full force and effect in accordance with their terms.

8. Defined Terms. All terms not herein defined shall have the meanings ascribed to them in the Merger Agreement.

9. Counterparts. This Amendment may be executed in one or more counterparts, each of which shall be deemed to be an original but all of which together shall constitute one and the same instrument. Further, the parties agree that this Amendment may be executed and delivered by facsimile or e-mail transmission.

10. Entire Agreement. This Amendment, together with the Merger Agreement, constitutes the entire agreement of the parties with respect to the subject matter hereof and may not be amended or waived except as set forth in writing.

[Signature Page to Follow]

15

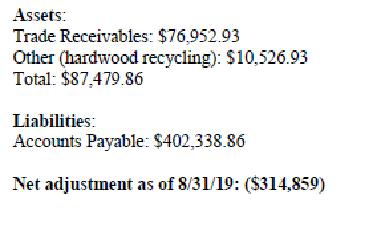

IN WITNESS WHEREOF, the parties hereto have executed this Amendment No. 2 and Joinder to Agreement and Plane of Merger effective as of the date first written above.

BUYER: MICHICANN MEDICAL INC.

By: “Michael Marchese” Name: Michael Marchese Title: President

MERGER SUB: RWB ACQUISITION SUB, INC.

By: “Michael Marchese” Name: Michael Marchese Title: President

(Signature Page to Amendment No.2 to Agreement and Plan of Merger)

(Signature Page to Amendment No.2 to Agreement and Plan of Merger)

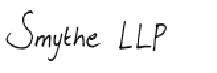

Schedule 2.2

Closing Distributions and Payments

For purposes of the cash payment payable pursuant to Section 2.2(b)(i):

Payee | $ Portion | Address | Wire Transfer Instructions |

Arthur VanWingerden

| $141,317.815 | (REDACTED) | (REDACTED) |

Kenneth VanWingerden

| $141,317.815 | (REDACTED) | (REDACTED) |

Dawn VanWingerden

| $141,317.815 | (REDACTED) | (REDACTED) |

Grace VanWingerden

| $141,317.815 | (REDACTED) | (REDACTED) |

Bruce Daniel

| $100,000.00 | (REDACTED) | (REDACTED) |

For other payments or RWB Stock issuances under the Merger Agreement:

Payee | Pro Rata Percentage | Address | Wire Transfer Instructions |

Arthur VanWingerden

| 24.35% | (REDACTED) | (REDACTED) |

Kenneth VanWingerden

| 24.35% | (REDACTED) | (REDACTED) |

Dawn VanWingerden

| 24.35% | (REDACTED) | (REDACTED) |

Grace VanWingerden | 24.35% | (REDACTED) | (REDACTED) |

|

|

|

|

Bruce Daniel

| 2.6% | (REDACTED) | (REDACTED) |

This Schedule 2.2 is subject to that Letter of Direction to be delivered to Buyer by Arthur VanWingerden and Kenneth VanWingerden with respect to Bruce Daniel at or prior to Closing.

AMENDMENT NO. 1 TO

AGREEMENT AND PLAN OF MERGER

THIS AMENDMENT NO. 1 TO THE AGREEMENT AND PLAN OF MERGER (this “Amendment”) is made effective as of November 1, 2019, by and among Michicann Medical Inc., Mid-American Growers, Inc., RWB Acquisition Sub, Inc. and Arthur VanWingerden and Ken VanWingerden, the sellers.

BACKGROUND

WHEREAS, the parties entered into that certain Agreement and Plan of Merger, dated as of October 9, 2019 (as amended, the “Merger Agreement”); and

WHEREAS, the parties desire to amend certain terms and conditions of the Merger Agreement as set forth herein in accordance with the terms of Section 11.4 of the Merger Agreement.

NOW THEREFORE, in consideration of the mutual covenants contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

AGREEMENT

1. Amendments to the Merger Agreement.

a. Section 2.2(a) of the Merger Agreement is hereby deleted and replaced by the following:

“(i) Within two (2) Business Days of execution of this Agreement, Buyer shall pay to Sellers a cash payment equal to $5,000,000 and (ii) on or around November 1, 2019, Buyer shall pay to Sellers a cash payment equal to $3,000,000 (together, the payments under clauses (i) and (ii), the “Deposit”), which Deposit shall be applied toward the Aggregate Purchase Price at Closing, or should the Closing not occur and this Agreement is terminated, such Deposit shall be fully refundable to Buyer by Sellers in accordance with Section 8.3.”

b. Section 8.1(d) of the Merger Agreement is hereby amended by replacing the date “October 31, 2019” with the date “December 31, 2019.”

2. Affirmation. This Amendment is to be read and construed with the Merger Agreement as constituting one and the same agreement. Except as specifically modified by this Amendment, all remaining provisions, terms and conditions of the Merger Agreement shall remain in full force and effect in accordance with their terms. The parties acknowledge that Buyer previously paid to Sellers the $5,000,000 portion of the Deposit referenced above.

