RED WHITE & BLOOM BRANDS INC.

NOTES TO THE PRO-FORMA CONSOLIDATED FINANCIAL STATEMENTS

As at January 31, 2020

(Unaudited – Expressed in Canadian Dollars)

1.DEFINITIVE AGREEMENT

On February 12, 2019, Tidal Royalty Corp. (the “Company”) entered into a binding letter of intent (the “LOI”) with MichiCann Medical Inc. (operating as Red White & Bloom) (“RWB” or “MichiCann”) with respect to the acquisition of all of the issued outstanding shares of MichiCann (the “Proposed Transaction”). After completion of the Proposed Transaction, the shareholders of Tidal will hold approximately 20% of the issued common shares of the resulting issuer, and the former shareholders of MichiCann will hold approximately 80% of the resulting issuer shares, on a fully-diluted basis (the “Resulting Issuer”).

On March 12, 2020, the Company and MichiCann entered into an amended and restated business combination agreement (the “Amended Agreement”) pursuant to which the Company will acquire all of the issued and outstanding shares of MichiCann (the “Proposed Transaction”) on a 2:1 basis, subject to adjustment in certain circumstances (the “Exchange Ratio”). The terms of the Amended Agreement provide that the share consideration will now be comprised of one (1) common share (the “Common Shares”) and one (1) series 2 convertible preferred share (the “Series 2 Shares”) of the resulting company (the “Resulting Issuer”). The Series 2 Shares to be issued to MichiCann shareholders (i) will carry voting rights (entitling a holder to one vote per Series 2 Share held, voting together with the holders of Common Shares), (ii) will be entitled to 5% annual dividends payable in additional Series 2 Shares (the “Dividends”), (iii) will be convertible (together with accrued Dividends) into Common Shares on a 1:1 basis at the option of the holder on or after the seven (7) month anniversary of their issuance date, and (iv) will automatically be converted on the same basis on the two (2) year anniversary of their issuance date. All outstanding options and warrants to purchase MichiCann common shares will be exchanged with options and warrants to purchase Common Shares and Series 2 Shares in accordance with the Exchange Ratio.

The Amended Agreement contemplates the following changes: Immediately prior to the completion of the Amalgamation, the Company will (i) complete a share consolidation on a 16:1 basis (the “Consolidation”), (ii) change its name to “Red White & Bloom Brands Inc.” (the “Name Change”) and (iii) reconstitute its board of directors such that the board of the Resulting Issuer will consist of five (5) directors, which will include two (2) members of the current board of the Company and three (3) nominees of MichiCann (the “Board Appointments”).

The Proposed Transaction will be completed by way of a three-cornered amalgamation under the Business Corporations Act (Ontario), whereby 2690229 Ontario Inc., a wholly-owned subsidiary of the Company (“Subco”) will amalgamate with MichiCann (the “Amalgamation”). The Proposed Transaction will constitute a “Fundamental Change” of the Company, as such term is defined in the policies of the Canadian Securities Exchange (the “CSE”) and as a result the Company will be required to obtain the approval of the holders of its outstanding common shares, by simple majority, which it intends to obtain by way of written consent.

Immediately prior to the completion of the Amalgamation, the Company will (i) complete a share consolidation on a 16:1 basis (the “Consolidation”), (ii) change its name to “Red White & Bloom Inc.” or such other name as may be approved by the board of directors of the Company and accepted by the relevant regulatory authorities (the “Name Change”) and (iii) reconstitute its board of directors (the “Board”) such that the board of the Resulting Issuer will consist of six (6) directors, which will include two (2) members of the current board of the Company and four (4) nominees of MichiCann (the “Board Appointments”). On completion of the Proposed Transaction, the board of the Resulting Issuer will also appoint a nominee of Tidal to act in the capacity as a board observer, and such board observer will be nominated and recommended for election as a director at the next annual shareholders meeting of the Resulting Issuer.

On April 24, 2020, the Company closed the Amended and Restated Business Combination Agreement with Tidal Subco and Michicann, consolidated its common shares of a 16:1 basis and changed its name to Red White & Bloom Brands Inc.

3

RED WHITE & BLOOM BRANDS INC.

NOTES TO THE PRO-FORMA CONSOLIDATED FINANCIAL STATEMENTS

As at January 31, 2020

(Unaudited – Expressed in Canadian Dollars)

1.DEFINITIVE AGREEMENT (continued)

Pursuant to the terms of the Amended Agreement, the closing of the Proposed Transaction is subject to a number of conditions, including but not limited to (i) obtaining the requisite shareholder approvals, (ii) the completion of the Consolidation, the Name Change and the Board Appointments, (iii) obtaining requisite regulatory approvals including the approval of the CSE for the Proposed Transaction and the listing of the Common Shares, (iv) obtaining escrow agreements from the directors and officers of each of MichiCann and Tidal, and certain shareholders of each of MichiCann, its Michigan based investee and Tidal pursuant to which the escrowed shares would be subject to restrictions on transfer and other dealings and released in three equal tranches over a period of 18 months following the closing of the Proposed Transaction, and (v) other closing conditions customary for transactions of this nature.

