1.ABOUT THIS LISTING STATEMENT

1.1General

Unless otherwise indicated:

(i)except where otherwise indicated, all references to dollar amounts and “$” are to Canadian currency;

(ii)any statements in this Listing Statement made by or on behalf of management are made in such persons’ capacities as officers of the Resulting Issuer and not in their personal capacities; and

(iii)all information in this Listing Statement is stated as at May 7, 2020, unless otherwise indicated.

1.2Cautionary Statement Regarding Forward-Looking Statements

The information provided in this Listing Statement, including schedules and information incorporated by reference, may contain “forward-looking statements” about Red White & Bloom Brands Inc. (the “Resulting Issuer”), MichiCann Medical Inc. (“MichiCann”) and Tidal Royalty Corp. (the “Issuer”). In addition, the Issuer, MichiCann or the Resulting Issuer may make or approve certain statements in future filings with Canadian securities regulatory authorities, in press releases, or in oral or written presentations by representatives of the Issuer that are not statements of historical fact and may also constitute forward-looking statements. All statements, other than statements of historical fact, made by the Issuer. MichiCann or the Resulting Issuer that address activities, events or developments that the Issuer, MichiCann or the Resulting Issuer expects or anticipates will or may occur in the future are forward-looking statements, including, but not limited to, statements preceded by, followed by or that include words such as “may”, “will”, “would”, “could”, “should”, “believes”, “estimates”, “projects”, “potential”, “expects”, “plans”, “intends”, “anticipates”, “targeted”, “continues”, “forecasts”, “designed”, “goal”, or the negative of those words or other similar or comparable words.

Forward-looking statements may relate to future financial conditions, results of operations, plans, objectives, performance or business developments. These statements speak only as at the date they are made and are based on information currently available and on the then-current expectations of the party making the statement and/or assumptions concerning future events, which are subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from that which was expressed or implied by such forward-looking statements, including, but not limited to, risks and uncertainties related to:

·the available funds of the Resulting Issuer and the anticipated use of such funds;

·the regulation of the cannabis industry;

·the availability of financing opportunities, legal and regulatory risks inherent in the legal cannabis industry, risks associated with economic conditions, dependence on management and currency risk; and

·other risks described in this Listing Statement and described from time to time in

4

documents filed by the Issuer, MichiCann or the Resulting Issuer with Canadian securities regulatory authorities.

Consequently, all forward-looking statements made in this Listing Statement and other documents of the Issuer, MichiCann and the Resulting Issuer are qualified by such cautionary statements and there can be no assurance that the anticipated results or developments will actually be realized or, even if realized, that they will have the expected consequences to or effects to the Issuer, MichiCann and/or the Resulting Issuer.

The cautionary statements contained or referred to in this section should be considered in connection with any subsequent written or oral forward-looking statements that the Issuer, MichiCann or the Resulting Issuer and/or persons acting on its behalf may issue. The Issuer, MichiCann and the Resulting Issuer undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required under securities legislation. See “3.1 – GENERAL DEVELOPMENT OF BUSINESS – Risk Factors” and “17 –RISK FACTORS”.

1.3Market and Industry Data

This Listing Statement includes market and industry data relevant to the Resulting Issuer and business that has been obtained from third party sources, including industry publications. The Resulting Issuer believes that its industry data is accurate and that its estimates and assumptions are reasonable, but there is no assurance as to the accuracy or completeness of this data. Third party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there is no assurance as to the accuracy or completeness of included information. Although the data is believed to be reliable, the Resulting Issuer has not independently verified any of the data from third party sources referred to in this Listing Statement or ascertained the underlying economic assumptions relied upon by such sources.

1.4Glossary of Terms

Amalco |

| means the amalgamation corporation resulting and continuing from the Amalgamation. |

Amalgamating Corporations |

| means Tidal, Tidal Subco and MichiCann. |

Amalgamation

|

| means the amalgamation of MichiCann and Subco by way of a “three-cornered amalgamation” with Tidal pursuant to Section 174 of the OBCA. |

Amalgamation Agreement |

| means the agreement among MichiCann, Tidal and Subco in respect of the Amalgamation. |

Amalgamation Resolution |

| means the special resolution of the MichiCann Shareholders approving the Amalgamation which is to be considered at the MichiCann Meeting. |

Business Combination Agreement |

| means the Business Combination Agreement between Tidal, Tidal Subco and MichiCann dated May 8, 2019, as amended and restated on March 12, 2020. |

Completion Deadline |

| means April 30, 2020 or such later date as may be mutually agreed between the Parties in writing. |

5

Closing |

| means the closing of the Transaction. |

CSE |

| means the Canadian Securities Exchange. |

Dissenting Shareholder |

| means a registered holder of MichiCann Shares who, in connection with the special resolution of the MichiCann Shareholders approving the Amalgamation, has exercised the right to dissent pursuant to Section 185 of the OBCA in strict compliance with the provisions thereof and thereby becomes entitled to be paid the fair value of his, her or its MichiCann Shares and who has not withdrawn the notice of the exercise of such right as permitted by Section 185 of the OBCA. |

Effective Date |

| means the date shown on the Certificate of Amalgamation giving effect to the Amalgamation. |

Effective Time |

| means 12:01 a.m. (Toronto time) on the Effective Date or such other time on the Effective Date as may be agreed by MichiCann and Tidal. |

Exchange Ratio |

| means 2 Resulting Issuer Consideration Shares (comprised of 1 Resulting Issuer Shares and 1 Resulting Issuer Series II Preferred Shares) for each one (1) MichiCann Share held. |

Excluded Laws |

| means any U.S. federal laws, statutes, codes, ordinances, decrees, rules, regulations which apply to the production, trafficking, distribution, processing, extraction, and/or sale of marijuana (cannabis) and related substances. |

Federal CSA |

| means the U.S. Controlled Substances Act of 1970. |

Fundamental Change Written Consent |

| means the written consent of the holders of Tidal Shares to approve the Transaction |

Holder Application |

| Means the application to LARA by the holder of the PharmaCo Debenture seeking permission to convert the PharmaCo Debenture and own the PharmaCo Shares. |

IFRS |

| means the International Financial Reporting Standards, as issued by the International Accounting Standards Board. |

Issuer |

| means Tidal Royalty Corp. |

legal cannabis industry |

| means any business operating in a State of the United States that pertains in any way to cannabis, which is carried out in compliance with all applicable State laws and regulations. |

LARA |

| means The Department of Licensing and Regulatory Affairs in the State of Michigan or as it otherwise may be known from time to time. |

Management |

| means the management of the Resulting Issuer. |

6

Material Adverse Effect |

| means any event, change or effect that is or would reasonably be expected to be materially adverse to the financial condition, operations, assets, liabilities, or business of a Party and its Subsidiaries, considered as a whole, provided, however, that a Material Adverse Effect shall not include an adverse effect resulting from a change: (a) which arises out of or in connection with a matter that has been publicly disclosed or otherwise disclosed in writing by such Party to the other Party prior to the date of this Agreement; (b) resulting from conditions affecting the medical marijuana industry as a whole; or (c) resulting from general economic, financial, currency exchange, securities or commodity market conditions in Canada, the United States or elsewhere. |

MichiCann |

| means MichiCann Medical Inc. |

Michicann Meeting |

| means a special meeting of the shareholders of MichiCann to be held in order to seek shareholder approval for the Amalgamation. |

MichiCann Shareholder |

| means a registered holder of MichiCann Shares, from time to time, and “MichiCann Shareholders” means all such holders. |

MichiCann Shareholder Approval |

| means the approval of the Amalgamation Resolution by at least two-thirds of the votes cast by the MichiCann Shareholders present in person or by proxy at the MichiCann Meeting. |

MichiCann Shares |

| means the common shares in the capital of MichiCann.. |

OBCA |

| means the Ontario Business Corporations Act, R.S.O. 1990, c. B.16. |

PharmaCo

|

| Means PharmaCo Inc., a corporation incorporated under the laws of Michigan. |

Preferred Shares |

| means the non-voting, Series 1 Convertible Preferred Shares of the Issuer. |

Red White & Bloom Brands Inc. |

| means the Resulting Issuer. |

Resulting Issuer |

| means Tidal after completion of the Transaction and after giving effect to the Tidal Name Change to Red White & Bloom Brands Inc. |

Resulting Issuer Consideration Shares |

| means the Resulting Issuer Shares and the Resulting Issuer Series II Preferred Shares, to be issued in accordance with the Exchange Ratio. |

Resulting Issuer Convertible Securities |

| means, collectively, the Resulting Issuer Options and the Resulting Issuer Warrants. |