3. Defined Terms. All terms not herein defined shall have the meanings ascribed to them in the Merger Agreement.

4. Counterparts. This Amendment may be executed in one or more counterparts, each of

1

which shall be deemed to be an original but all of which together shall constitute one and the same instrument. Further, the parties agree that this Amendment may be executed and delivered by facsimile or e-mail transmission.

5. Entire Agreement. This Amendment, together with the Merger Agreement, constitutes the entire agreement of the parties with respect to the subject matter hereof and may not be amended or waived except as set forth in writing.

[Signature Page to Follow]

2

IN WITNESS WHEREOF, the parties hereto have executed this Amendment No.1 effective as of the date first written above.

3

IN WITNESS WHEREOF, the parties hereto have executed this Amendment No.1 effective as of the date first written above.

4

EXECUTION VERSION

________________________________________________________________

AGREEMENT AND PLAN OF MERGER

by and among

MICHICANN MEDICAL INC.,

MID-AMERICAN GROWERS, INC.,

RWB ACQUISITION SUB, INC.,

and T

HE SELLERS PARTY HERETO

October 9, 2019

________________________________________________________________

1

TABLE OF CONTENTS

ARTICLE I. THE MERGER .....................................................................................................2

1.1. The Merger...............................................................................................................2

1.2. Conversion of Shares ...............................................................................................3

1.3. Dissenters’ Rights. ...................................................................................................4

1.4. Estimated Closing Statement ...................................................................................4

1.5. Purchase Price..........................................................................................................5

ARTICLE II. CLOSING; PAYMENT OF CONSIDERATION; CLOSING DELIVERABLES......................................................................................................................... 5

2.1. Closing .....................................................................................................................5

2.2. Aggregate Purchase Price Distributions and Payments ...........................................5

2.3. Post-Closing Cash Adjustments. ..............................................................................6

2.4. Consulting Payment.................................................................................................7

2.5. Tax Withholding ......................................................................................................8

2.6. Closing Deliveries of Sellers ...................................................................................8

2.7. Closing Deliveries of Buyer and Merger Sub........................................................11

ARTICLE III. REPRESENTATIONS AND WARRANTIES OF SELLERS............................11

3.1. Authority................................................................................................................11

3.2. Title to Company Capital Stock .............................................................................11

3.3. Noncontravention...................................................................................................11

3.4. Litigation ................................................................................................................12

3.5. Investment..............................................................................................................12

ARTICLE IV. REPRESENTATIONS AND WARRANTIES REGARDING THE COMPANY.............................................................................................................................. 13

4.1. Authority................................................................................................................13

4.2. Organization and Qualification of the Company...................................................13

4.3. Noncontravention...................................................................................................13

4.4. Capitalization; Title to Company Capital Stock ....................................................14

4.5. Absence of Certain Developments.........................................................................14

4.6. Compliance with Applicable Laws........................................................................16

4.7. Financial Statements. .............................................................................................16

4.8. Assets. ....................................................................................................................17

4.9. Taxes ......................................................................................................................18

4.10. Contracts. ..............................................................................................................20

4.11. Real Property. ........................................................................................................21

4.12. Litigation ................................................................................................................22

4.13. Intellectual Property...............................................................................................23

4.14. Insurance Policies .................................................................................................24

4.15. Licenses and Permits..............................................................................................24

i

4.16. Welfare and Benefit Plans. ....................................................................................24

4.17. Health, Safety and Environment ............................................................................26

4.18. Employees..............................................................................................................26

4.19. Affiliate Transactions.............................................................................................27

4.20. Books and Records ................................................................................................27

4.21. Broker Fees ............................................................................................................27

ARTICLE V. REPRESENTATIONS AND WARRANTIES OF BUYER AND MERGER SUB 28

5.1. Organization ...........................................................................................................28

5.2. Authorization .........................................................................................................28

5.3. Noncontravention...................................................................................................28

5.4. Capitalization .........................................................................................................29

5.5. Brokers or Finders..................................................................................................29

ARTICLE VI. COVENANTS PRIOR TO CLOSING ................................................................30

6.1. General...................................................................................................................30

6.2. Notices and Consents.............................................................................................30

6.3. Conduct of Business by the Parties........................................................................30

6.4. Access ....................................................................................................................31

6.5. Schedule Updates...................................................................................................31

6.6. Notice of Material Developments..........................................................................31

6.7. Exclusivity .............................................................................................................31

6.8. Tax Covenant .........................................................................................................32

6.9. Pre-Closing Restructuring Transactions ................................................................32

6.10. Additional Seller ....................................................................................................32

6.11. Open LUST File.....................................................................................................32

ARTICLE VII. CONDITIONS TO CLOSING ...........................................................................33

7.1. Conditions to Buyer’s and Merger Sub’s Obligations ...........................................33

7.2. Conditions to the Company’s and Sellers’ Obligations .........................................35

7.3. Mutual Conditions to the Parties’ Obligations.......................................................36

ARTICLE VIII. TERMINATION...............................................................................................36

8.1. Termination ............................................................................................................36

8.2. Effect of Termination.............................................................................................37

8.3. Return of Deposit...................................................................................................37