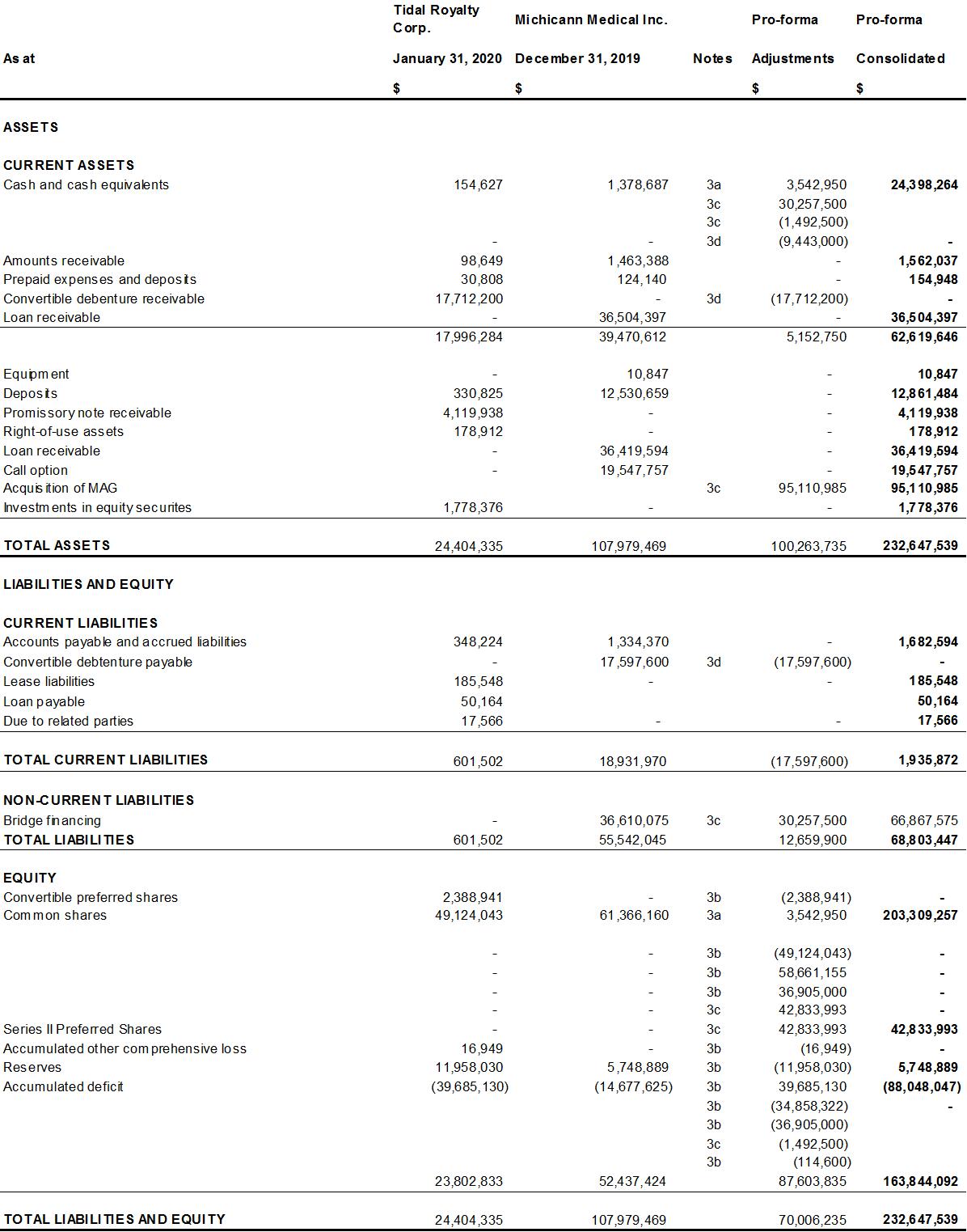

2.BASIS OF PRESENTATION

The unaudited pro-forma consolidated statement of financial position of the Company gives effect to the Transaction as described above. In substance, the Transaction involves MichiCann shareholders obtaining control of the Company and accordingly the Transaction will be considered a reverse takeover transaction (“RTO”) with MichiCann acquiring the Company. As the Company does not meet the definition of a business under International Financial Reporting Standards (“IFRS”), the consolidated financial statements of the combined entity will represent the continuation of MichiCann. The Transaction has been accounted for as a share-based payment, in accordance with IFRS 2, by which MichiCann acquired the net assets and the Company’s status as a Reporting Issuer. Accordingly, the accompanying unaudited pro-forma consolidated statement of financial position of the Company has been prepared by management using the same accounting policies. There are no differing accounting policies between the Company and MichiCann.