Resulting Issuer Options |

| means stock options to purchase Resulting Issuer Shares and Resulting Issuer Series II Preferred Shares to be issued to the holders of the MichiCann Options in replacement for their MichiCann Options in accordance with the Exchange Ratio. |

Resulting Issuer Preferred Shares |

| means the Tidal Preferred Shares after giving effect to the completion of the Business Combination. |

7

Resulting Issuer Series II Preferred Shares |

| means the Tidal Series II Preferred Shares after giving effect to the completion of the Business Combination. |

Resulting Issuer Shares |

| means the common shares in the capital of the Resulting Issuer.

|

Resulting Issuer Warrants |

| means purchase warrants to purchase Resulting Issuer Shares and Resulting Issuer Series II Preferred Shares to be issued to the holders of the MichiCann Warrants in replacement for their MichiCann Warrants in accordance with the Exchange Ratio. |

Tidal |

| means Tidal Royalty Corporation. |

Tidal Advisory Fee |

| means the 14,762,000 Resulting Issuer Shares to be issued to certain advisors upon completion of the Business Combination of which 50% will be Resulting Issuer Shares and 50% will be Resulting Issuer Series II Preferred Shares. |

Tidal Board |

| means the board of directors of the Issuer. |

Tidal Director Appointments

|

| means subject to the completion of the Amalgamation, the reconstitution of the Tidal Board to consist of five (5) directors in the manner provided for in the Business Combination Agreement. |

Tidal Name Change |

| means the change of name of the Issuer to “Red White & Bloom Brands Inc.” or such other name as may be agreed upon by the Issuer and MichiCann. |

Tidal Shares |

| means the common shares in the capital of the Issuer. |

Tidal Share Consolidation |

| means the consolidation of the issued and outstanding Tidal Shares on the basis of sixteen (16) pre-consolidation Tidal Shares for one (1) post-consolidation Tidal Share. |

Tidal Shareholder Approval |

| means obtaining the Fundamental Change Written Consent signed by at least 50.1% of the Tidal Shareholders as required pursuant to the rules of the CSE. |

Tidal Subco Or Subco |

| means 2690229 Ontario Inc. a wholly owned subsidiary of Tidal.

|

Transaction |

| means the Amalgamation and related transactions pursuant to the Business Combination Agreement. |

2.1Corporate Name and Head and Registered Office

The Issuer was incorporated under the laws of British Columbia on March 12, 1980 as Treminco Resources Ltd. On February 19, 1999, the Issuer changed its name to Elkhorn Gold Mining Corporation; on October 12, 2011, the Issuer changed its name to Tulloch Resources Ltd.; and effective July 18, 2017, the Issuer changed its name to Tidal Royalty Corp. The registered and records office of the Issuer is located at Suite 810, 789 West Pender Street, Vancouver, British Columbia V6C 1H2.

MichiCann was incorporated under the laws of Ontario on December 5, 2017. The registered and records office of MichiCann is located at 8820 Jane Street, Concord, Ontario, L4H 2M9.

8

Following completion of the Business Combination and the Tidal Name Change, it is expected that the full corporate name of the Resulting Issuer will be “Red White & Bloom Brands Inc.”. The registered and records office of the Resulting Issuer will be Suite 810, 789 West Pender Street, Vancouver, British Columbia V6C 1H2.

2.2Jurisdiction of Incorporation

The Issuer was incorporated under the Business Corporations Act (British Columbia). MichiCann was incorporated under the Business Corporations Act (Ontario).

9

2.3Intercorporate Relationships

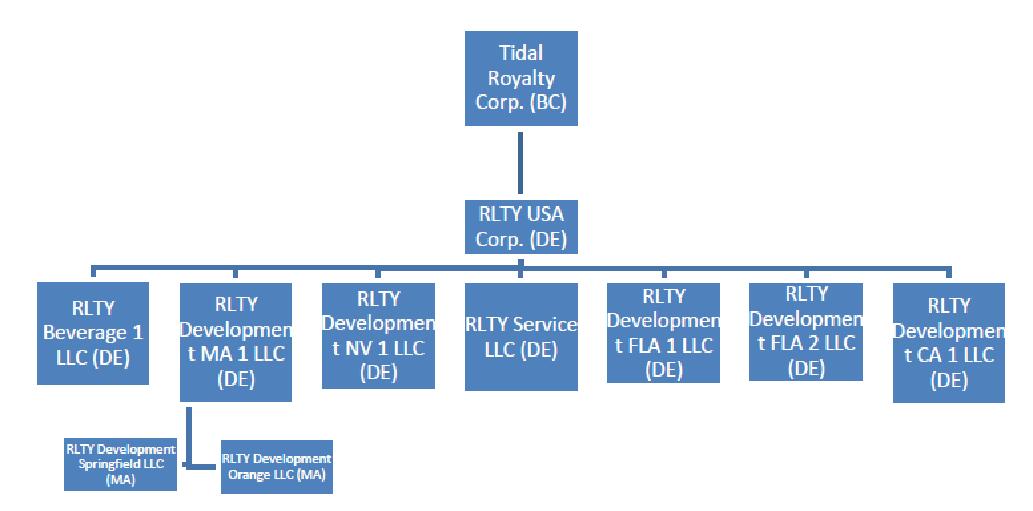

The following sets out the organization structure of the Issuer:

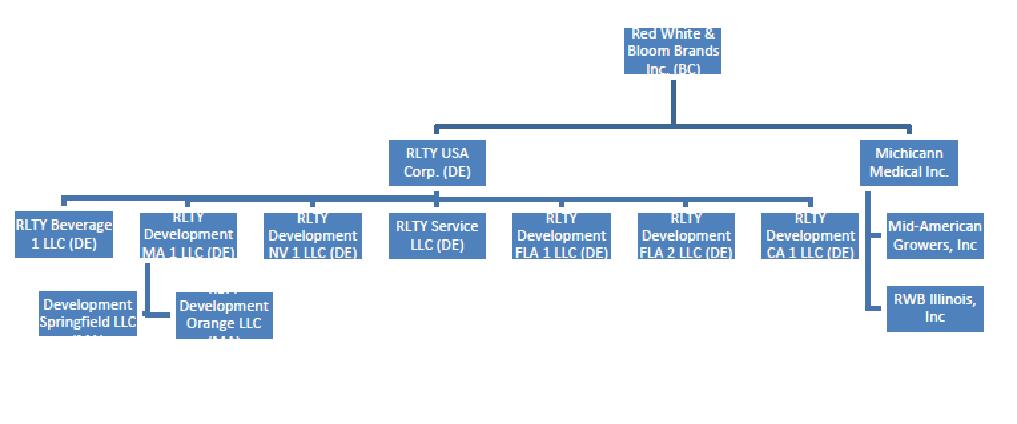

MichiCann has the following two subsidiaries:

1. Mid-American Growers, Inc. (“MAG”), a corporation existing under the laws of the State of Delaware following the merger of Mid-American Growers, Inc. and RWB Acquisition Sub, Inc. on January 10, 2020; and

2. RWB Illinois, Inc. (“RWB Illinois”), a corporation incorporated under the laws of the State of Delaware

On completion of the Transaction, the corporate structure of the Resulting Issuer is as follows:

10

2.4Issuer’s requalifying following a fundamental change

On May 8, 2019, the Issuer, Tidal Subco and MichiCann entered into a business combination agreement as amended and restated on March 12, 2020, (the “Business Combination Agreement”), which set out the terms for the reverse take-over of the Issuer by MichiCann by way of the Amalgamation and the related transactions.

General

The principal consequences of the Amalgamation are summarized as follows:

(a)the Amalgamating Corporations will amalgamate under the OBCA and will continue as one corporation under the name “MichiCann Medical Inc.”;

(b)each issued and outstanding MichiCann Share (other than those held by Dissenting Shareholders) shall be exchanged in accordance with the following exchange ratios:

Shareholders will receive* | For each

|

one (1) fully paid and non-assessable Tidal Share and one (1) fully paid and non-assessable Tidal Series II Preferred Share | 1 MichiCann Common Share |

One (1) Warrant to purchase one (1) Tidal Share and one (1) Tidal Series II Preferred Share | 1 MichiCann Warrant |

one (1) Option to purchase one (1) Tidal Share and one (1) Tidal Series II Preferred Share | 1 MichiCann Option

|

*following completion of the Tidal Share Consolidation

(c)the articles of Amalco will be substantially the articles of MichiCann;

(d)the by-laws of Amalco will be the by-laws of MichiCann;

(e)the property and assets of each of the Amalgamating Corporations will be the property and assets of Amalco and Amalco will be liable for all of the liabilities and obligations of each of the Amalgamating Corporations; and

(f)all Tidal Options to be issued to holders of MichiCann Options on the Amalgamation will be issued under Tidal’s current stock option plan.