ARTICLE IX. POST-CLOSING COVENANTS ........................................................................37

9.1. Tax Matters. ...........................................................................................................37

9.2. Restrictive Covenants. ...........................................................................................40

9.3. Further Assurances.................................................................................................42

9.4. Release. ..................................................................................................................42

ii

9.5. Company Name .....................................................................................................44

9.6. Hemp Operations Payable......................................................................................44

9.7. Consulting Shares ..................................................................................................44

ARTICLE X. INDEMNIFICATION ......................................................................................44

10.1. Indemnification by the Sellers ...............................................................................44

10.2. Indemnification by Buyer ......................................................................................45

10.3. Third Party Claims................................................................................................46

10.4. Direct Claims .........................................................................................................47

10.5. Failure to Give Timely Notice ...............................................................................47

10.6. Survival of Representations and Warranties..........................................................47

10.7. Certain Limitations and Exceptions.......................................................................48

10.8. Manner of Payment................................................................................................49

10.9. Allocation of Indemnification Payments ...............................................................49

ARTICLE XI. MISCELLANEOUS.............................................................................................49

11.1. Notices, Consents, Etc ...........................................................................................49

11.2. Public Announcements ..........................................................................................50

11.3. Severability ............................................................................................................50

11.4. Amendment and Waiver ........................................................................................50

11.5. Counterparts...........................................................................................................51

11.6. Expenses ................................................................................................................51

11.7. Headings ................................................................................................................51

11.8. Assignment ............................................................................................................51

11.9. Definitions..............................................................................................................51

11.10. Entire Agreement...................................................................................................58

11.11. Third Parties ...........................................................................................................58

11.12. Interpretative Matters.............................................................................................58

11.13. Knowledge .............................................................................................................58

11.14. No Strict Construction ...........................................................................................59

11.15. Jurisdiction and Governing Law............................................................................59

11.16. Service of Process..................................................................................................59

11.17. WAIVER OF JURY TRIAL..................................................................................59

11.18. Schedules ...............................................................................................................59

11.19. Consent and Waiver...............................................................................................60

11.20. Special Rule for Fraud ...........................................................................................60

11.21. Specific Performance.............................................................................................60