The unaudited pro-forma consolidated statement of financial position is not necessarily indicative of the Company’s consolidated financial position on closing of the Transaction had the Transaction closed on the dates assumed herein.

The unaudited pro-forma consolidated statement of financial position has been compiled from information derived from and should be read in conjunction with the following information, prepared in accordance with IFRS:

·the Company’s interim financial statements as at and for the period ended January 31, 2020;

·MichiCann’s audited financial statements as at and for the year ended December 31, 2019; and

·the additional information set out in Note 3 of this unaudited pro-forma consolidated statement of financial position that are directly attributable to the Transaction or factually supportable.

4

RED WHITE & BLOOM BRANDS INC.

NOTES TO THE PRO-FORMA CONSOLIDATED FINANCIAL STATEMENTS

As at January 31, 2020

(Unaudited – Expressed in Canadian Dollars)

3. UNAUDITED PRO-FORMA ASSUMPTIONS AND ADJUSTMENTS

The unaudited pro-forma consolidated statement of financial position gives effect to the completion of the Transaction incorporating the assumptions within Note 1, as if it had occurred on the date presented, January 31, 2020.

a.)Subsequent to January 31, 2020, the Company issued 70,858,999 common shares pursuant to the exercise of warrants at $0.05 per warrant.

b.)As consideration for 100% of the outstanding common shares of MichiCann. the Company will issue 84,211,770 common shares in exchange for all outstanding common shares of MichiCann. As a result of the share exchange, the former shareholders of MichiCann will acquire control of the Company and the Transaction will be treated as an RTO. The Transaction will be accounted for as an acquisition of the net assets and the Company’s status as a Reporting Issuer by MichiCann via a share-based payment.

The excess of the estimated fair value of the equity instruments that MichiCann is deemed to have issued to acquire the Company, plus the transaction costs (both the “Consideration) and the estimated fair value of the Company’s net assets, will be recorded as a charge to the accumulated deficit as a cost of obtaining the Company’s status as a Reporting Issuer.

For the purposes of the pro-forma consolidated statement of financial position, management has estimated the fair value of the equity instruments deemed to be issued in regard to the Company. The fair value of the 23,464,462 common shares amounted to $46,928,958, based on a deemed price of $2.50. The price was calculated based on MichiCann’s most recent financing of $5.00 adjusted for the 2 to 1 share split.

The Finder’s fee of 14,762,000 Resulting Issuer shares is calculated on the deemed price of $2.50.

5

RED WHITE & BLOOM BRANDS INC.

NOTES TO THE PRO-FORMA CONSOLIDATED FINANCIAL STATEMENTS

As at January 31, 2020

(Unaudited – Expressed in Canadian Dollars)

3. UNAUDITED PRO-FORMA ASSUMPTIONS AND ADJUSTMENTS (continued)

The allocation of the Consideration for the purposes of the pro-forma consolidated statement of financial position is as follows:

Net assets acquired:

Cash and cash equivalents

| 154,627

|

Amounts receivable

| 98,649

|

Convertible debenture receivable

| 17,712,200

|

Prepaid expenses and deposits

| 30,808

|

Promissory note receivable

| 4,119,938

|

Deposits

| 330,825

|

Right-of-use Assets

| 178,912

|

Investments

| 1,778,376

|

Accounts payable and accrued liabilities

| (348,224)

|

Lease liabilities

| (185,548)

|

Loan payable

| (50,164)

|

Due to related parties

| (17,566)

|

Net assets acquired

| 23,802,833

|

|

|

Consideration

| $ 58,661,155

|

|

|

Cost of the Company's status as a Reporting Issuer charged to deficit

| $34,858,322

|

c.)On June 4, 2019, Bridging entered into a credit agreement (the “Credit Agreement”) with MichiCann and PharmaCo (collectively, the “Borrowers”) pursuant to which Bridging established a non-revolving credit facility (the “Facility”) for the Borrowers in a maximum principal amount of CAD $36,374,400 (the “Facility Limit”). The purpose of the Facility is so that the PharmaCo can purchase certain real estate and business assets in the state of Michigan, to make additional permitted acquisitions and for general corporate and operating purposes.