The ownership of the Resulting Issuer on a fully diluted basis by the former shareholders of MichiCann and Tidal will be 87% and 13%, respectively.

11

If all of the conditions of the proposed Amalgamation are satisfied, including receiving the requisite shareholder approval as described herein and conditional approval of the Exchange, the Articles of Amalgamation are expected to be filed on April 24, 2020.

Business Combination Agreement

The following summary of the Business Combination Agreement is qualified in its entirety by the text of the Business Combination Agreement, a copy of which is attached hereto as Appendix “J” and which has also been filed by Tidal with the Canadian securities regulatory authorities and is available at www.sedar.com.

Business Combination Steps

The Business Combination is structured as a three-cornered amalgamation involving the Amalgamation of MichiCann with Tidal Subco pursuant to section 174 of the OBCA in exchange for Tidal Shares pursuant to the following steps:

·MichiCann shall duly call and convene the MichiCann Meeting not later than April 15, 2020 at which the MichiCann Shareholders will be asked to approve the Amalgamation Resolution;

·Tidal shall circulate the Fundamental Change Written Consent for the purpose of obtaining the Tidal Shareholder Approval;

·Tidal shall circulate forms of directors resolutions for the purpose of obtaining the approval of the board of directors for the Tidal Share Consolidation, the Tidal Name Change and the Tidal Director Appointments, or hold one or more directors meetings in lieu thereof, in accordance with Tidal’s articles and applicable Laws, as soon as reasonably practicable;

·Following the receipt of the MichiCann Shareholder Approval, the Tidal Shareholder Approval and immediately prior to the filing of the Articles of Amalgamation, Tidal shall take all necessary corporate steps to complete the Tidal Share Consolidation, the Tidal Name Change and the Tidal Director Appointments;

·MichiCann and Tidal Subco shall amalgamate by way of statutory amalgamation under Section 174 of the OBCA on the terms and subject to the conditions contained in the Amalgamation Agreement and MichiCann and Tidal further agree that the Effective Date shall occur within five (5) Business Days following the later of: (i) the receipt of Tidal Shareholder Approval; and (ii) the satisfaction or waiver of all conditions imposed under the Business Combination Agreement and by the CSE or any other regulatory requirements;

·Upon completion of the Amalgamation:

oMichiCann and Tidal Subco will amalgamate under the provisions of the OBCA and continue as one amalgamated corporation, being Amalco;

12

oholders of outstanding MichiCann Shares shall receive Resulting Issuer Consideration Shares in accordance with the Exchange Ratio;

oeach outstanding Subco Share will be exchanged for Amalco Shares on the basis of one (1) Amalco Share for each Subco share;

oas consideration for the issuance of the Resulting Issuer Consideration Shares to the holders of MichiCann Shares to effect the Amalgamation, Amalco will issue to the Resulting Issuer one (1) fully paid Amalco Share for each Resulting Issuer Consideration Share so issued;

oall of the property and assets of each of MichiCann and Subco will be the property and assets of Amalco and Amalco will be liable for all of the liabilities and obligations of each of MichiCann and Subco; and

oAmalco will be a wholly-owned Subsidiary of Tidal;

·Resulting Issuer Options and Resulting Issuer Warrants shall be issued to the holders of the MichiCann Options and MichiCann Warrants, respectively, in exchange and replacement for, on an equivalent basis, such MichiCann Options and MichiCann Warrants, which shall thereby be cancelled. For greater certainty, 50% of the Resulting Issuer Options and the Resulting Issuer Warrants shall be exercisable into Resulting Issuer Shares and 50% of the Resulting Issuer Options and Resulting Issuer Warrants shall be exercisable into Resulting Issuer Series II Preferred Shares;

·14,762,000 Resulting Issuer Shares will be issued to certain advisors upon completion of the Business Combination of which 50% will be Resulting Issuer Shares and 50% will be Resulting Issuer Series II Preferred Shares;

·as soon as practicable after the Effective Date, in accordance with normal commercial practice, the Resulting Issuer shall issue or cause to be issued certificates, DRS Statements or electronic positions within CDS representing the appropriate number of the Resulting Issuer Shares and Resulting Issuer Series II Preferred Shares to the former MichiCann Shareholders and the former Tidal Shareholders, as applicable. No fractional shares will be delivered to any MichiCann Shareholder or Tidal Shareholder otherwise entitled thereto and instead the number of shares to be issued to each former MichiCann Shareholder and Tidal Shareholder will be rounded down to the nearest whole number; and

·the Parties shall take any other action and do anything, including the execution of any other agreements, documents or instruments, that are necessary or useful to give effect to the Business Combination.

Representations, Warranties and Covenants

The Business Combination Agreement contains customary representations and warranties made by each of the parties in respect of the respective assets, liabilities, financial position, business and

13

operations of Tidal, Tidal Subco and MichiCann. Both Tidal and MichiCann also provided covenants in favour of each other in the Business Combination Agreement which govern the conduct of the operations and affairs of each respective party prior to the closing date.

Mutual Conditions to the Transaction

The Business Combination Agreement contains conditions to the obligations of Tidal and MichiCann to complete the Transaction. Unless all such conditions are satisfied or waived by the party or parties for whose benefit such conditions exist, the Transaction will not be completed. The following is a summary of the significant conditions contained in the Business Combination Agreement:

(a)there shall have been no action taken under any applicable Law or by any Government Authority and there shall not be in force any order or decree restraining or enjoining the consummation of the Business Combination;

(b)the Business Combination Agreement shall not have been terminated pursuant to the terms of the Business Combination Agreement;

(c)all regulatory approvals (including Exchange approvals) and corporate approvals for the Amalgamation shall have been obtained;

(d)each party shall not have entered into any transaction or contract which would have a material effect on the financial and operational condition, or the assets of each party, excluding those transactions or contracts undertaken in the ordinary course of business, without first discussing and obtaining the approval of the other party;

(e)the MichiCann Shareholder Approval shall have been obtained;

(f)the Tidal Shareholder Approval shall have been obtained;

(g)Tidal shall have completed the Tidal Share Consolidation, the Tidal Name Change and the Tidal Director Appointments;

Additional Conditions Precedent to the Obligations of MichiCann

(a) on or prior to the Effective Date, and effective upon completion of the Amalgamation, each of the directors and officers of Tidal who are not continuing on in such capacities shall have tendered their resignations and provided mutual releases in a form acceptable to MichiCann and the board of directors of Tidal, subject to the approval of the CSE, shall have been reconstituted, and the officers shall have been appointed;

(b) no Material Adverse Change with respect to Tidal shall have occurred between the date hereof and the Effective Date and the CEO of Tidal or another officer satisfactory to MichiCann shall deliver a certificate addressed to MichiCann certifying the foregoing immediately prior to the Effective Time;

14

(c) Tidal shall have complied and performed, in all material respects, all of its covenants and other obligations under the Business Combination Agreement which have not been waived by MichiCann, and all representations and warranties of Tidal contained in the Business Combination Agreement shall have been true and correct in all material respects as of the date of the Business Combination Agreement and shall remain true and correct in all material respects thereafter (provided, however, that if the breaching Party has been given written notice by the other Party specifying in reasonable detail any such misrepresentation, breach or non-performance, the breaching Party shall have had three days to cure such misrepresentation, breach or non-performance), and the CEO of Tidal or another officer satisfactory to MichiCann shall deliver a certificate addressed to MichiCann certifying the foregoing immediately prior to the Effective Time;

(d) the Tidal board of directors, the Subco board of directors and the Tidal Shareholders as necessary, shall have adopted all necessary resolutions and all other necessary corporate actions shall have been taken by Tidal to permit the consummation of the Business Combination and the transactions contemplated therewith; and

(e) MichiCann shall have received all of the Tidal Escrow Agreements and all covenants under the Tidal Escrow Agreements to be performed on or before the Effective Time which have not been waived by MichiCann shall have been duly performed by the counterparties thereto in all material respects.

If any of the above conditions shall not have been complied with or waived by MichiCann on or before the Completion Deadline or, if earlier, the date required for the performance thereof, then, subject to the cure provision provided for in section (c), MichiCann may terminate the Business Combination Agreement in circumstances where the failure to satisfy any such condition is not the result, directly or indirectly, of a breach of the Business Combination Agreement by MichiCann. In the event that the failure to satisfy any one or more of the above conditions precedent results from a material default by MichiCann of its obligations under the Business Combination Agreement and if such condition(s) precedent would have been satisfied but for such default, MichiCann shall not rely on such failure (to satisfy one or more of the above conditions) as a basis for its own noncompliance with its obligations under the Business Combination Agreement.