iii

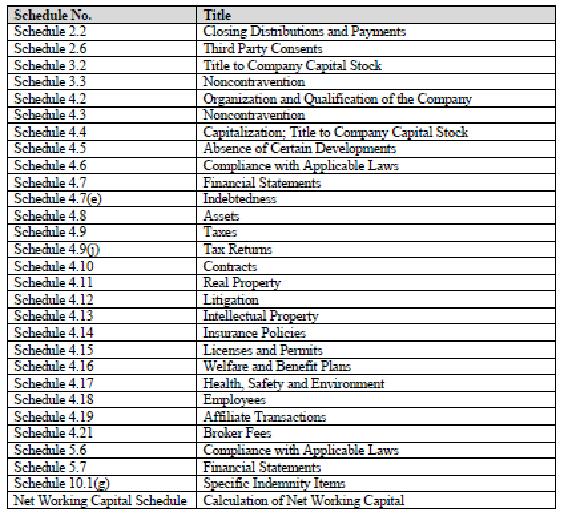

EXHIBITS AND SCHEDULES | |

Exhibits: |

|

Exhibit A | Pre-Closing Restructuring Transactions |

Exhibit B | Form of Real Estate Purchase Agreement |

Schedules: |

|

Schedule 2.2 | Closing Distributions and Payments |

Schedule 2.6 | Third Party Consents |

Schedule 3.2 | Title to Company Capital Stock |

Schedule 3.3 | Noncontravention |

Schedule 4.2 | Organization and Qualification of the Company |

Schedule 4.3 | Noncontravention |

Schedule 4.4 | Capitalization; Title to Company Capital Stock |

Schedule 4.5 | Absence of Certain Developments |

Schedule 4.6 | Compliance with Applicable Laws |

Schedule 4.7 | Financial Statements |

Schedule 4.7(e) | Indebtedness |

Schedule 4.8 | Assets |

Schedule 4.9 | Taxes |

Schedule 4.9(j) | Tax Returns |

Schedule 4.10 | Contracts |

Schedule 4.11 | Real Property |

Schedule 4.12 | Litigation |

Schedule 4.13 | Intellectual Property |

Schedule 4.14 | Insurance Policies |

Schedule 4.15 | Licenses and Permits |

Schedule 4.16 | Welfare and Benefit Plans |

Schedule 4.17 | Health, Safety and Environment |

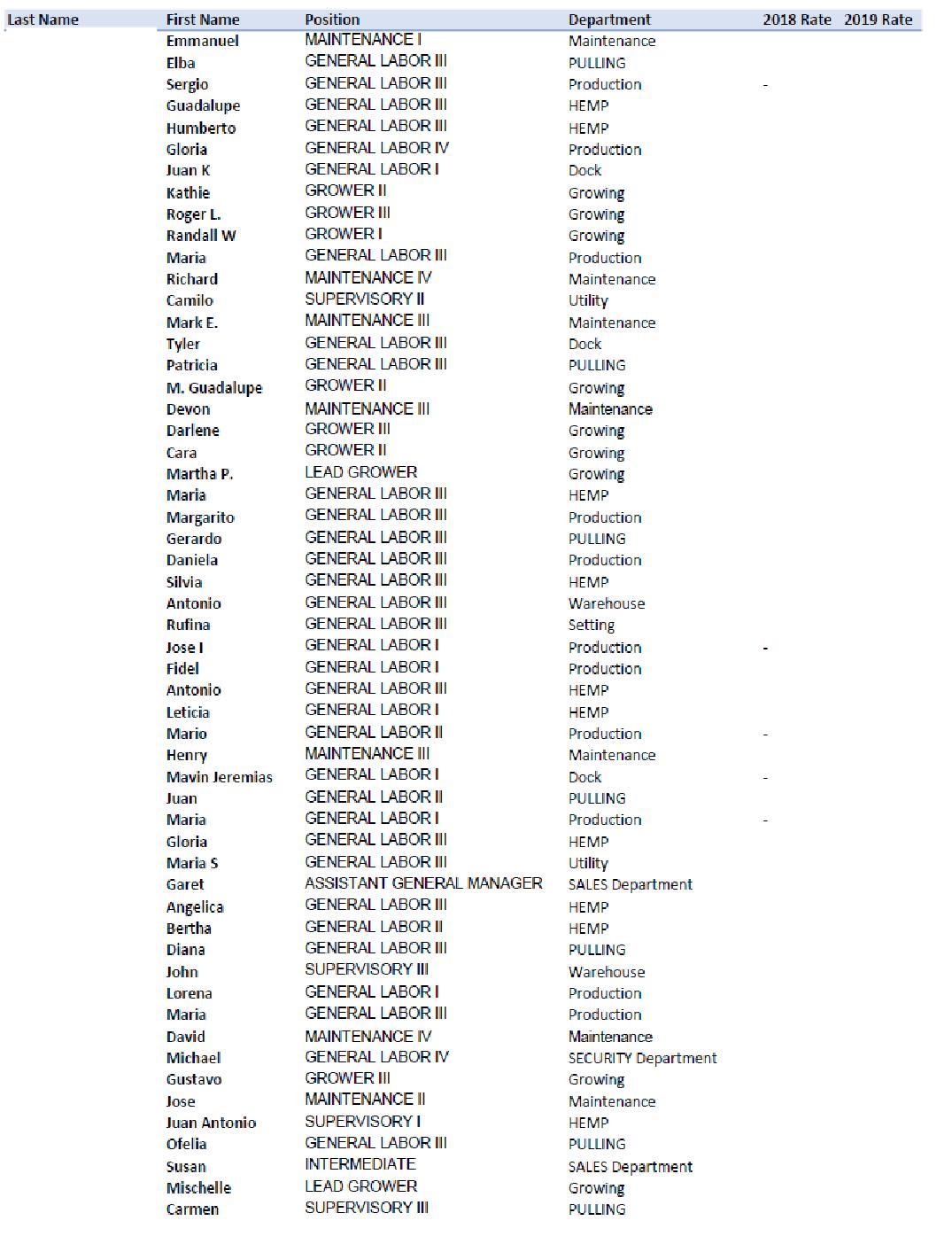

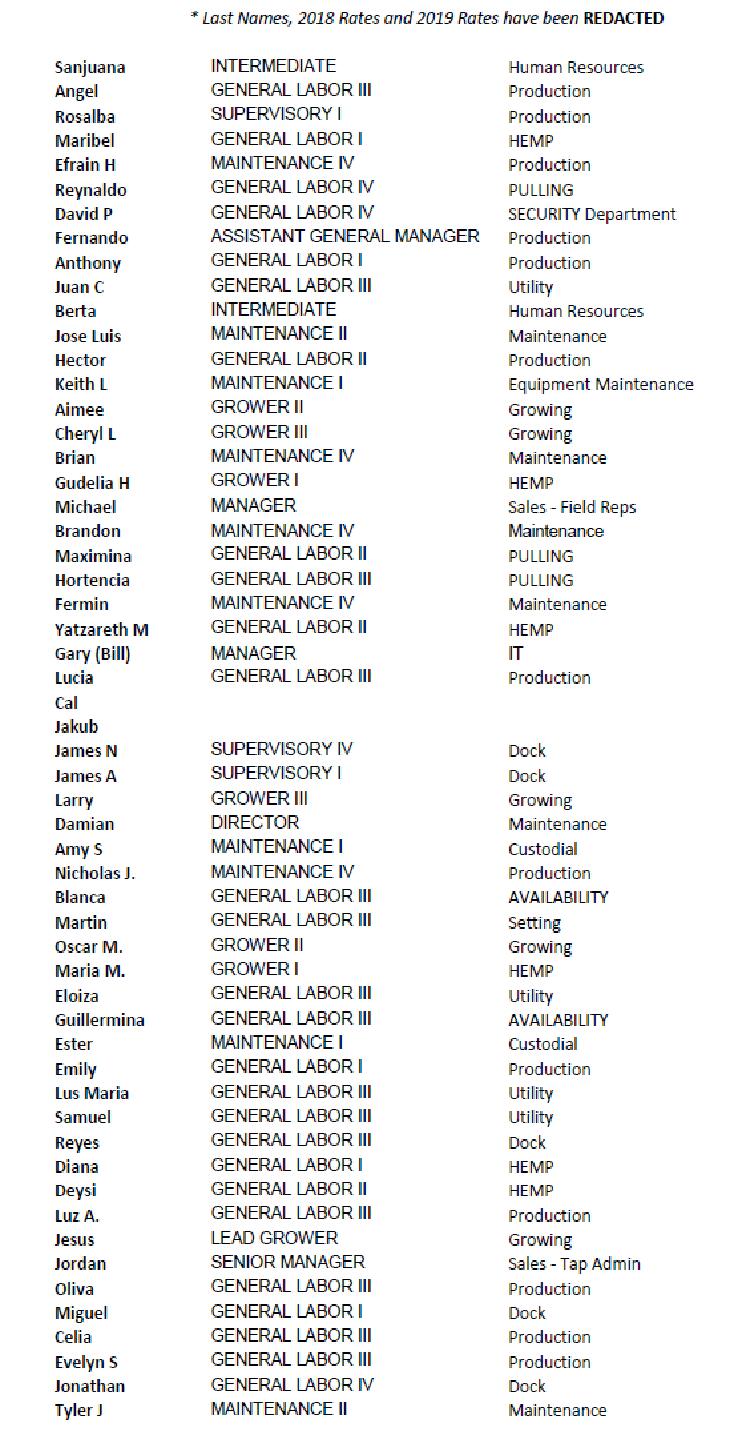

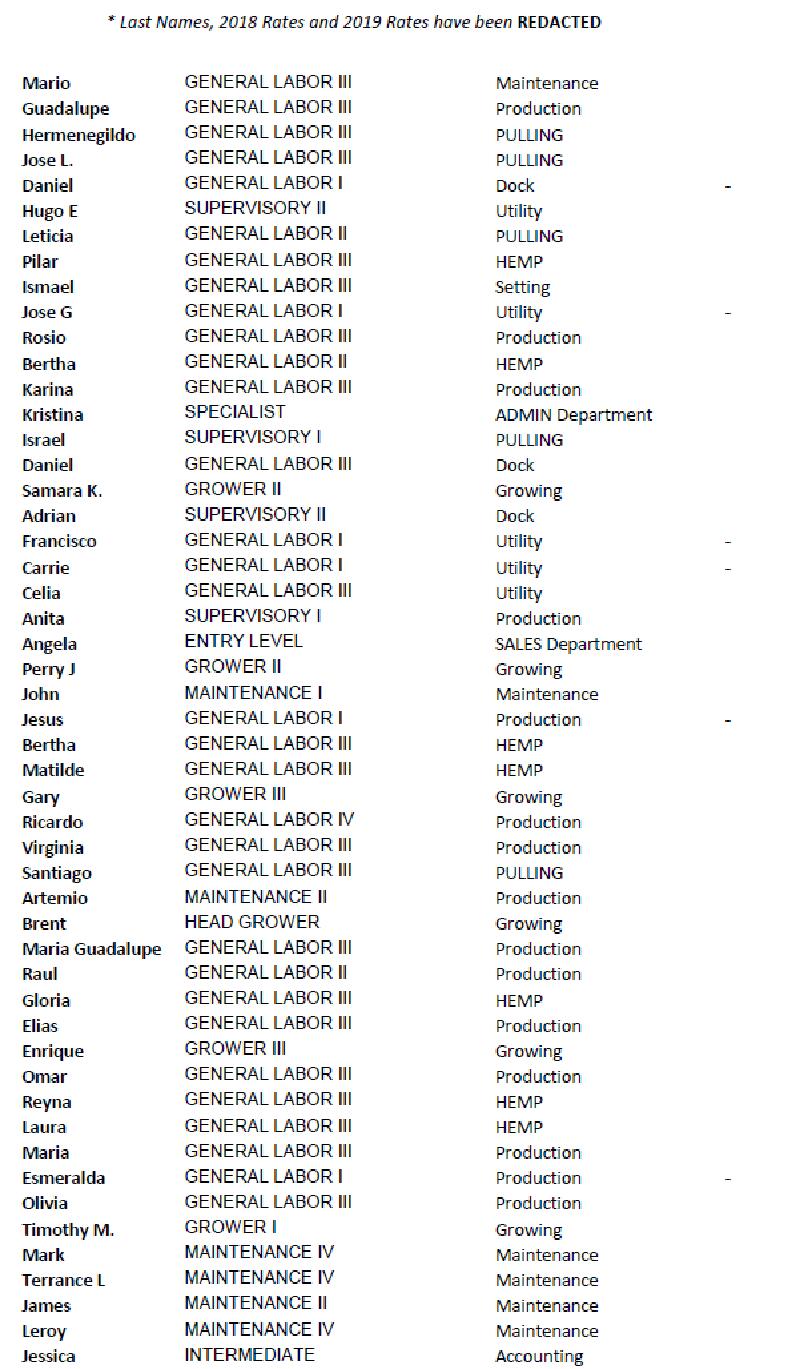

Schedule 4.18 | Employees |

Schedule 4.19 | Affiliate Transactions |

Schedule 4.21 | Broker Fees |

Schedule 5.4 | Capitalization |

Schedule 5.6 | Compliance with Applicable Laws |

Schedule 5.7 | Financial Statements |

Schedule 10.1(g) | Specific Indemnity Items |

iv

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this “Agreement”) is entered into as of October 9, 2019, by and among Mid-American Growers, Inc., a Delaware corporation (the “Company”), Michicann Medical Inc. (“Buyer” or “Michicann”), RWB Acquisition Sub, Inc., a Delaware corporation and a wholly owned Subsidiary of Buyer (“Merger Sub”), and each of Arthur VanWingerden and Ken VanWingerden (each a “Seller” and together, the “Sellers”).

PREAMBLE

WHEREAS, Sellers own all of the issued and outstanding Equity Interests of the Company.

WHEREAS, the Company is engaged in the business in the State of Illinois of large scale outdoor farming and indoor greenhouse cultivation facilities, including hemp cultivation and processing (the “Business”).