On January 10, 2020, the Facility was amended (the “Amended Facility”) pursuant to an amended and restated credit agreement between Bridging, MichiCann (as guarantor) and PharmaCo, RWB Illinois and MAG (as borrowers) (the “Amended Credit Agreement”).

The Amended Facility increased the Facility Limit to US $49,750,000 in the aggregate of which US $27,000,000 was to refinance the existing Facility and US $22,750,000 ($30,257,500 CAD) was used to complete the MAG Acquisition and for general corporate and operating purposes.

6

RED WHITE & BLOOM BRANDS INC.

NOTES TO THE PRO-FORMA CONSOLIDATED FINANCIAL STATEMENTS

As at January 31, 2020

(Unaudited – Expressed in Canadian Dollars)

3. UNAUDITED PRO-FORMA ASSUMPTIONS AND ADJUSTMENTS (continued)

d.)On October 9, 2019, MichiCann entered into an agreement and plan of merger (the “MAG Merger Agreement”) with Mid-American Growers, Inc., RWB Acquisition Sub, Inc. and Arthur VanWingerden and Ken VanWingerden (collectively, the “MAG Sellers”) pursuant to which MichiCann will acquire all the issued and outstanding shares of Mid-American Growers, Inc. This Merger Agreement was amended on November 1, 2019 and January 9, 2020. MAG owned 124 acres of real property commonly known as 14240 Greenhouse Avenue, Granville Illinois (the “MAG Owned Property”).

Concurrent with the closing of the MAG Acquisition, MichiCann’s wholly owned subsidiary, RWB Illinois acquired additional 106 acres of land located at 14240 Greenhouse Avenue, Granville, Illinois for US$2,000,000 pursuant to a real estate purchase agreement made and entered into as of January 10, 2020 between RWB Illinois, VW Properties LLC, as seller, and each of the MAG Sellers (the “Real Estate Purchase Agreement”).

Pursuant to the MAG Merger Agreement, on closing of the MAG Acquisition, MichiCann paid to the MAG Sellers US $7,100,000 ($9,443,000 CAD) in cash and issued to the Sellers a non-transferable, fully paid right to receive in the aggregate 17,133,597 Resulting Issuer Shares and 17,133,579 Resulting Issuer Series 2 Preferred Shares (assuming completion of the Transaction prior to June 1, 2020).

e.)On February 25, 2019, pursuant to the terms of the Proposed Transaction, the Company advanced $15,000,000 to Michicann pursuant to a senior secured convertible debenture (the “MichiCann Debenture”). The MichiCann Debenture is non-interest bearing, other than in the event of default by MichiCann and matures on August 25, 2019 (the “Maturity Date”). The MichiCann Debenture is secured by way of first ranking security against the personal property of MichiCann. If the Proposed Transaction is not completed by the Maturity Date or MichiCann’s fails to comply with the terms of the MichiCann Debenture and MichiCann pursues an alternative go public transaction or a change of control transaction (an “Alternate Liquidity Transaction”), the Company may elect to convert, in whole or in part, the outstanding amount of the MichiCann Debenture into common shares of MichiCann at a price per MichiCann share that is the lesser if i) $2.50 per MichiCann Share and (ii) a 20% discount to the issue or effective price per Michicann Share under the Alternate Liquidity Transaction. If the Proposed Transaction is not complete by October 25, 2019, MichiCann may elect to prepay the outstanding amount under the MichiCann Debenture, with a prepayment penalty of 10%.

On August 28, 2019, the Issuer advanced MichiCann an additional US $2,000,000 to fund MichiCann working capital pursuant to the First Amending Agreement.

For the purposes of these pro-forma consolidated financial statements, the amounts due to and from have been eliminated on consolidation.

7

RED WHITE & BLOOM BRANDS INC.

NOTES TO THE PRO-FORMA CONSOLIDATED FINANCIAL STATEMENTS

As at January 31, 2020

(Unaudited – Expressed in Canadian Dollars)

4. UNAUDITED PRO-FORMA SHAREHOLDERS’ EQUITY

As a result of the Transaction and the pro-forma assumptions and adjustments, the Shareholders’ Equity of the combined entity as at January 31, 2020 is comprised of the following:

| Number of post split common shares

| Amount

|

|

| $

|

Existing MichiCann Shareholders

| 84,211,770

| 64,909,110

|

Advisory fee on the Transaction

| 7,381,000

| 36,905,000

|

Common shares deemed to be issued to Tidal shareholders

| 23,464,462

| 58,661,155

|

Shares reserved for MAG asset acquisition

| 17,133,579

| 42,833,993

|

Pro forma balance at January 31, 2020

| 132,190,811

| 203,309,257

|

5.EFFECTIVE INCOME TAX RATE

The effective income tax rate for the resulting issuer is 27%.

8