Additional Conditions Precedent to the Obligations of Tidal

(a) no Material Adverse Change with respect to MichiCann taken as a whole shall have occurred between the date hereof and the Effective Date and the President of MichiCann or another officer satisfactory to Tidal shall deliver a certificate addressed to Tidal certifying the foregoing immediately prior to the Effective Time;

(b) MichiCann shall have complied and performed, in all material respects, all of its covenants or other obligations under this Agreement which have not been waived by Tidal, and all representations and warranties of MichiCann contained in the Business Combination Agreement shall have been true and correct in all material respects as of the date of the Business Combination

15

Agreement and shall remain true and correct in all material respects thereafter (provided, however, that if the breaching Party has been given written notice by the other Party specifying in reasonable detail any such misrepresentation, breach or nonperformance, the breaching Party shall have had three days to cure such misrepresentation, breach or nonperformance), and the President of MichiCann or another officer satisfactory to Tidal shall deliver a certificate addressed to Tidal certifying the foregoing immediately prior to the Effective Time;

(c) the MichiCann board of directors and the MichiCann Shareholders shall have adopted all necessary resolutions and all other necessary corporate actions shall have been taken by MichiCann to permit the consummation of the Amalgamation, the Business Combination and the transactions contemplated by the Documents;

(d) Tidal shall have received all of the MichiCann Escrow Agreements and all covenants under the MichiCann Escrow Agreements to be performed on or before the Effective Time which have not been waived by Tidal shall have been duly performed by the counterparties thereto in all material respects; and

(e) the number of Dissenting MichiCann Shares, for which dissent rights have not been withdrawn, at the time of the MichiCann Meeting shall not exceed 5% of the number of issued and outstanding MichiCann Shares.

If any of the above conditions shall not have been complied with or waived by Tidal on or before the Completion Deadline or, if earlier, the date required for the performance thereof, then, subject to the cure provision provided for in section (b), Tidal may terminate this Agreement in circumstances where the failure to satisfy any such condition is not the result, directly or indirectly, of a breach of the Business Combination Agreement by Tidal or Subco. In the event that the failure to satisfy any one or more of the above conditions precedent results from a material default by Tidal or Subco of its obligations under the Business Combination Agreement and if such condition(s) precedent would have been satisfied but for such default, neither Party shall rely on such failure (to satisfy one or more of the above conditions) as a basis for its own noncompliance with its obligations under the Business Combination Agreement.

Management of Tidal and MichiCann believes that all material consents, rulings, approvals and assurances required for the completion of the Transaction will be obtained prior to the closing sate in the normal course upon application. There can be no assurance, however, that all of the conditions to the Transaction will be fulfilled prior to the anticipated closing date. The fulfilment of certain conditions may be waived by the parties to the Business Combination Agreement.

2.5Non-Corporate Issuers or Issuers Outside of Canada

3.GENERAL DEVELOPMENT OF THE BUSINESS

3.1General Development of the Issuer’s Business

Between 1985 and 2000, the Issuer was involved in mineral exploration and was listed initially on the Vancouver Stock Exchange (as it was then known) and subsequently on the TSX Venture

16

Exchange (the “TSX”). On September 4, 2001, the Issuer’s Shares were delisted from the TSX for failure to meet the continued listing requirements of the TSX. Cease Trade Orders (“CTO’s”) were imposed on the Issuer by the Ontario Securities Commission and British Columbia Securities Commissions (the “Commissions”) on January 11, 2002 and January 3, 2002, respectively. Between April 2001 and July 2010, the Issuer was inactive and did not carry on any business. On October 11, 2011, the Issuer changed its name to the Tulloch Resources Ltd.

On January 16, 2012, pursuant to Section 171 of the British Columbia Securities Act and Section 144 of the Ontario Securities Act, the Commissions issued revocation orders in respect to the prior CTO’s issued against the Issuer. As part of the revocation, the Issuer undertook not to complete a transaction that would result in a Reverse Takeover while the Issuer is not listed on a “recognized stock exchange” unless prior to closing of such transaction, the Issuer provides the British Columbia Securities Commission with 10 business days’ notice of the transaction.

Between 2012 and 2016, the Issuer undertook three (3) equity financings, raising an aggregate of $125,000, through private placements of its common shares to cover expenses involved in the restoration of the Issuer, ongoing costs, and expenses involved in searching for an appropriate project. From 2014 to 2017, the Issuer identified and reviewed a number of opportunities but did not proceed with any project.

In July 2017, the Issuer changed its business to become an Investment Company with a focus on the U.S. legal cannabis industry. In order to make this change the Issuer:

1.retained new management with a track record in the U.S. legal cannabis industry and of acquiring and divesting in arm’s-length enterprises;

2.changed its name from Tulloch Resources Ltd. to Tidal Royalty Corp;

3.consolidated its common shares on a three (3) old for one (1) new basis;

4.considered and created a clearly defined investment policy; and

5.received shareholders’ approval to the change of the Issuer’s business from mineral exploration to that of an Investment Company.

Prior Financings

On January 30, 2015, the Issuer issued 1,400,000 common shares in connection with a non-brokered financing at a price of $0.05 per common share for aggregate proceeds of $70,000.

On December 29, 2015, the Issuer issued 550,000 common shares in connection with a non-brokered financing at a price of $0.10 per common share for aggregate proceeds of $55,000.

On February 8, 2018, March 1, 2018 and April 30, 2018, the Issuer issued 59,370,000, 57,120,000 and 10,090,000 Special Warrants respectively, in connection with a non-brokered financing at a price of $0.05 per Special Warrant for aggregate proceeds of $6,329,000. The Special Warrants converted to Units four months from the date of issue.

On May 15, 2018, the Issuer issued 40,000,000 Preferred Share units in connection with a non-brokered offering at a price of $0.05 per Preferred Share unit for aggregate gross proceeds of $2,000,000.

17

On June 12, 2018, the Issuer issued 91,387,756 common shares in connection with a non-brokered private placement at a price of $0.33 per common share for aggregate gross proceeds of $30,157,960.

Investment Portfolio

On August 31, 2018, the Issuer executed a definitive agreement with VLF Holdings LLC, an Oregon limited liability company d/b/a Diem Cannabis (“Diem”) to finance the expansion of TDMA LLC, a Massachusetts subsidiary of Diem (“TDMA”) into Massachusetts. Diem is an experienced licensed operator in the highly-competitive Oregon market. Pursuant to the agreement, the Issuer will provide Diem Cannabis with up to US$12.5 million over three years to develop and operate a large-scale cultivation and processing facility (the “Site”) and up to four dispensaries (the “Dispensaries”) in Massachusetts (the “Diem Financing”). The Diem Financing will be in the form of (i) promissory notes advanced at various stages of development of operations in the state; and (ii) the purchase price for real property acquisitions with respect to Sites and Dispensaries. Wholly owned subsidiaries of Tidal, RLTY Development Springfield LLC and RLTY Development Orange LLC have acquired title to the real property purchased in respect of the Site and Dispensary acquisitions and will enter into leases with TDMA (or its nominee) with respect to their operation.

On November 15, 2018, the Issuer announced it had purchased $3 million of units (the “FLRish Units”) of FLRish, Inc., the parent company of Harborside (“Harborside”) and entered into a non-binding memorandum of understanding (“MOU”) with Harborside to provide royalty financing to prospective “Harborside” brand dispensary operators. There has been no progress on the MOU as of the date of this listing statement. Each FLRish Unit is comprised of (A) one 12% unsecured convertible debenture, convertible into common shares of Harborside (i) at the option of the holder at any time prior to the last business day immediately preceding the third anniversary date of the closing; and (ii) automatically upon a Harborside going-public transaction, at a conversion price equal to the lower of (i) $6.90; and (ii) a 10% discount to the price of the common shares of Harborside as part of a qualifying transaction; and (B) 87 common share purchase warrants exercisable for a period of two years following the closing into common shares of Harborside at an exercise price of $8.60 (subject to acceleration in the event of a going public transaction). Pursuant to the terms of the MOU, the Issuer has agreed to provide up to US$10 million in royalty financing to prospective dispensary operators licensing the “Harborside” brand. Each potential dispensary financing transaction will be assessed by the Issuer on a case-by-case basis and will be subject to the satisfactory completion of due diligence by the Issuer and the consummation of definitive documentation with the prospective dispensary operator.

In June 2019, Harborside Inc. (formerly Lineage Grow Company Ltd.) completed its previously announced reverse takeover of FLRish Inc. (doing business as Harborside), pursuant to the terms of a merger agreement dated Feb. 8, 2019, as amended on April 17, 2019, among the company, FLRish and Lineage Merger Sub Inc., a wholly owned subsidiary of the company. The reverse takeover was completed by way of a three-cornered merger, whereby FLRish merged with Merger Sub to form a merged corporation and a wholly owned subsidiary of the company.