WHEREAS, prior to the Closing Date, the Company and Sellers entered into various restructuring transactions as more fully described on Exhibit A attached hereto (the “Pre-Closing Restructuring Transactions”), whereby Sellers caused the Company to transfer and assign certain assets of the Company to a newly formed subsidiary of the Company (“RetainCo”), caused RetainCo to assume and accept, certain assets and Liabilities of the Business, and caused the Company to distribute all of the equity interest in RetainCo to Sellers and Sellers caused the transfer of certain other assets used in the Business to the Company.

WHEREAS, Buyer, Sellers and the Company intend to effect a merger of Merger Sub with and into the Company upon the terms and conditions set forth in this Agreement and in accordance with the Delaware Corporation Law (the “Merger”). Upon consummation of the Merger, Merger Sub will cease to exist and the Company will become a wholly owned subsidiary of Buyer.

WHEREAS, the boards of directors (or equivalent governing body) of the Company, Buyer, and Merger Sub have approved this Agreement and the Merger.

WHEREAS, the board of directors of the Company has declared that it is advisable that this Agreement and the transactions contemplated hereby be adopted and approved by Sellers in their capacity as the stockholders of the Company.

WHEREAS, the board of directors of Merger Sub has determined that it is advisable that this Agreement and the transactions contemplated hereby be adopted and approved by Buyer in its capacity as the sole stockholder of Merger Sub. Merger Sub and the Company are hereinafter sometimes referred to collectively as the “Constituent Corporations.”

WHEREAS, the authorized Equity Interests of the Company consists of 1,000 shares of common stock, par value $5.00 per share (the “Company Capital Stock”).

WHEREAS, the authorized capital stock of Merger Sub consists of 5,000 shares of common stock, par value $0.01 per share (the “Merger Sub Common Stock”), 100 of which are issued and outstanding and owned by Buyer.

NOW, THEREFORE, in consideration of the mutual covenants of the parties hereinafter set forth and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

ARTICLE I.

THE MERGER

1.1. The Merger. On and subject to the terms and conditions contained herein, at the Effective Time, Merger Sub shall be merged with and into the Company, with the Company being the surviving corporation in the Merger (the Company, as the surviving corporation after the Merger, is sometimes referred to herein as the “Surviving Corporation”).

(a) Consummation of the Merger. On the Closing Date, subject to satisfaction or waiver of the conditions specified in ARTICLE VII hereof, the Company and Merger Sub shall, and Buyer shall cause Merger Sub to execute a certificate of merger (the “Certificate of Merger”) in accordance with the relevant provisions of Delaware Corporation Law and cause the Certificate of Merger to be filed with the Secretary of State of the State of Delaware. The Merger shall be effective at such time as may be specified in the Certificate of Merger by mutual agreement of Merger Sub and the Company (the “Effective Time”).

(b) Effect of the Merger. The Merger shall have the effects set forth herein and in the applicable provisions of Delaware Corporation Law. Without limiting the generality of the foregoing, from and after the Effective Time, the Surviving Corporation shall possess all properties, rights, privileges, powers and franchises of the Company and Merger Sub, and all of the claims, obligations, liabilities, debts and duties of the Company and Merger Sub shall become the claims, obligations, liabilities, debts and duties of the Surviving Corporation.

(c) Articles of Incorporation. At the Effective Time, the articles of incorporation of Merger Sub as in effect immediately prior to the Effective Time shall be the articles of incorporation of the Surviving Corporation until thereafter amended in accordance with the terms thereof or as provided by applicable Law; provided that the name of the corporation set forth therein shall be changed to the name of the Company.

(d) By Laws. At the Effective Time, the bylaws of Merger Sub as in effect immediately prior to the Effective Time shall be the bylaws of the Surviving Corporation until thereafter amended with the terms thereof or as provided by applicable Law; provided that the name of the corporation set forth therein shall be changed to the name of the Company.