Immediately prior to the reverse takeover taking effect, the company: (i) consolidated its common shares on the basis of approximately 41.82 common shares into one new common share; (ii) changed its name to Harborside Inc.; (iii) reclassified the post-consolidation common shares as subordinate voting shares; and (iv) created a new class of multiple voting shares. On closing, the

18

shareholders of FLRish received multiple voting shares, subordinate voting shares or a combination thereof for each share of FLRish outstanding immediately prior to completion of the reverse takeover.

On November 5, 2018, the Issuer entered into a binding letter of intent with Lighthouse Strategies LLC (“Lighthouse”) to make subscription, by way of private placement, for US $5,000,000 of Lighthouse’s Series A membership units.

Lighthouse is a finance, research & technology, and portfolio management company. It operates 11 companies and 150,000 square feet of real estate under management serving both traditional and regulated markets, including vertically integrated cannabis assets licensed in California and Nevada. Lighthouse is renowned for developing the world’s first non-alcoholic cannabis-infused craft beer and liquor brand. Cannabiniers, a Lighthouse company, debuted Two Roots Brewing Co. in Las Vegas, Nevada earlier this year.

On December 1, 2018 Lighthouse entered into a Financing Fee Agreement with RLTY Beverage 1 LLC (the “Financing Fee Agreement”). Pursuant to the Financing Fee Agreement, Tidal is entitled to 1% of net sales of certain of Lighthouse’s beverage lines, including Cannabiniers, Two Roots Brewing Co and Creative Waters Beverage Company. Financing fees will accumulate at 1% of net sales until December 1, 2019, at which point Tidal may choose to receive such fees in cash or Series A membership units of Lighthouse at US $2.11 per unit. Thereafter, financing fees are payable quarterly in cash. The terms of the Financing Fee Agreement are between four and six years, depending on certain milestones and includes acceleration provisions in certain events (including a substantial asset divestiture, change of control, or initial public offering).

On February 25, 2019, Tidal advanced $15,000,000 to MichiCann pursuant to a senior secured convertible debenture which was amended on August 28, 2019 pursuant to a first amending agreement (the “First Amending Agreement”), September 11, 2019 pursuant to a second amending agreement (the “Second Amending Agreement”) and March 12, 2020 pursuant to a third amending agreement (the “Third Amending Agreement”) (together, the “MichiCann Debenture”). The MichiCann Debenture is non-interest bearing, other than in the event of default by MichiCann and matures on April 30, 2020 (the “Maturity Date”). The MichiCann Debenture is secured by way of a security interest against the personal property of MichiCann which security interest is subordinated to the security interest held by Bridging Finance Inc. (“Bridging”). If the Proposed Transaction is not completed by the Maturity Date or MichiCann fails to comply with the terms of the MichiCann Debenture and MichiCann pursues an alternative go public transaction or a change of control transaction (an “Alternate Liquidity Transaction”), the Company may elect to convert, in whole or in part, the outstanding amount of the MichiCann Debenture into common shares of MichiCann at a price per MichiCann share that is the lesser if i) $2.50 per MichiCann Share and (ii) a 20% discount to the issue or effective price per Michicann Share under the Alternate Liquidity Transaction. If the Proposed Transaction is not complete by April 30, 2020, MichiCann may elect to prepay the outstanding amount under the MichiCann Debenture, with a prepayment penalty of 10%. On August 28, 2019, the Issuer advanced MichiCann an additional US $2,000,000 pursuant to the First Amending Agreement and on March 12, 2020, an additional US $500,000 pursuant to the Third Amending Agreement to fund MichiCann working capital.

The Tidal Debenture is secured against the assets of MichiCann pursuant to a general security and pledge agreement dated February 25, 2019 (the “GSA and Pledge Agreement”) which security interests have been subordinated behind the security interest held by Bridging.

19

On May 8, 2019, the Issuer entered into the Business Combination Agreement with Tidal Subco and MichiCann (as amended June 28, 2019 and July 30, 2019).

On March 12, 2020, the Issuer entered in the Amended and Restated Business Combination Agreement with Tidal Subco and Michicann and entered into a third amending agreement with MichiCann to, among other things, extend the maturity date of the Debenture to April 30, 2020.

On April 24, 2020, the Issuer closed the Amended and Restated Business Combination Agreement with Tidal Subco and Michicann, consolidated its common shares of a 16:1 basis and changed its name to Red White & Bloom Brands Inc.

3.2 General Development of MichiCann’s Business

MichiCann, operating as Red White & Bloom, is an investment company with a focus on the US cannabis industry. MichiCann’s current investments are the PharmaCo Debenture and its rights under the PharmaCo Put/Call Option Agreement.

On January 4, 2019, MichiCann entered into the Put-Call Option Agreement with the shareholders of PharmaCo, which if exercised and subject to regulatory approval, would result in MichiCann acquiring all the issued and outstanding shares of PharmaCo. (See General Development of MichiCann’s Business – Agreements with PharmaCo).

PharmaCo has been granted a Step 1 prequalification by the Medical Marijuana Licensing Board of the State of Michigan and has been awarded multiple municipal and state approvals for grower permits (cultivation), manufacturing (including extraction and derivative manufacturing) and provisioning centers (dispensaries). Current approvals allow for stacking of Michigan “C Licenses” providing the PharmaCo with a unique opportunity to establish itself as one of the largest licensed producer of cannabis in Michigan state.

On January 10, 2020, MichiCann closed the asset acquisition of Mid-American Growers, Inc.

On January 10, 2020, MichiCann’s wholly-owned subsidiary, RWB Illinois acquired 142 acres of land located at 14240 Greenhouse Avenue, Granville, Illinois. (For a more detailed description of these agreements, see General Development of MichiCann’s Business – Agreements with MAG).

Prior Financings

Since MichiCann’s incorporation on December 5, 2017, MichiCann has completed the following financings:

On April 3, 2018, MichiCann issued an aggregate of $1,012,000 principal amount of unsecured convertible debentures (the “Unsecured Debentures”) convertible into MichiCann Shares at a price of $0.50 per MichiCann Share. All Unsecured Debentures converted into an aggregate of $2,024,000 MichiCann Shares on November 21, 2018.

On December 18, 2018, MichiCann issued 30,068,182 MichiCann Shares pursuant to a non-brokered financing (first tranche) at a price of $1.00 per MichiCann Share for aggregate proceeds of $30,068,182.

On February 22, 2019, MichiCann issued 4,500,000 MichiCann Shares pursuant to a non-brokered financing (second tranche) at a price of $1.00 per MichiCann Share for aggregate proceeds of $4,500,000.

20

On February 22, 2019, MichiCann issued 2,240,000 MichiCann Shares pursuant to a non-brokered financing at a price of $2.50 per MichiCann Share for aggregate proceeds of $5,600,000.

On February 25, 2019, MichiCann issued the $15,000,000 MichiCann Debenture which was increased by an additional US $2,000,000 on August 28, 2019 pursuant to the First Amending Agreement.

On September 30, 2019, MichiCann issued 1,168,100 MichiCann Shares pursuant to a non-brokered financing (first tranche) at a price of $5.00 per MichiCann Share for aggregate proceeds of $5,840,500.

On October 9, 2019, MichiCann issued 840,000 MichiCann Shares pursuant to a non-brokered financing (second tranche) at a price of $5.00 per MichiCann Share for aggregate proceeds of $4,200,000.

On October 23, 2019, MichiCann issued 1,200,000 MichiCann Shares pursuant to a non-brokered financing (third tranche) at a price of $5.00 per MichiCann Share for aggregate proceeds of $6,000,000.

On December 18, 2019, MichiCann issued 27,000 MichiCann Shares pursuant to a non-brokered financing (second tranche) at a price of $5.00 per MichiCann Share for aggregate proceeds of $135,000.

On June 4, 2019, Bridging entered into a credit agreement (the “Credit Agreement”) with MichiCann and PharmaCo (collectively, the “Borrowers”) pursuant to which Bridging established a non-revolving credit facility (the “Facility”) for the Borrowers in a maximum principal amount of CAD $36,374,400 (the “Facility Limit”). The purpose of the Facility is so that the PharmaCo can purchase certain real estate and business assets in the state of Michigan, to make additional permitted acquisitions and for general corporate and operating purposes.

The obligations under the Facility are due and payable on the earlier of:

(a) the termination date (being January 4, 2020); and

(b) the acceleration date (being the earlier of the date of an insolvency event or that a demand notice is delivered pursuant to the terms of the Credit Agreement).