(e) Directors. The directors of Merger Sub, as of the Effective Time, shall be the directors of the Surviving Corporation until their respective successors are duly elected and qualified in the manner provided in the articles of incorporation and bylaws of the Surviving Corporation or until their earlier resignation or removal or as otherwise provided by applicable Law.

(f) Officers. The officers of Merger Sub, as of the Effective Time, shall be the officers of the Surviving Corporation until their successors are duly elected and qualified in the

2

manner provided in the articles of incorporation and bylaws of the Surviving Corporation or until their earlier resignation or removal or as otherwise provided by applicable Law.

(g) Further Assurances. If, at any time after the Effective Time, the Surviving Corporation shall consider or be advised that any further deeds, assignments or assurances in Law or any other acts are necessary, desirable or proper to vest, perfect or confirm, of record or otherwise, in the Surviving Corporation the title to any property or right of the Constituent Corporations acquired or to be acquired by reason of, or as a result of, the Merger or to otherwise carry out the purposes of this Agreement or effect the Merger, the Surviving Corporation and its officers and directors shall execute and deliver all such deeds, assignments and assurances in Law and do all acts necessary, desirable or proper to vest, perfect or confirm title to such property or right in the Surviving Corporation, and the officers and directors of the Constituent Corporations and the officers and directors of the Surviving Corporation are fully authorized in the name of the Constituent Corporations or otherwise to take any and all such action solely for the purposes set forth in this Section 1.1(g).

1.2. Conversion of Shares. At the Effective Time, by virtue of the Merger and without any action on the part of Buyer, Merger Sub, the Company or the holders of any of the securities described below:

(a) Each share of Merger Sub Common Stock issued and outstanding immediately prior to the Effective Time shall be converted into one (1) validly issued, fully paid and non-assessable share of common stock, par value $0.01 per share, of the Surviving Corporation.

(b) Except as otherwise provided herein, the Company Capital Stock issued and outstanding immediately prior to the Effective Time (other than (x) shares of Company Capital Stock cancelled pursuant to Section 1.2(c)) and (y) Dissenting Shares) shall be converted into the right to receive, upon delivery and surrender of the Certificates formerly representing the issued and outstanding Company Capital Stock, the Estimated Merger Consideration (subject to Sections 2.2, 2.3 and 2.4), and such share of Company Capital Stock after such conversion shall automatically be cancelled and retired and shall cease to exist.

(c) Each share of Company Capital Stock held in the treasury of the Company and each share of Company Capital Stock owned or held, directly or indirectly, by the Company immediately prior to the Effective Time shall be cancelled and retired and shall cease to exist without any conversion thereof and no payment of cash or any other consideration or distribution shall be made with respect thereto.

(d) As of the Effective Time, each holder of a certificate representing a share of Company Capital Stock (each such certificate, a “Certificate”) (other than a Certificate representing Dissenting Shares, the treatment of which is addressed in Section 1.3) shall cease to have any rights with respect thereto and any shares of Company Capital Stock that were represented thereby prior to the Effective Time, except the right to receive, upon surrender of such Certificate, a portion, without interest, in accordance with this Agreement, of the Estimated Merger Consideration (subject to Sections 2.2, 2.3 and 2.4). Surrendered Certificates shall forthwith be cancelled by the Surviving Corporation.

3

(e) None of the Surviving Corporation, Buyer, or Merger Sub shall be liable to any Person in respect of amounts paid to a public official to the extent required under any applicable abandoned property, escheat or similar Law.

1.3. Dissenters’ Rights.

(a) Each issued and outstanding share of Company Capital Stock that is held by a Person who has not voted in favor of the Merger or consented thereto in writing or executed an enforceable waiver of dissenters’ rights to the extent permitted by applicable Law and, in the case of any Person required to have exercised dissenters’ rights under Section 262 of the Delaware Corporation Law as of the Effective Time of the Merger in order to preserve such rights, with respect to which dissenters’ rights under the Delaware Corporation Law have been properly exercised, shall not be converted into the right to receive any portion of the Estimated Merger Consideration and shall be converted into the right to receive payment from the Surviving Corporation with respect thereto as provided by the Delaware Corporation Law, unless and until the holder of any such share shall have failed to perfect or shall have effectively withdrawn or lost his, her or its right to appraisal and payment under the Delaware Corporation Law, in which case such share shall thereupon be deemed, as of the Effective Time, to have been cancelled and retired and to have ceased to exist and been converted into the right to receive, upon surrender of such Certificate, a portion, without interest, in accordance with this Agreement, of the Estimated Merger Consideration. From and after the Effective Time, no stockholder who has demanded dissenters’ rights shall be entitled to vote his, her or its shares of Company Capital Stock for any purpose or to receive payment of dividends or other distributions on his, her or its shares (except dividends or other distributions payable to stockholders of record at a date prior to the Effective Time, or dividends that accrued thereon prior to the Effective Time). Any shares of Company Capital Stock for which dissenters’ rights have been properly exercised, and not subsequently withdrawn, lost or not perfected, are referred to herein as “Dissenting Shares.”