In respect of the advance made by Bridging to the Borrowers under the Facility, the Borrowers agreed to pay Bridging:

Interest at the prime rate plus 10.55% per annum calculated and compounded monthly, payable monthly in arrears on the last day of each month; and

A work fee equal to CAD $909,360 (the “Work Fee”) was paid to Bridging.

The obligations under the Facility are secured by general security agreements on each Borrower, mortgages on certain owned real property of PharmaCo among other security obligations.

As the funds under the Facility (net of the Work Fee, commissions and other transaction expenses of Bridging) were advanced by Bridging directly to MichiCann, MichiCann in turn advanced the funds (net of MichiCann’s transaction expenses) to PharmaCo pursuant to a Promissory Note (the “Promissory Note”) issued by PharmaCo to MichiCann in the principal amount of CAD.

21

$30,648,516.53 (the “Principal”). The Principal was due and payable in full on January 2, 2020 (the “Maturity Date”). PharmaCo may prepay the Principal in full in whole prior to the Maturity Date. Any amounts payable by PharmaCo or MichiCann to Bridging under the Facility will reduce the amount of PharmaCo’s obligations to MichiCann on a dollar for dollar basis under the Promissory Note.

On January 10, 2020, the Facility was amended (the “Amended Facility”) pursuant to an amended and restated credit agreement between Bridging, MichiCann (as guarantor) and PharmaCo, RWB Illinois and MAG (as borrowers) (the “Amended Credit Agreement”).

The Amended Facility increased the Facility Limit to US $49,750,000 in the aggregate of which US $27,000,000 was to refinance the existing Facility and US $22,750,000 was used to complete the MAG Acquisition and for general corporate and operating purposes.

The obligations under the Facility are due and payable on the earlier of:

(a) the termination date (being July 10, 2021 subject to the right of the Borrowers to extend the termination date by paying a 1% fee for two additional six-month periods for a total of 30 months); and

(b) the acceleration date (being the earlier of the date of an insolvency event or that a demand notice is delivered pursuant to the terms of the Amended Credit Agreement).

In respect of the advance made by Bridging to the Borrowers under the Facility, the Borrowers agreed to pay Bridging:

Interest at the prime rate plus 12% per annum calculated and compounded monthly, payable monthly in arrears on the last day of each month; and

PharmaCo

PharmaCo was incorporated under the laws of the State of Michigan on March 11, 2016. PharmaCo has been granted a Step 1 prequalification by the Medical Marihuana Licensing Board of the State of Michigan on October 18, 2019, File No. ERGA-18-000091. See “4.1 – Narrative Description of Business” for a discussion of PharmaCo’s assets.

Agreements with PharmaCo

On January 4, 2019, MichiCann entered into a debenture purchase agreement (the “Debenture Purchase Agreement”) with PharmaCo pursuant to which MichiCann agreed to purchase an up to US $114,734,209 8% senior secured convertible debenture of PharmaCo (the “PharmaCo Debenture”). The PharmaCo Debenture has a maturity date of January 4, 2023 unless the PharmaCo Debenture becomes earlier due.

The principal amount of PharmaCo Debenture outstanding is convertible at any time on the earlier of the business day immediately preceding: (i) the Maturity Date; and (ii) the date that is 30 days after the holder received LARA’s written approval of the Holder Application. In such circumstances, the principal amount of the PharmaCo Debenture is convertible into common shares of PharmaCo at a conversion price equal to the then outstanding balance of the PharmaCo Debenture divided by the total number of PharmaCo Shares then outstanding.

22

Notwithstanding the foregoing, the conversion of the PharmaCo Debenture is subject to PharmaCo and MichiCann having obtained all required permits from governmental authorities in connection with MichiCann’s ownership of PharmaCo Shares, including, without limitation, all required cannabis licenses or related permits issued by LARA (but excluding any permit or other requirement which arises or may arise under any Excluded Law).

The PharmaCo Debenture is secured against the assets of PharmaCo pursuant to security agreement dated as of January 4, 2019.

On January 4, 2019, MichiCann advanced USD$21,320,758.20 as a first tranche under the PharmaCo Debenture, (which, included prior advances of USD $4,269,521.00 made by MichiCann to PharmaCo pursuant to various non-interest bearing promissory notes).

On January 4, 2019, MichiCann entered into a put/call option agreement (the “Put/Call Option Agreement”) with PharmaCo and its shareholders (“PharmaCo Shareholders”) pursuant to which the PharmaCo Shareholders granted MichiCann the call right to acquire 100% of the issued and outstanding shares of PharmaCo from the PharmaCo Shareholders, and MichiCann granted all of the PharmaCo Shareholders the put right to sell 100% of the issued and outstanding shares of PharmaCo to MichiCann, in exchange for the issuance of 37,000,000 MichiCann Shares in the aggregate (subject to standard anti-dilution protections) subject to all state and local regulatory approvals including the approval of the Medical Marihuana Licensing Board and/or the Bureau of Medical Marihuana Regulation (“BMMR”) within the Department of Licensing and Regulatory Affairs (“LARA”) in the State of Michigan. Each PharmaCo Shareholder shall have the right, but not the obligation, as its sole direction, to sell to PharmaCo all, but not less than all, of the PharmaCo Shares held by it (the “Put Right”). The Put Right shall be exercised by a PharmaCo Shareholders by the delivery of a written notice to MichiCann.

On February 22, 2019, MichiCann advanced USD $6,046,863.19 as a second tranche under the PharmaCo Debenture.

On March 1, 2019, MichiCann advanced USD $11,327,594.02 as a third tranche under the PharmaCo Debenture.

On October 10, 2019, MichiCann advanced USD $2,100,000 as a fourth tranche under the PharmaCo Debenture.

On December 9, 2019, MichiCann advanced USD $925,000 as a fifth tranche under the PharmaCo Debenture.

On January 22, 2020, MichiCann advanced USD $1,500,000 as a sixth tranche under the PharmaCo Debenture.

Other Investments

MAG

On January 10, 2020, Mid-American Growers, Inc. completed its merger with MichiCann’s wholly-owned subsidiary, RWB Acquisition Sub, Inc., to form MAG. MAG is a facility, recently licensed for Hemp production, consist of a 3.6 million square foot modernized greenhouse with tens of thousands of square feet in ancillary structures to support future hemp CBD production in the State of Illinois.

23

Agreements with MAG

On October 9, 2019, MichiCann entered into an agreement and plan of merger (the “MAG Merger Agreement”) with Mid-American Growers, Inc., RWB Acquisition Sub, Inc. and Arthur VanWingerden and Ken VanWingerden (collectively, the “MAG Sellers”) pursuant to which MichiCann will acquire all the issued and outstanding shares of Mid-American Growers, Inc. This Merger Agreement was amended on November 1, 2019 and January 9, 2020. MAG owned 124 acres of real property commonly known as 14240 Greenhouse Avenue, Granville Illinois (the “MAG Owned Property”).

Concurrent with the closing of the MAG Acquisition, MichiCann’s wholly owned subsidiary, RWB Illinois acquired additional 106 acres of land located at 14240 Greenhouse Avenue, Granville, Illinois for US$2,000,000 pursuant to a real estate purchase agreement made and entered into as of January 10, 2020 between RWB Illinois, VW Properties LLC, as seller, and each of the MAG Sellers (the “Real Estate Purchase Agreement”).

Pursuant to the MAG Merger Agreement, on closing of the MAG Acquisition, MichiCann paid to the MAG Sellers US $7,100,000 in cash and issued to the Sellers a non-transferable, fully paid right to receive in the aggregate 17,133,597 Resulting Issuer Shares and 17,133,597 Resulting Issuer Series 2 Preferred Shares.

3.3 Trends, Commitments, Events or Uncertainties

In accordance with the Canadian Securities Administrators’ Staff Notice 51-352, below is a table of concordance that is intended to assist readers in identifying those parts of this Listing Statement that address the disclosure expectations outlined in Staff Notice 51-352.

Industry Involvement | Specific Disclosure Necessary to Fairly Present all Material Facts, Risks and Uncertainties | Listing Statement Cross Reference |

All Issuers with U.S. Marijuana-Related Activities | Describe the nature of the issuer’s involvement in the U.S. marijuana industry and include the disclosures indicated for at least one of the direct, indirect and ancillary industry involvement types noted in this table.

| See “4.2 – Market Information, Trends, Commitments, Events and Uncertainties” |

| Prominently state that marijuana is illegal under U.S. federal law and that enforcement of relevant laws is a significant risk. | See “4.2 – Market Information, Trends, Commitments, Events and Uncertainties” |

| Discuss any statements and other available guidance made by federal authorities or prosecutors regarding the risk of enforcement action in any jurisdiction where the issuer conducts U.S. marijuana-related activities. | See “4.2 – Market Information, Trends, Commitments, Events and Uncertainties” |

| Outline related risks including, among others, the risk that third-party service providers could suspend or withdraw services and the risk that regulatory bodies could impose certain restrictions on the issuer’s ability to operate in the U.S. | See “4.2 – Market Information, Trends, Commitments, Events and Uncertainties”

Section 17 – Risk Factors – U.S. state regulatory uncertainty |

24

| Given the illegality of marijuana under U.S. federal law, discuss the issuer’s ability to access both public and private capital and indicate what financing options are/are not available in order to support continuing operations. | See “4.1 – Narrative Description of Business” |

| Quantify the issuer’s balance sheet and operating statement exposure to U.S. marijuana-related activities. | See Financial Statements of Tidal Royalty Corp. |

| Disclose if legal advice has not been obtained, either in the form of a legal opinion or otherwise, regarding (a) compliance with applicable state regulatory frameworks and (b) potential exposure and implications arising from U.S. federal law. | Legal advice has been obtained. |

U.S. Marijuana Issuers with direct involvement in cultivation or distribution | Outline the regulations for U.S. states in which the issuer operates and confirm how the issuer complies with applicable licensing requirements and the regulatory framework enacted by the applicable U.S. state. | See “4.2 – Market Information, Trends, Commitments, Events and Uncertainties”

Section 17 – Risk Factors – U.S. state regulatory uncertainty |

| Discuss the issuer’s program for monitoring compliance with U.S. state law on an ongoing basis, outline internal compliance procedures and provide a positive statement indicating that the issuer is in compliance with U.S. state law and the related licensing framework. Promptly disclose any non-compliance, citations or notices of violation which may have an impact on the issuer’s licence, business activities or operations. | See “4.2 – Market Information, Trends, Commitments, Events and Uncertainties”

Section 17 – Risk Factors – U.S. state regulatory uncertainty |

25

U.S. Marijuana Issuers with indirect involvement in cultivation or distribution | Outline the regulations for U.S. states in which the issuer’s investee(s) operate. | While the Company currently only has ancillary involvement in the U.S. cannabis industry through its financing commitments to Diem, the Company anticipates entering into additional arrangements, which may include non-controlling investments in an entity directly involved in the U.S. marijuana industry, and the Company will evaluate, monitor and reassess the following disclosure, and any related risks, on an ongoing basis. The Company’s disclosure regarding its marijuana-related activities will be supplemented, amended and communicated to investors in public filings, including in the event of a change in the type of industry involvement of the Company, government policy changes or the introduction of new or amended guidance, laws or regulations regarding marijuana regulation.. |

| Provide reasonable assurance, through either positive or negative statements, that the investee’s business is in compliance with applicable licensing requirements and the regulatory framework enacted by the applicable U.S. state. Promptly disclose any non-compliance, citations or notices of violation, of which the issuer is aware, that may have an impact on the investee’s licence, business activities or operations. | Although the Company’s activities, and the Company believes the activities of the companies it finances, are compliant with applicable U.S. state and local law, strict compliance with state and local laws with respect to cannabis would neither absolve the Company or the entities the Company finances of liability under U.S. federal law, nor provide a defense to any federal proceeding which may be brought against the Company |

U.S. Marijuana Issuers with material ancillary involvement | Provide reasonable assurance, through either positive or negative statements, that the applicable customer’s or investee’s business is in compliance with applicable licensing requirements and the regulatory framework enacted by the applicable U.S. state. | Section 17 – Risk Factors – U.S. state regulatory uncertainty |

See “4.2 – Market Information, Trends, Commitments, Events and Uncertainties”.

26

4.NARRATIVE DESCRIPTION OF THE BUSINESS

4.1Narrative Description of the Business

Tidal Royalty Corp

General

Issuer is a publicly traded company with a focus on investing and financing in businesses that pertain in any way to cannabis which are carried out in compliance with applicable U.S. state laws (“legal cannabis industry”). The Issuer anticipates entering into financing arrangements involving royalties, debt and other forms of investments / acquisitions in private and public companies in the US legal cannabis industry.

The Issuer’s business objective is to provide capital solutions to companies in the legal cannabis industry with large-scale potential and a highly-skilled and experienced management team across multiple industry verticals, including cultivation, processing and distribution. The Issuer is actively pursuing opportunities to provide expansion capital to licensed, qualified operators across multiple industry verticals including cultivation, processing and distribution.

Composition of Investment Portfolio

The nature and timing of the Issuer’s investments will depend, in part, on available capital at any particular time and the investment opportunities identified and available to the Issuer. The Issuer expects its investment activities will be primarily focused on enterprises located in the United States, although investments may extend globally (including the purchase of securities listed on foreign stock exchanges). The Issuer expects to invest solely in cannabis sector. The Issuer believes that any risk of limited diversification may be mitigated by closely monitoring its investments. The actual composition of the Issuer’s investment portfolio will vary over time depending on its assessment of a number of factors, including the performance of U.S. cannabis markets and credit risk.

Investment Objectives

The principal investment objectives of the Issuer are as follows:

·to seek high return investment opportunities by providing project-specific financing to public and private companies through a range of investment instruments;

·to identify early stage opportunities with attractive risk/reward ratios;

·to preserve its capital and limit the downside risk of its capital;

·to achieve a reasonable rate of capital appreciation;

·to minimize the risk associated with investments by obtaining appropriate security, where possible; and

·to generate predictable cash-flow.

The Issuer’s investment objectives, investment strategy and investment restrictions may be amended from time to time on the recommendation of senior management and approval by the

27

board of directors of the Issuer. The Issuer does not anticipate the declaration of dividends to shareholders at this time and plans to re-invest the profits of its investments to further the growth and development of the Issuer’s investment portfolio.

Investment Strategy

To achieve the objectives as stated above, while mitigating risk, the Issuer, when appropriate, shall employ the following disciplines:

·The Issuer will obtain detailed knowledge of the relevant business in which the investment will be made, as well as the target company (“Investee”).

·The Issuer will seek to retain management or consultants having specific industry expertise within the industry or sector in which an investment is contemplated or has been made.

·The Issuer will work closely with the Investee’s management and board, and in some cases, assist in sourcing experienced and qualified persons to add to the board and/or management of the Investee. In certain circumstances, a representative of the Issuer may be appointed to an Investee’s board of directors.

Investments may include:

oequity, bridge loans, secured loans, unsecured loans, convertible debentures, warrants and options, royalties, streaming investments, net profit interests and other hybrid instruments;

oacquisitions, partnership interests, or joint venture interests with Investees;

oacquisition of a business or its assets, directly or via a wholly owned subsidiary, and subsequent managing or assisting in developing the underlying business;

ocapital investment in private companies, and assistance in moving them to an acquisition or merger transaction with a larger company or to the public stage through initial public offering, reverse takeover or other liquidity event;

oearly stage equity investments in public companies believed to have favourable management and business; and

owhere appropriate, acting as a third-party advisor for opportunities in target or other companies, in exchange for a fee.

·The Issuer will have flexibility on the return sought, while seeking to recapture its capital within a reasonable period following the initial investment(s).

·The Issuer will seek to maintain the ability to actively review and monitor all of its investments on an ongoing basis. Investees will be required to provide continuous disclosure of operations and financial status. From time to time, the Issuer may insist on board or management representation on Investees.

·The Issuer will continually seek liquidity opportunities for its investments, with a view to optimizing the return on its investment; recognizing that no two investments will be alike in terms of the duration held or the best means of exiting an investment.

28

·The Issuer may acquire interests in Investees within the framework of the above guidelines, which from time to time may result in the Issuer holding a control or complete ownership position in an Investee.

·The Issuer may utilize the services of both independent organizations and securities dealers to gain additional information on target investments where appropriate.

Notwithstanding the foregoing, from time to time, the board of directors may authorize such investments outside of these disciplines as it sees fit for the benefit of the Issuer and its shareholders.

Portfolio

The Issuer’s current portfolio companies are Diem Cannabis, Harborside and Lighthouse, the financing transactions in respect of each are described further below.

Diem Cannabis

On August 31, 2018, the Issuer entered into a definitive agreement (the “Closing”) with VLF Holdings LLC, an Oregon limited liability company d/b/a Diem Cannabis (“Diem”) to finance the expansion of TDMA LLC, a Massachusetts subsidiary of Diem (“TDMA”) into Massachusetts. Diem is an experienced licensed operator in the highly-competitive Oregon market. Pursuant to the agreement, the Issuer will provide Diem Cannabis with up to US$12.5 million over three years to develop and operate a large-scale cultivation and processing facility (the “Site”) and up to four dispensaries (the “Dispensaries”) in Massachusetts (the “Diem Financing”). The Financing will be in the form of (i) promissory notes advanced at various stages of development of operations in the state; and (ii) the purchase price for real property acquisitions with respect to Sites and Dispensaries. Newly-formed subsidiaries of RLTY Development MA 1 LLC will acquire title to the real property purchased in respect of the Site and Dispensary acquisitions and will enter into leases (“Leases”) with TDMA (or its nominee) with respect to their operation.