(b) The Company shall give Buyer (a) prompt notice and a copy of any Company stockholder’s demand for payment or objection to the Merger, of any request to withdraw a demand for payment and of any other instrument delivered to it pursuant to Delaware Corporation Law and (b) the opportunity to direct all negotiations and proceedings with respect to such demands, objections and requests. Except with the prior written consent of Buyer, the Company shall not make any payment with respect to any such demands, objections and requests and shall not settle (or offer to settle) any such demands, objections and requests or approve any withdrawal of the same.

1.4. Estimated Closing Statement. Sellers shall deliver to Buyer, at least three (3) business days prior to the Closing Date, a statement (the “Estimated Closing Statement”) setting forth its calculation of (i) the estimated Net Working Capital of the Company as of the Adjustment Calculation Time (the “Estimated Net Working Capital”), (ii) the estimated Seller Transaction Expenses (the “Estimated Seller Transaction Expenses”) and (iii) the resulting calculation of the Estimated Merger Consideration. The Estimated Closing Statement shall have been prepared in accordance with GAAP, and in good faith in accordance with the terms of this Agreement and shall be reasonably satisfactory to Buyer. Buyer and its representatives shall have been given reasonable access to the books and records of the Company relating to the Estimated Closing Statement.

4

1.5. Purchase Price. The aggregate purchase price for the Company Capital Stock (the “Aggregate Purchase Price”) is the Estimated Merger Consideration, subject to Sections 2.2, 2.3 and 2.4.

ARTICLE II.

CLOSING; PAYMENT OF CONSIDERATION; CLOSING DELIVERABLES

2.1. Closing. Subject to the conditions set forth herein, the consummation of the transactions that are the subject of this Agreement (the “Closing”) shall occur at the offices of Honigman LLP, 660 Woodward Avenue, 2290 First National Building, Detroit, Michigan 48226, or at such other place as Buyer and Sellers may mutually agree upon in writing, or remotely by mail, facsimile, e-mail and/or wire transfer, in each case to the extent acceptable to the parties hereto, at 10:00 a.m., Detroit time, on the second business day after satisfaction of the conditions set forth in Article VI (other than those to be satisfied at the Closing, but subject to their satisfaction or waiver at the Closing). The date on which the Closing is to occur is herein referred to as the “Closing Date.” Regardless of the actual time of the Closing, except as otherwise expressly provided herein, for tax and accounting purposes, the Closing shall be deemed effective as of close of the day immediately preceding the Closing Date (the “Tax Effective Time”).

2.2. Aggregate Purchase Price Distributions and Payments.

(a) Within two (2) Business Days of execution of this Agreement, Buyer shall pay to Sellers a cash payment equal to $5,000,000 (the “Deposit”), which Deposit shall be applied toward the Aggregate Purchase Price at Closing, or should the Closing not occur and this Agreement is terminated, such Deposit shall be fully refundable to Buyer by Sellers in accordance with Section 8.3.

(b) At the Closing, Sellers shall deliver and surrender to Buyer (or to Buyer’s agent) the Certificates formerly representing the issued and outstanding Company Capital Stock.

(c) At the Closing, Buyer shall deliver to the applicable party listed below the following:

(i) to Sellers, a cash payment equal to the Estimated Merger Consideration, minus the Deposit, minus the Post-Closing Cash Consideration by wire transfer of immediately available funds to the account or accounts designated by Sellers on Schedule 2.2; and

(ii) At Buyer’s election, Buyer shall cause the refinancing of the Specified Indebtedness in connection with the Closing (or, if permissible, the parties shall cause the Company shall to retain the Specified Indebtedness at the Closing, in either case, Specified Indebtedness shall be deemed paid by Buyer as a result of such refinancing or assumption; and

(iii) Buyer shall pay, or cause to be paid, on behalf of Sellers, the Estimated Seller Transaction Expenses by wire transfer of immediately available funds as directed by Sellers.

5

(iv) Buyer will deliver to Sellers the Stock Consideration (which will equal the right to receive 19,800,000 shares of RWB Stock, pursuant to an instrument(s) reasonably and mutually acceptable to the Parties, which will provide for the actual issuance of RWB Stock on or after January 1, 2020 (the “RWB Stock Issuance Right”), subject to and following completion of the RTO, by depositing such RWB Stock Issuance Right into an escrow account subject and pursuant to the Lock-Up Escrow Agreement, and following the Closing, the RWB Stock Issuance Right, and any RWB Stock issued pursuant to the RWB Stock Issuance Right) will be released to Sellers pursuant to and in accordance with the distribution schedule set forth in the Lock-Up Escrow Agreement, with such legends as may be required by applicable securities laws. The RWB Stock Issuance Right will be reduced by the number of shares of RWB Stock issued to Anne Hyde as Consulting Shares.

(d) Additional Cash Payment. On the date that is thirty (30) days following the Closing Date, Buyer shall deliver to Sellers, a cash payment equal to the Post-Closing Cash Consideration by wire transfer of immediately available funds to the account or accounts designated by Sellers on Schedule 2.2.

2.3. Post-Closing Cash Adjustments.