The Leases will be “triple net” and will include payments of (i) annual base rent; (ii) percentage rent of net sales; and (iii) additional rent relating to the costs of property insurance, real estate taxes and any maintenance and repair. Where Diem proposes to enter into a third-party lease in respect of a dispensary (an “Operating Lease”) as opposed to the purchase of real property, Diem will enter into the operating lease directly with the third-party lessor and will grant to us a collateral assignment in such Operating Lease.

The stages of development of operations at which financing will be deployed are: (1) At the due diligence phase when Sites and Dispensaries are being identified, investigated and preliminary purchase and sale or lease agreements are being negotiated. Financing at this stage is expected to be used by Diem to fund day-to-day operations including salaries of its staff, rent, legal fees, etc. (2) At the purchase and sale or lease phase when definitive purchase and sale or lease agreements are entered into. In the case of properties to be purchased, financing will be used by the applicable Issuer subsidiary to purchase the property, make property insurance payments, pay legal fees, etc. In the case of properties to be leased, financing is expected to be used by Diem to make lease payments, any applicable deposits, insurance payments, legal fees, etc. (3) At the construction phase when the Site and Dispensaries are retrofitted or constructed for their intended use. Financing at this stage is expected to be used by Diem to fund construction costs, lease or purchase

29

equipment and chattels, and other expenditures required in order for the Site and Dispensaries to become operational.

Currently, a property in respect of a Dispensary has been acquired in Springfield, MA (title acquired by RLTY Development Springfield LLC) (the “Springfield Property”) and a property in respect of a Site has been acquired in Orange, MA (title acquired by RLTY Development Orange LLC) (the “Orange Property”).

The payment of rent pursuant to the Leases will only commence in respect of the Orange Property and each Dispensary once they are constructed, licenses for manufacturing/sales have been obtained and the locations are fully operational. Construction on the Springfield Property is expected to commence imminently and is estimated to last three-to-five months. Construction on the Orange Property is expected to commence imminently and is estimated to last 10-12 months. Applications to the appropriate regulatory authorities in respect of property-specific licenses are expected to commence late in 2019. As such, it is currently anticipated that the payment of rent pursuant to the Lease in respect of the Springfield Property will commence in the fourth quarter of 2019 and the payment of rent pursuant to the Lease in respect of the Orange Property to commence in the first quarter of 2020. However, construction projects may often involve unforeseen delays or uncover unexpected issues beyond the control of Issuer, and it is difficult to anticipate the length of time required to receive regulatory approval and for the required licenses to be issued. As such, there can be no assurance that the payment of rent pursuant to the Leases in respect of the Orange Property and the Springfield Property will commence on this anticipated timeline or at all. As the identification and negotiations for the purchase or lease of additional Dispensaries are ongoing, it is not yet known when such additional Leases will be entered into and the payment of rent will commence.

The Financing will be secured by (i) guarantees of the payment and performance of all obligations of TDMA by Diem and certain of its subsidiaries (the “Entity Guarantors”) and key individuals (the “Individual Guarantors”); (ii) liens over all of the assets of the Entity Guarantors; (iii) pledges by the Entity Guarantors and Individual Guarantors of all equity interests in Diem and/or its subsidiaries; and (iv) in the case of Operating Leases, collateral assignments in such Operating Leases.

During the period ended October 31, 2018, and pursuant to the Financing, the Issuer entered into a promissory note (“Promissory Note”) agreement with TDMA for $434,933 (USD$334,190) as a working capital advance for identification and negotiation of the purchase agreements for the Site and Dispensaries. The Promissory Note bears interest of 10% per annum and is due on February 28, 2021, unless earlier satisfied as described below.

Once the Site and Dispensaries are operational and the Leases have been entered into, the Promissory Note and all subsequently issued promissory notes (including interest accrued thereon) will be deemed satisfied in full. If the Site and Dispensaries are not operational within 2.5 years following the Closing, the Issuer will have the right to seek certain repayments, including repayment of the Promissory Note and all subsequently issued promissory notes.

On August 23, 2019, the Company entered into a Termination of Framework Agreement (the “Termination”) with Diem. Pursuant to the termination, the Company will convey titles of certain properties (Note 7) to TDMA in exchange of two promissory notes (the “Property Promissory

30

Note”) for US $372,500. The Framework Agreement Promissory Note bears interest of 10% per annum and is due on August 31, 2021.

On September 26, 2019, the Company entered into a definitive Membership Interest Purchase Agreement (the “MIPA”) with TDMA to acquire all of the issued and outstanding equity in TDMA Orange, LLC, a Diem Cannabis subsidiary. Pursuant to the terms of the MIPA, the Company obtains 100% interest in two cultivation licenses and a processing license in the county of Orange, in the Commonwealth of the State of Massachusetts.

As consideration, the Company will forgive the Framework Agreement Promissory Note and Property Promissory Note including accrued interest, cross collateralization and general security arrangement.

Lighthouse Strategies LLC

On January 9, 2019, the Issuer’s wholly-owned subsidiary, RLTY Beverage 1 LLC, closed its strategic private placement for $5-million (U.S.) of Series A membership units of Lighthouse Strategies LLC (“Lighthouse”) and the concurrent financing fee agreement.

Pursuant to the financing fee agreement, the Issuer is entitled to 1% of the net sales of certain of Lighthouse's beverage lines, including Cannabiniers, Two Roots Brewing Co. and Creative Waters Beverage Company. Financing fees will accrue until Dec. 1, 2019, at which point the Issuer may choose to receive such fees in cash or Series A membership units of Lighthouse. Thereafter, financing fees are payable quarterly in cash. The term of the financing fee agreement is between four and six years, depending on the achievement of certain milestones and includes acceleration provisions in certain events (including a substantial asset divestiture, change of control or initial public offering).

Harborside Inc.

On November 15, 2018, the Issuer purchased $3 million of units (the “Units”) of FLRish, Inc., the parent company of Harborside (“Harborside”) and entered into a non-binding memorandum of understanding (“MOU”) with Harborside to provide royalty financing to prospective “Harborside” brand dispensary operators. Each Unit is comprised of (A) one 12% unsecured convertible debenture, convertible into common shares of Harborside (i) at the option of the holder at any time prior to the last business day immediately preceding the third anniversary date of the closing; and (ii) automatically upon a Harborside going-public transaction, at a conversion price equal to the lower of (i) $6.90; and (ii) a 10% discount to the price of the common shares of Harborside as part of a qualifying transaction; and (B) 87 common share purchase warrants exercisable for a period of two years following the closing into common shares of Harborside at an exercise price of $8.60 (subject to acceleration in the event of a going public transaction).

Pursuant to the terms of the MOU, the Issuer has agreed to provide up to US$10 million in royalty financing to prospective dispensary operators licensing the “Harborside” brand. Each potential dispensary financing transaction will be assessed by the Issuer on a case-by-case basis and will be subject to the satisfactory completion of due diligence by the Issuer and the consummation of definitive documentation with the prospective dispensary operator.

During the year ended July 31, 2019, Harborside completed a reverse-take over (“RTO”) of Lineage Grow Company. On June 10, 2019 Harborside commenced trading on the Canadian

31

Securities Exchange under the symbol “HBOR”. Following the completion of the RTO, the debentures and accrued interest were converted into 567,205 common shares with an estimated fair value of $ 3,573,392. The Company recognized a realized gain on change in fair value of investments in equity investments and convertible debentures of $865,790 for the year ended July 31, 2019.

MichiCann

MichiCann, operating as Red White & Bloom, is an investment company with a focus on the US cannabis industry. MichiCann’s current investments are the PharmaCo Debenture and its rights under the PharmaCo Put/Call Option Agreement.

On January 4, 2019, MichiCann entered into the Put-Call Option Agreement with the shareholders of PharmaCo, which if exercised and subject to regulatory approval, would result in MichiCann acquiring all the issued and outstanding shares of PharmaCo. (See General Development of MichiCann’s Business – Agreements with PharmaCo).

MichiCann holds an 8% senior secured convertible debenture (the “Debenture”) of its Michigan based investee (“PharmaCo”), a private company incorporated under the laws of the State of Michigan.

On February 25, 2019, Tidal issued the $15,000,000 MichiCann Debenture. During the period ended October 31, 2019, the Issuer amended the MichiCann Debenture and advanced an additional US $2,000,000 to fund MichiCann working capital.